Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

I received distributions from Marimo REIT, a high yielding REIT with a June and December fiscal year end.

It’s an easy REIT to buy because you only need to hold it on the last business day of the month, just like stocks.

This time I’m going to share with you my opinion on whether you should actually hold and buy one!

This is a must-see for those who want to invest in REITs.

- Want to invest in high-dividend REITs

- Are moving assets from Japanese stocks to REITs

- Looking for REITs that are recommended for beginners

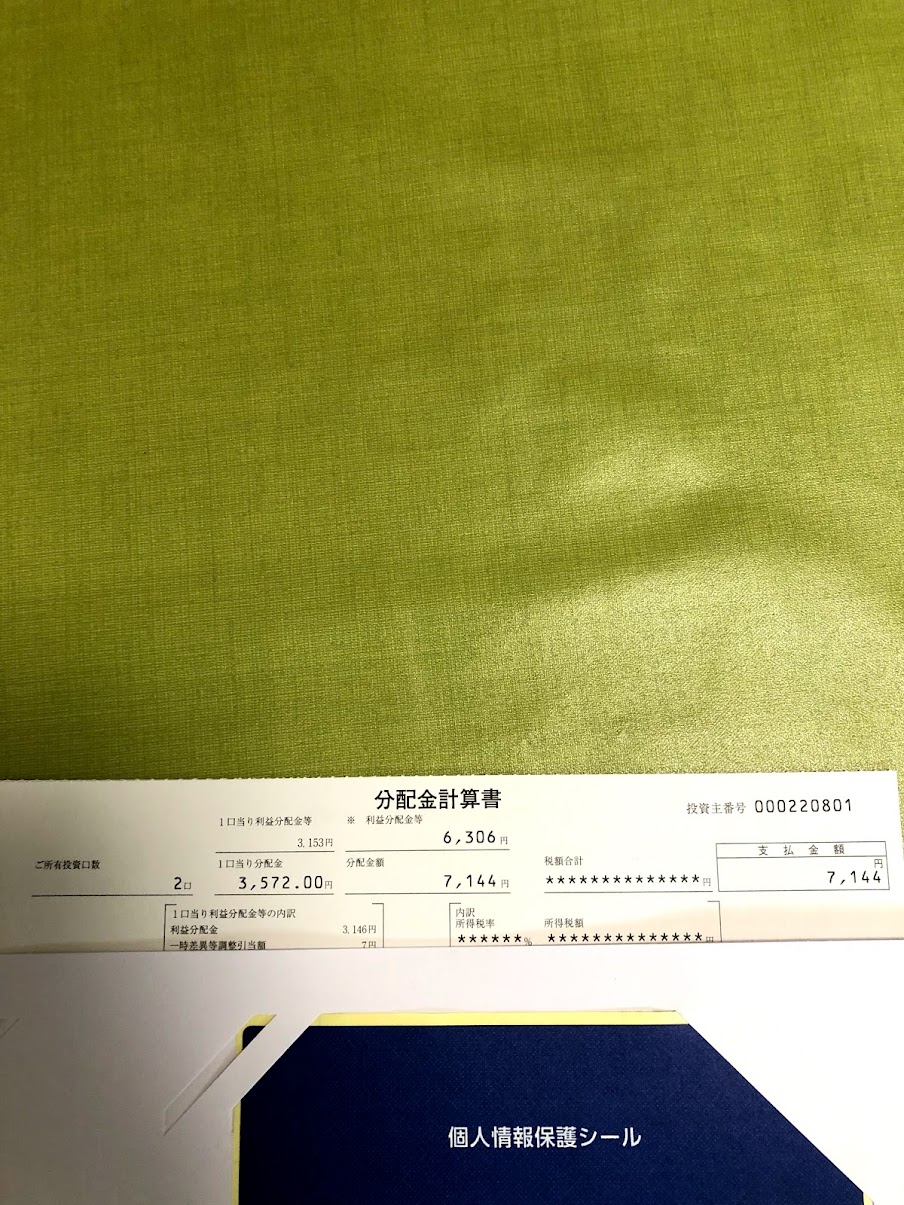

- Distributions from Marimo REIT, Inc. have arrived!

- Should I buy Marimo REIT?

- Trends and Forecasts for Distributions

- What is Marimo REIT Investment Corporation?

- Features of the REIT

- About the Sponsor

- Properties held by the REIT

The author has three years of investment experience and has a background in the securities industry.

By reading this article, you’ll learn all you need to know about Marimo REIT!

Distributions have arrived from Marimo Regional Innovation REIT, Inc.

Distributions have arrived from Marimo Chiiki Sosei Reit Investment Corporation, which settled accounts in June and December.

The distribution for the 10th period was 3,572 yen per share.

Even though it’s the month of the fiscal year mentioned above, the distributions won’t arrive for another three months, but since the REIT distributes over 90% of its shares, those high dividends are very attractive!

Some REITs have a lower average unit price than other stocks, so I don’t think it’s a dream to receive 10,000 yen in dividends per month.

I’m in the process of reconfiguring my portfolio to achieve this goal, lol.

Should anyone buy Marimo REIT?

In my opinion, I think you should buy it.

This is because they are sometimes cheaper than other Japanese stocks, and the distributions are high, so you can hold them for a long time.

Of course, it can be affected by the economy, but this REIT diversifies the risk of its properties, so you can feel secure.

The stock price hit a high of 13800 yen in June 2021 and started a downward trend, but it is now recovering and I see it going up in the future.

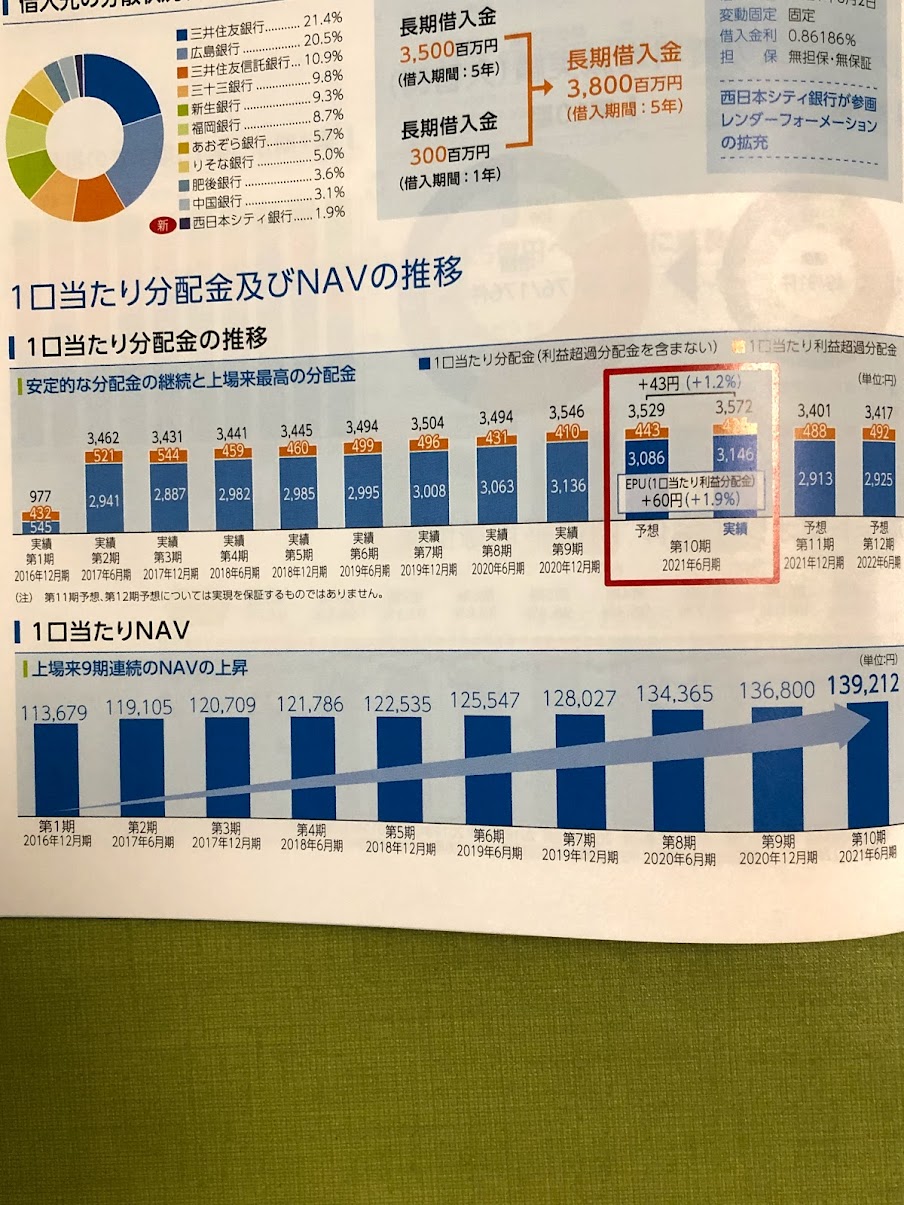

Trends and Forecasts of Distributions

With the exception of the first period, distributions have been stable at the 3500 yen level.

It is good that there has been no significant decline.

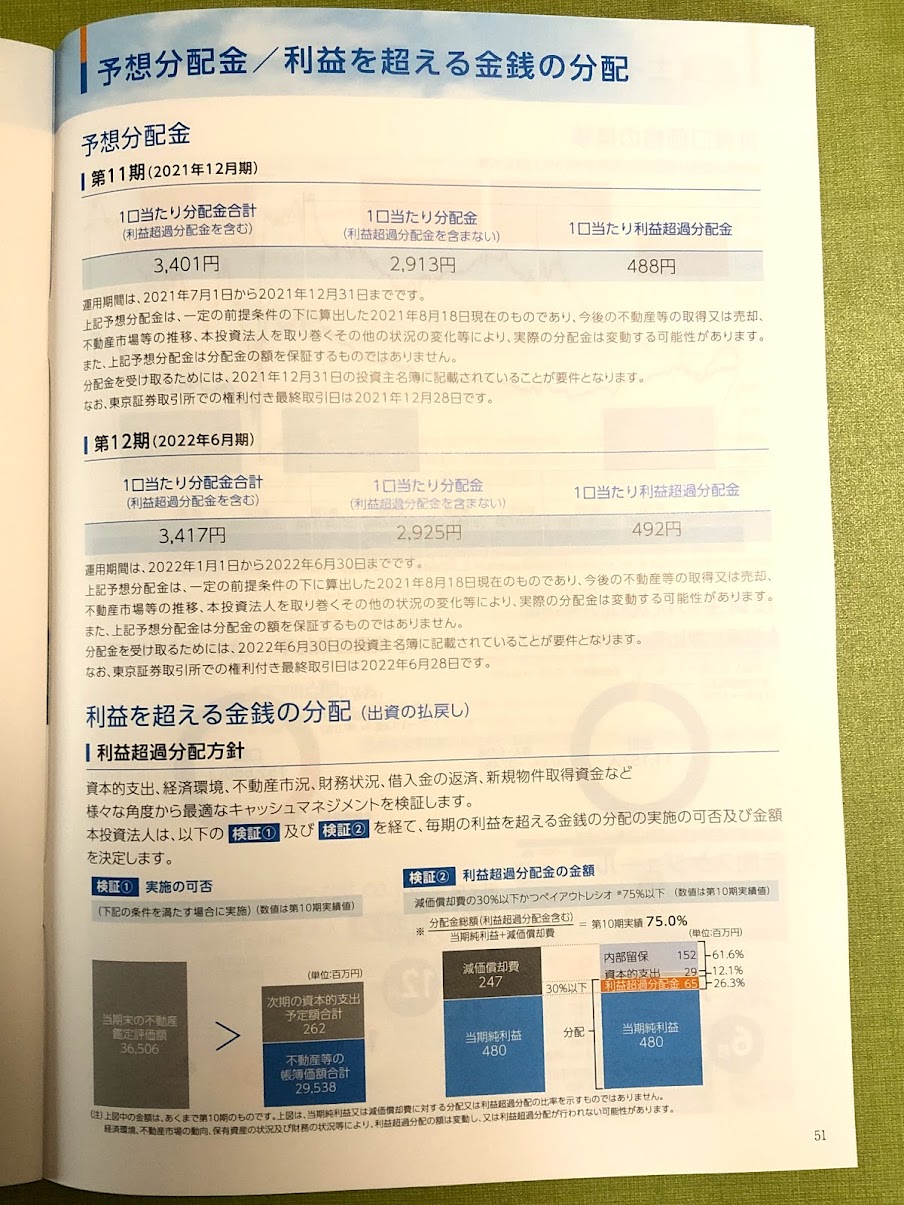

The forecast for the 11th period is 3,401 yen per share, and the forecast for the 12th period is 3,417 yen per 1 shares.

The forecasts are subject to revision, so I expect an increase in dividends.

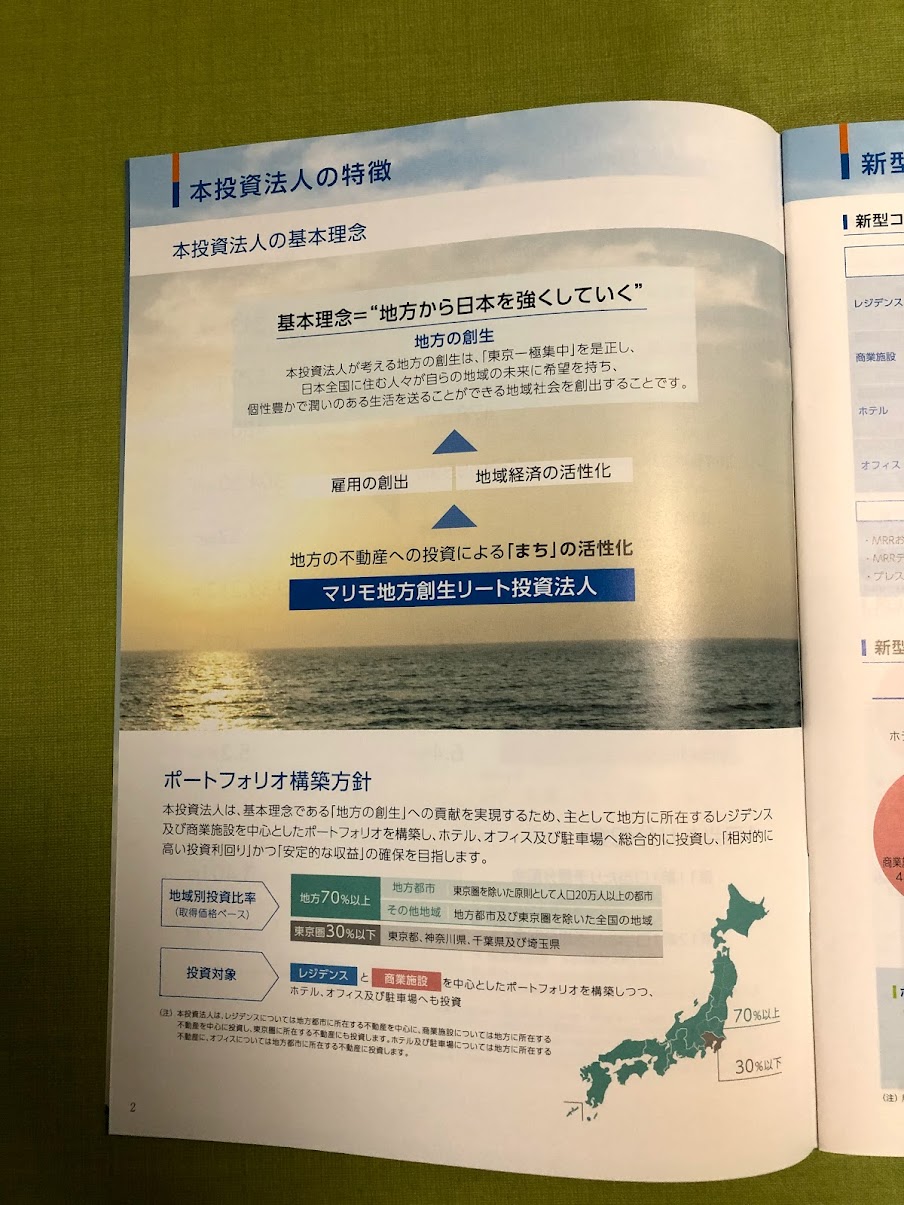

What is Marimo Chiiki Sosei Reit Investment Corporation?

Marimo Chiiki Sosei Reit Investment Corporation is a comprehensive REIT listed in 2016 that focuses on regional cities in Japan.

It focuses on incorporating residential and commercial properties, which makes it more stable than hotel-type REITs.

It boasts the second highest yield among REITs with a June/December fiscal year end, and I think it is the easiest to buy.

The dividend is also high in the 100,000 yen range, so it is a more reasonable choice than buying stocks with low dividends.

Features of REITs

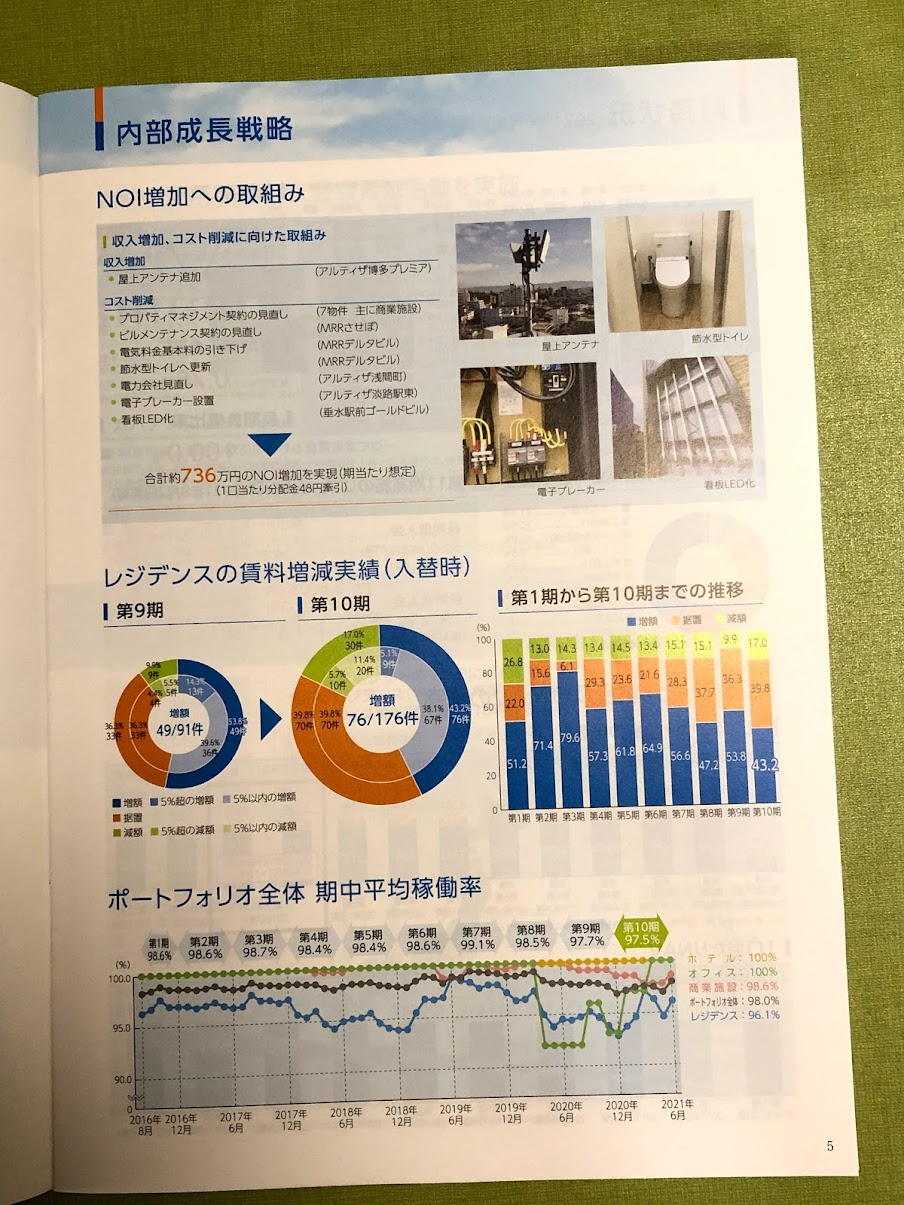

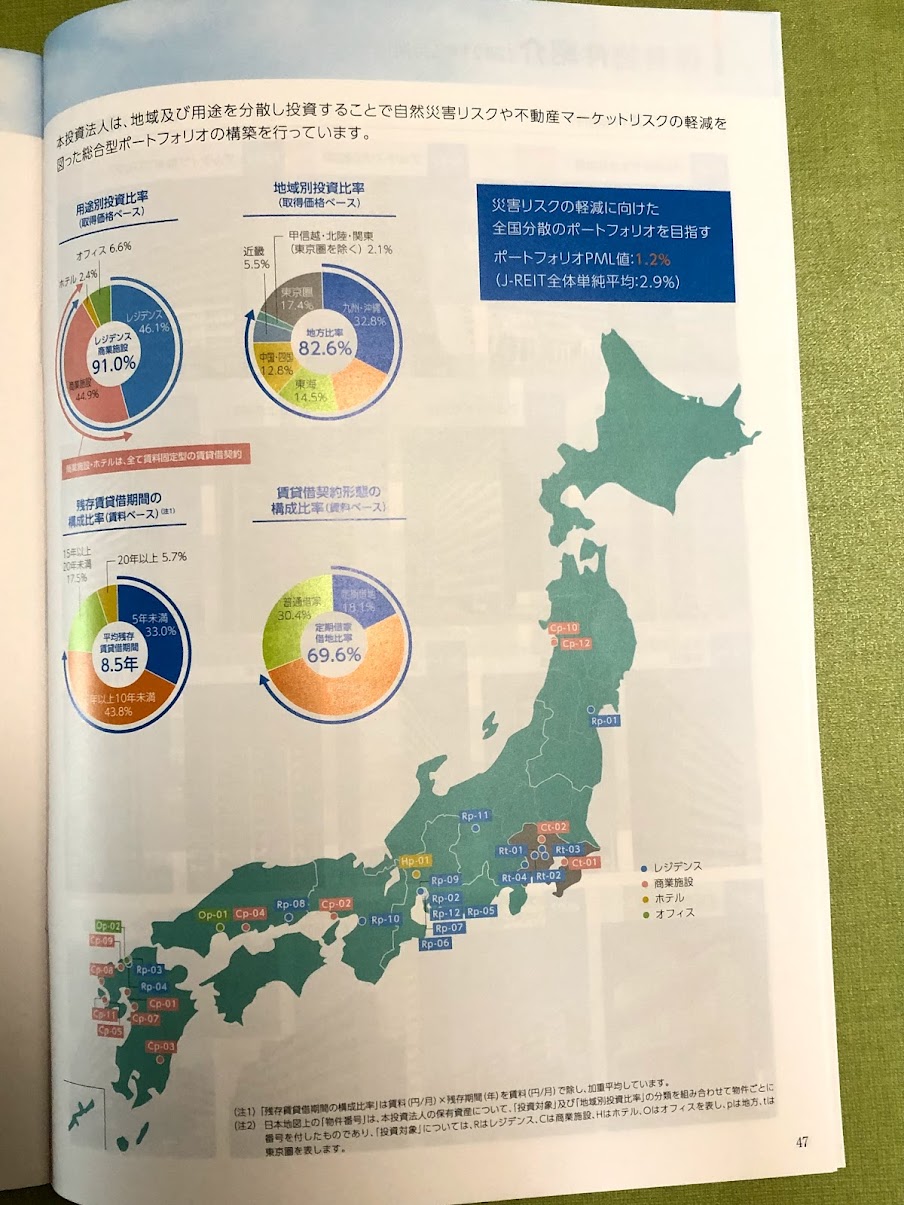

It is characterized by the fact that 70% of its portfolio is diversified into regional areas and by the fact that it is working on both internal and external growth strategies.

The aim is to revitalize rural areas by diversifying investment from the Tokyo concentration.

We are also strong in applying the technological capabilities of Marimo, a real estate company located in Hiroshima Prefecture, to acquire optimal properties.

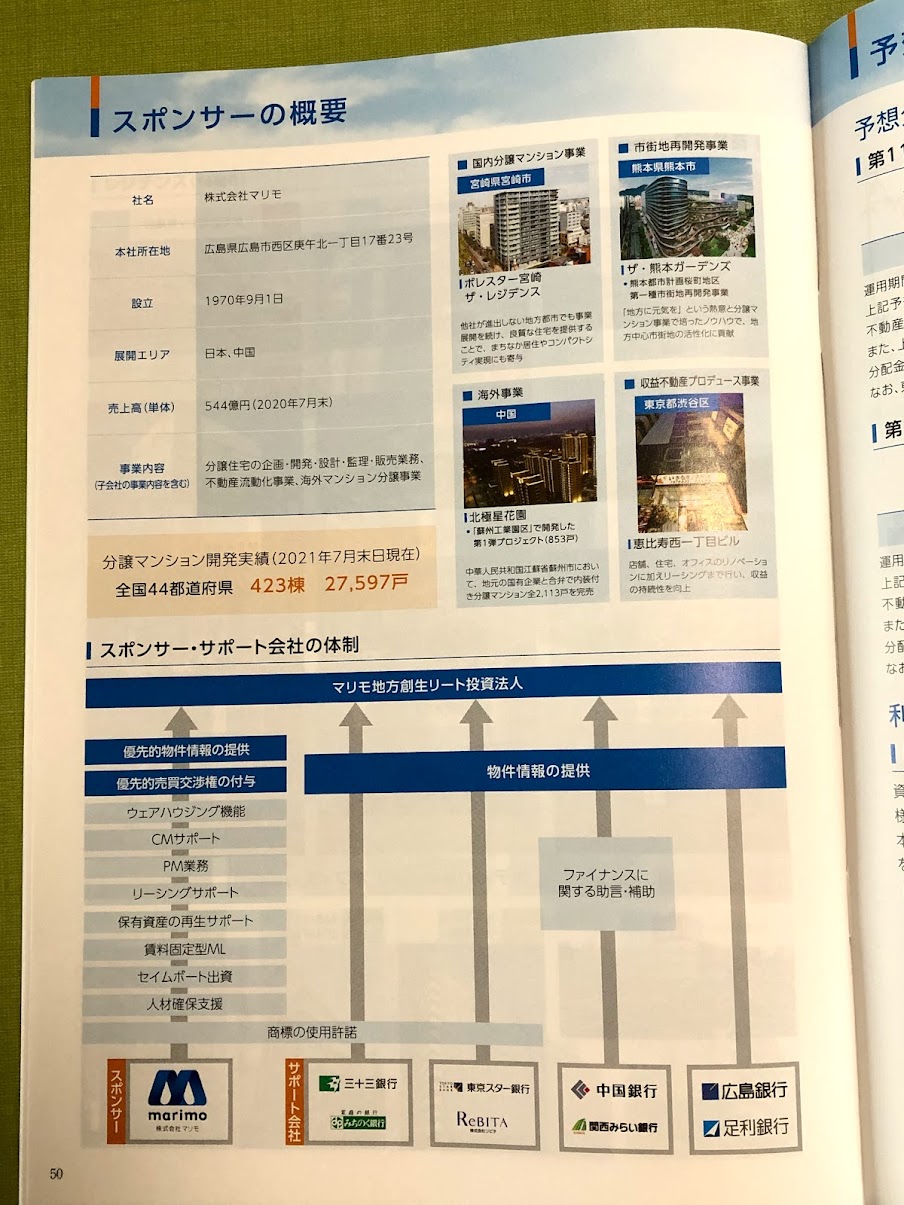

About the Sponsor

With property information provided by eight financial institutions, we are able to make focused investments in rural areas.

It can be said that we can participate in contributing to local communities through the REIT.

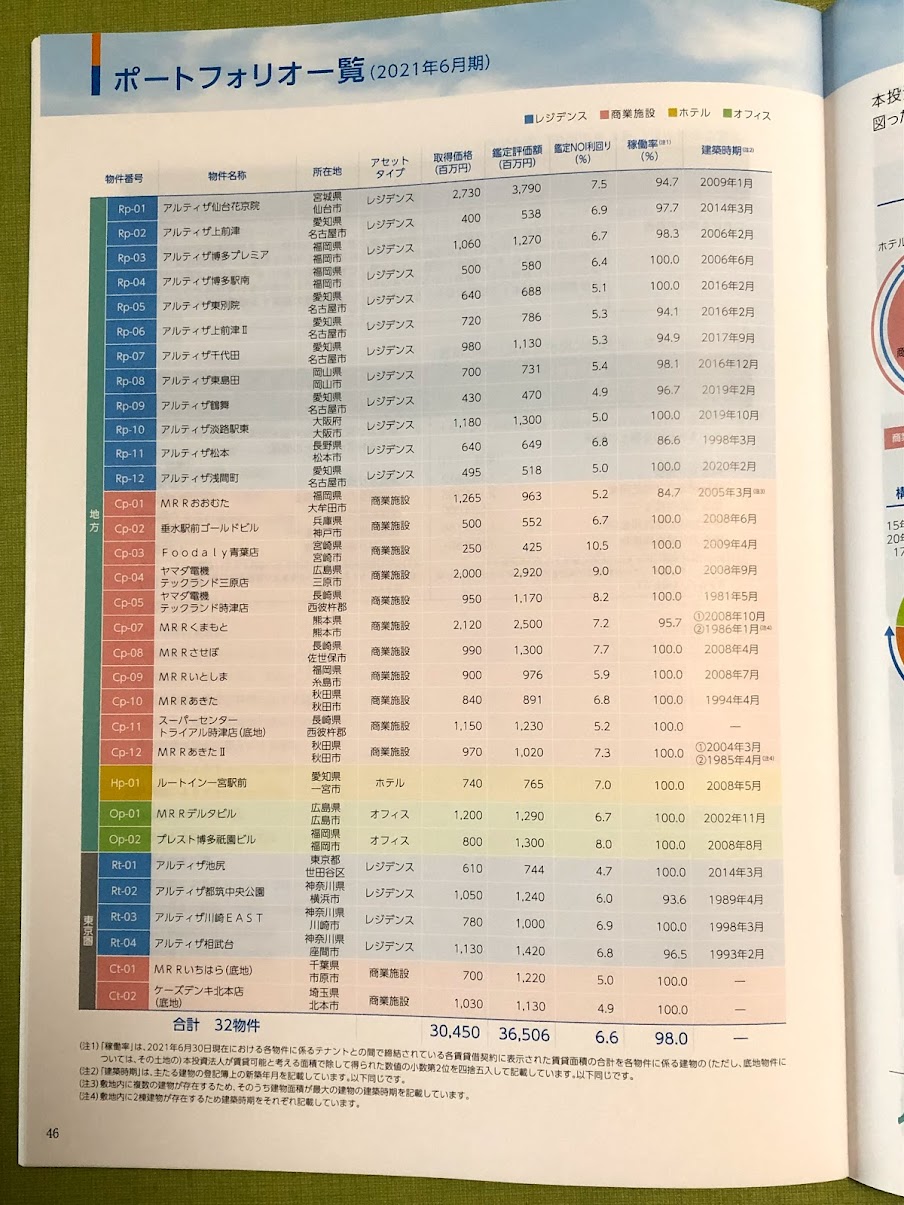

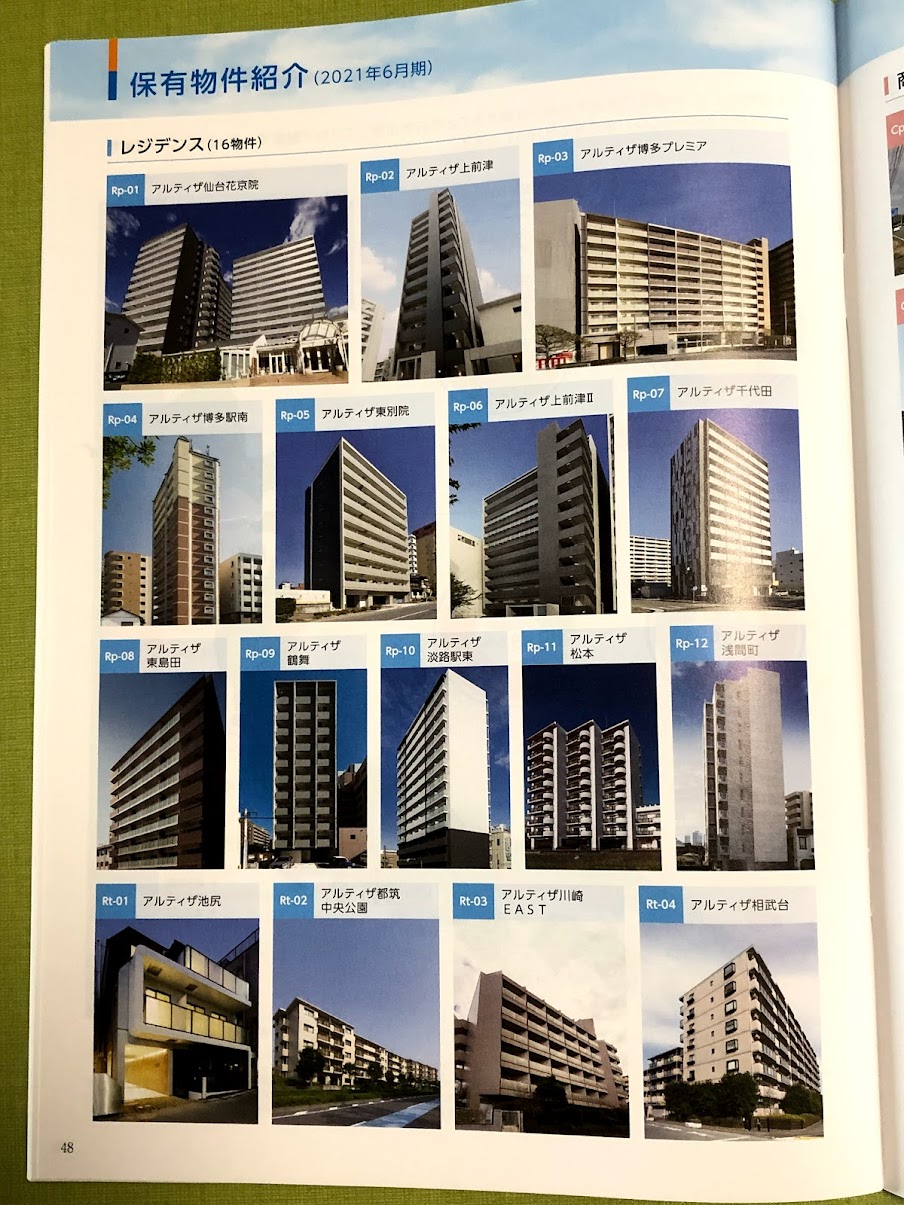

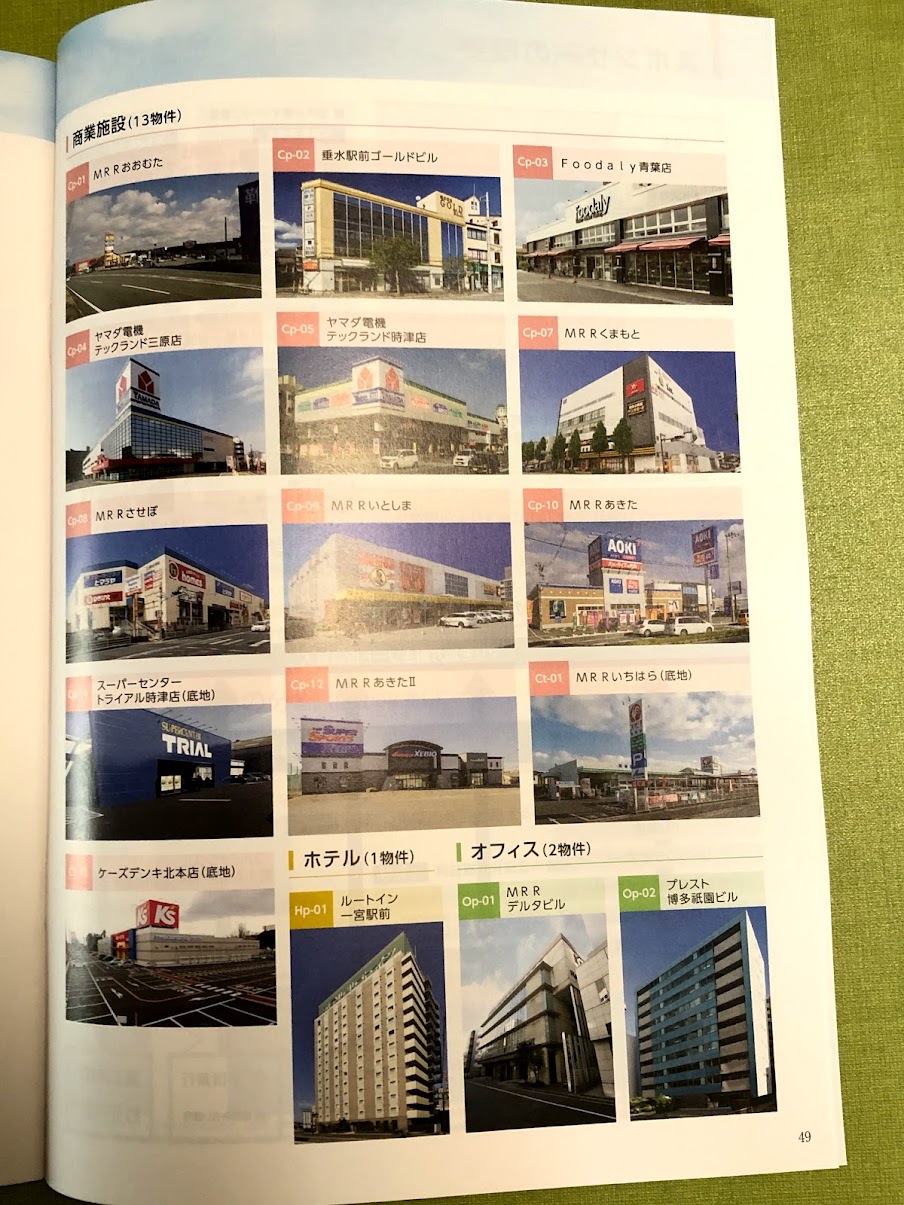

Properties held by the REIT

We hold a wide range of properties, from Akita in the north to Miyazaki in the south.

As a rule, they target cities with a population of 200,000 or more, so they are stable.

Summary

- Diversified investment in regional areas

- Attractive with high yields

- Best for long-term holding

I have introduced Marimo Regional Innovation REIT, Inc.

How about using it as a reference for your portfolio?

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント