Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

Have you ever heard of Itochu Corporation, one of Japan’s most famous trading companies?

In this article, I’d like to introduce you to Itochu Enex, the top-selling Japanese trading company and a member of the Itochu Group, and tell you about the company and when to buy it!

It is cheaper than other stocks, so why not try to own it when the time is right?

It is also a must-see for those who are interested in Japanese energy stocks.

- Want to buy Itochu Enex stock

- Looking for a stock with a high dividend yield

- Are looking for undervalued stocks.

- When is the best time to buy Itochu Enex?

- What is Itochu Enex?

- Company Business

- Company Indicators

- Dividends

- Three investment trusts for inclusion in our recommendations!

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll learn about Itochu Enex!

When is the best time to buy Itochu Enex?

In conclusion, I think it is a good time to buy when the stock price reaches 940 yen.

This is because if you look at the chart for the past five years, you can see that the stock price has fallen and risen around 940 yen, which is an average price.

With the recent movement, the stock price has been moving in the range of 900 yen to 1,000 yen, so if there is a good news, the stock price will go up further.

The annual high for 2021 is 1,176 yen in March, so if the stock price exceeds this level, I think something will change.

What is Itochu Enex?

8133 Itochu Enex Co., Ltd. was established in 1961 through the split-off of Itochu oil, a subsidiary of Itochu Corporation.

In 2001, the company changed its name from Itochu Fuels Corporation to its current one.

As an energy trading company, we provide a stable supply of oil, gas, and electricity to various parts of Japan.

In our medium-term management plan starting in 2021, we are working to strengthen our customer base and develop environmental energy.

Company’s Business Segments

The company has four segments, and I will explain the two with the highest sales.

Please also visit the company website.

1 Car Life Business

In this business segment, we operate approximately 1,700 gas stations across Japan, the largest in the country.

We differentiate ourselves from our competitors with our unique analytical and sales capabilities.

We also use our gas stations to sell automobiles and rent cars, so we can meet the needs of consumers.

2 Industrial Business Business

In this business, we sell petroleum and marine fuel to corporations.

Since we have sales bases all over the world, we have built a strong global sales network and have a stable supply system.

We also sell asphalt, which is used in road paving and industrial applications, and have bases all over Japan, boasting a 20% share of the domestic market.

Company Indicators

The following is a summary of major indices for Itochu Enex.

| PER | PBR | Dividend yield | Dividend payout ratio | Equity ratio |

| 9.2 times | 0.85 times | 4.51% | 2021/3 46.4% | 33.4% |

Looking at the indices, we can say that the figures are undervalued.

The capital adequacy ratio is also well balanced.

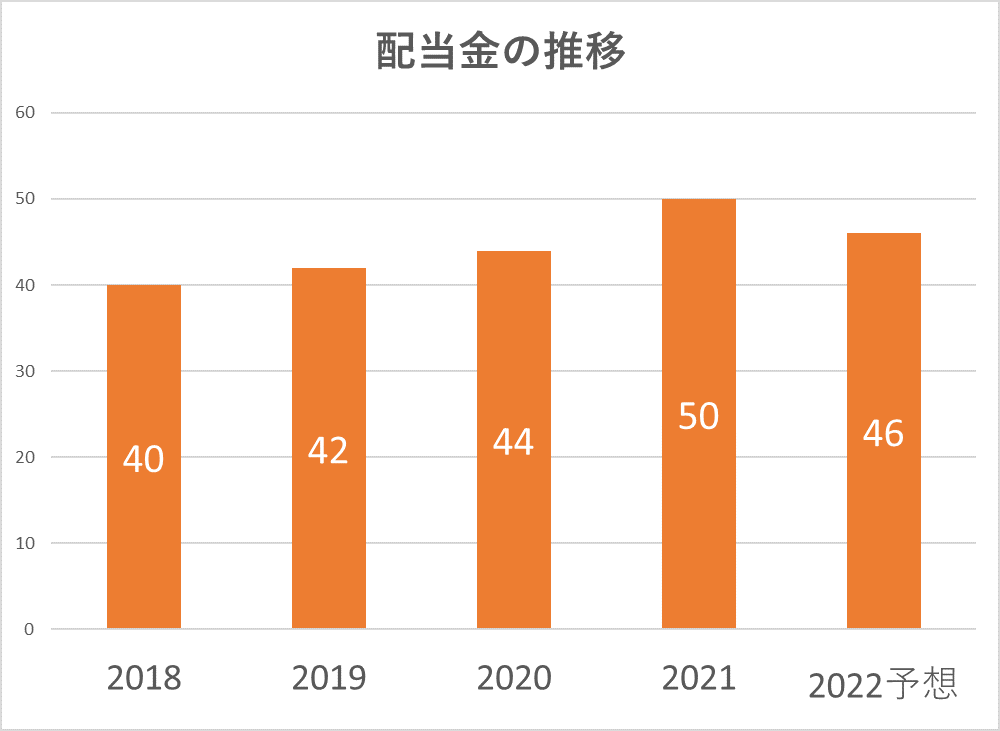

Dividends

The company pays out stable dividends.

The company aims to achieve a dividend payout ratio of 40% or more through aggressive shareholder returns, so I have high expectations for the future.

Three investment trusts for inclusion that I recommend!

Investment trusts are recommended for those who are worried about investing out of the blue.

They are managed by a wide range of professional investors, so you can diversify your risk!

We have selected the annual investment trusts that Itochu Enex is included in for your reference.

- Mitsui Sumitomo DS Asset Management Japan Undervalued Equity Open

- Tokyo Marine Asset Management Tokyo Marine Selection Japan Equity TOPIX

- Mitsubishi UFJ International Investment Trust eMAXIS JPX Nikkei Mid-Cap Index

Summary

- Itochu Enex is a good buy at 940 yen

- Extensive business development as a domestic energy trading company

- Good dividend and undervalued

I introduced Itochu Enex and when to buy!

Investing is a personal responsibility. Investing is your own responsibility, so make your own final decision after referring to various opinions.

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント