Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

When you think of a large bank in Japan, which bank do you imagine?

I’m going to introduce you to Mizuho Financial Group, the third largest financial institution in Japan, and one of the best known non-conglomerate financial institutions.

I’m going to show you when to buy Mizuho Financial Group and the risks involved!

If you are interested in bank stocks, this is a must-see!

- Want to buy Japanese bank stocks

- Looking for stocks with high dividends

- You are wondering whether to buy shares of Mizuho Bank, Ltd.

- When is the best time to buy MHFG stock?

- Three risks in buying MHFG stock

- What is MHFG?

- Company’s Business

- Company Indicators

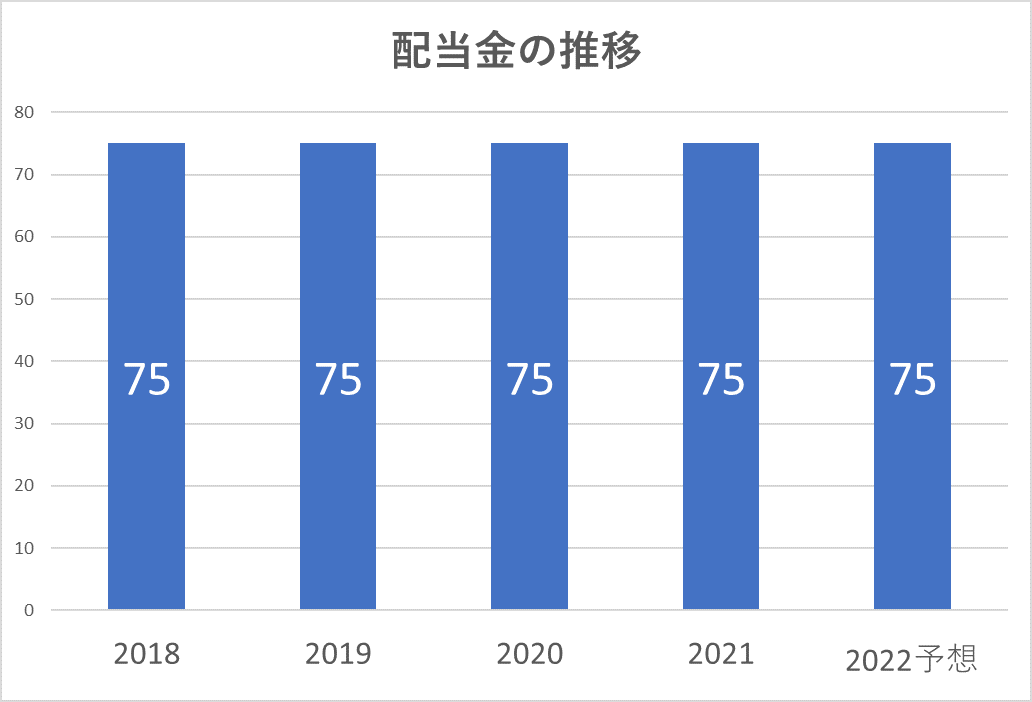

- Dividend Trends

- Three investment trusts I recommend incorporating into our portfolio!

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll learn all you need to know about Mizuho Financial Group!

When is the best time to buy Mizuho Financial Group?

In conclusion, I believe it is a good time to buy when the price is close to 1,490 yen.

Although there have been some bad news due to 8 system failures in 2021, I think the market has gotten used to the repeated system failures, so I think the future decline will be limited.

If good news comes out in the future, we can expect the stock price to rise.

However, the company has a tendency to become a gambling stock, so be careful when trading.

Three risks in buying Mizuho Financial Group stock

1 System failure risk

Of the three giant banks in Japan, Mizuho Bank has the highest number of system failures per year.

This has had a negative impact on customers and society, and it took a long time from the discovery of the problem to its resolution, resulting in a loss of trust.

Since it is likely to take time to resolve the underlying problem, the bad news may come out again.

2 Customer retention risk

Many system failures will cause more customers to leave the bank.

This may reduce the amount of funds available for loans and operations.

Since satisfaction with service is important for banks, whether for individuals or corporations, Mizuho Bank will need to hurry to resolve this issue.

3 Banking industry risk

The banking industry in Japan is easily influenced by the economy, and business has been sluggish year after year.

Another problem is that Japanese people have a high propensity to save and a poor consumption cycle, and the financial industry is promoting investment and other asset management to consumers.

Japanese banks make their profits from transaction fees, and I believe they will continue to raise their fees.

There will be a strong need to revamp their management model, which is not very smart compared to other countries.

What is Mizuho Financial Group?

Mizuho Financial Group, 8411, is a holding company established in 2003.

It was formed as a result of the consolidation of several banks and financial institutions through a banking restructuring.

Its subsidiaries include Mizuho Bank, Mizuho Trust & Banking, and Mizuho Securities.

It is known as the third largest bank in Japan.

Company’s Business

In the Mizuho Financial Group, Mizuho Bank accounts for more than 70% of the company’s revenue, making it the largest source of earnings.

The company provides savings, foreign currency deposits, loans, and insurance to individuals.

For corporations, it provides services such as financing and business support.

Company Indicators

The following is a summary of Mizuho Bank’s main indicators.

| PER | PBR | Dividend yield | Dividend payout ratio | Capital adequacy ratio |

| 7.7x | 0.42x | 4.82% | 2021/3 40.3% | 4.1% |

The indicators show that the company is undervalued.

Banks have low capital adequacy ratios, so there is no need to worry about these figures.

Dividends

Dividends are paid out stably.

It is unlikely that the dividend will be increased.

Three investment trusts for inclusion that I recommend!

Investment trusts can be started with a small amount of money, making them a good choice for beginners!

Since they are managed by professionals, risk diversification is possible.

We have selected investment trusts that Mizuho Bank has included and that close once a year, for your reference.

- Nissay Asset Management Nissay Japan Equity Fund

- Nikko Asset Management Index Fund 225

- Daiwa Asset Management Stock Index Fund 225

Summary

- One of the three largest banks in Japan

- A bank prone to system failures

- The challenge is to improve customer satisfaction in the future

I have introduced Mizuho Financial Group!

Investment is your own responsibility. Make your own final decision after referring to a variety of opinions.

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント