Hello everyone. I’m @olivertomolife and I like investing and shareholder special offers!

Did you know that the powders you eat in your daily life, such as cup noodles and soup, are made by Semba Sugar Industry?

The company has advanced drying technology that allows for long-term storage, and also produces caramels used in foods.

In this article, I’m going to go over the company’s stock price forecast and show you what kind of business they’re in!

- Those who are looking for stocks that are strong in Japanese food ingredients

- Want to invest in undervalued stocks

- Want to know more about Senba Saccharification Industry

- Stock price forecast of Semba Sugar Refining Co.

- What is Semba Sugar Refining?

- Company’s business

- Company index

- Dividends

- Shareholder benefits

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll learn all you need to know about Senba Saccharification!

Share Price Forecast for Semba Sugar Co.

Personally, I believe that the stock price will increase slightly over the next three years.

Therefore, I think it is a good time to buy if the price is in the 600 yen range.

Let’s take a look back at the stock price in the past.

If we look at the stock price for the five years from 2017, we can see that it started to rise in June 2017 and surged from February to April 2018.

This sharp rise is in my judgment due to speculators.

Although the share price was affected by the global outbreak of infectious diseases in 2020, the decline since then has been limited and it seems safe to assume that the company is aiming higher.

What is Semba Saccharification?

Semba Saccharification Industry was established in 1947 as a caramel manufacturing and sales company.

In 1964, the company also began selling powdered products, which are familiar as food ingredients.

Since then, the company has established its own packaging subsidiary, established an integrated manufacturing base, and acquired the international standard ISO 9001.

We have the advantage of being a company that manufactures a high percentage of caramels, 40% in Japan.

Overseas, we have factories in China and Vietnam.

Company’s Business

Development and manufacture of custom-made products for companies

In response to development requests from food manufacturers, the company manufactures a wide range of products such as corn soup and powdered soup for instant noodles.

The company’s proprietary drying technology makes it possible to produce freeze-dried and other types of miso soups.

Development, manufacturing and sales of our own brand products

Utilizing our many years of experience, we manufacture and sell our own brand of frozen yam, powdered tea, and other products.

We are developing new products while determining the needs of society.

Company Indicators

The following is a summary of the main indices of Senba Saccharification.

| PER | PBR | Dividend yield | Dividend payout | ratio Equity ratio |

| 10.6 times | 0.76 times | 2.24% | 29.4 % | 45.7% |

As you can see from the indicators, this is a very undervalued stock.

Since it may not be well known, it is a good idea to own it before it becomes famous.

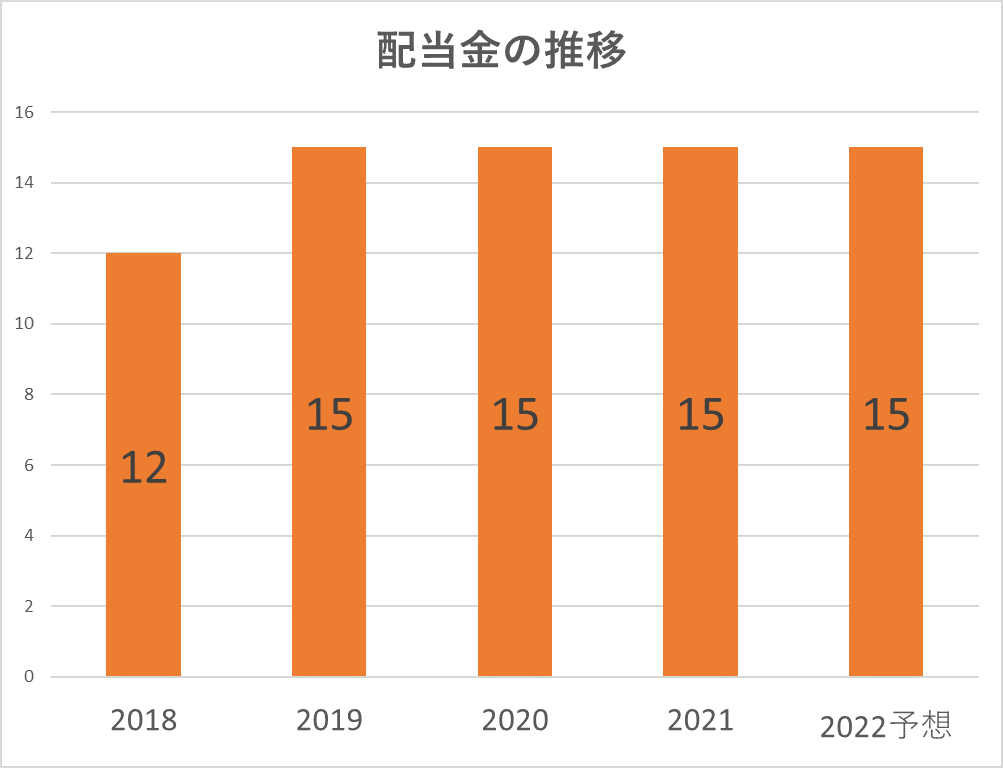

Trends in dividends

The dividend has remained almost unchanged.

I think it will be more attractive if the dividend is increased a little bit in the future.

Shareholder Benefits

If you hold 500 shares on the right day in September every year, you can receive 3,000 yen worth of the company’s products.

Also, if you hold the stock for more than three years, you can receive 6,000 yen worth of the company’s products annually!

If you are a long-term holder, you can receive special benefits in December and July.

Summary

- Strength in caramel production

- Undervalued stock

- Expectations for future performance

I analyzed Semba Sugar Chemical Industry!

Investing is your own responsibility. Make your own final decision after referring to a variety of opinions.

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント