Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

I’m sure you’ve heard of a company called Oedo Onsen at least once, haven’t you?

The REIT run by that company has the highest yield with a May/November fiscal year end.

The purchase price per unit is cheaper than other REITs, so I can recommend it as a place to invest.

I’m going to show you what kind of REIT it is, for those who are actually thinking of investing in Oedo REIT!

- People who want to know about Oedo REIT’s dividends

- Want to know more about Oedo REIT

- Want to know about Oedo REIT’s shareholder benefits

- What is Oedo Hot Spring REIT, Inc.

- Performance Highlights for the 10th Fiscal Period

- Properties owned by Oedo REIT

- When is the best time to buy Oedo REIT?

- Dividend Yield and Dividends of Oedo REIT

- Financial Information and Unitholder Composition

- Is the Unitholder Benefit Plan Discontinued?

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll learn all you need to know about Oedo Hot Spring REIT!

- What is Oedo Hot Spring REIT, Inc.

- Performance Highlights for the 10th Fiscal Period

- Properties owned by Oedo REIT

- When is the best time to buy Oedo REIT?

- Dividend Yield and Dividends of Oedo REIT

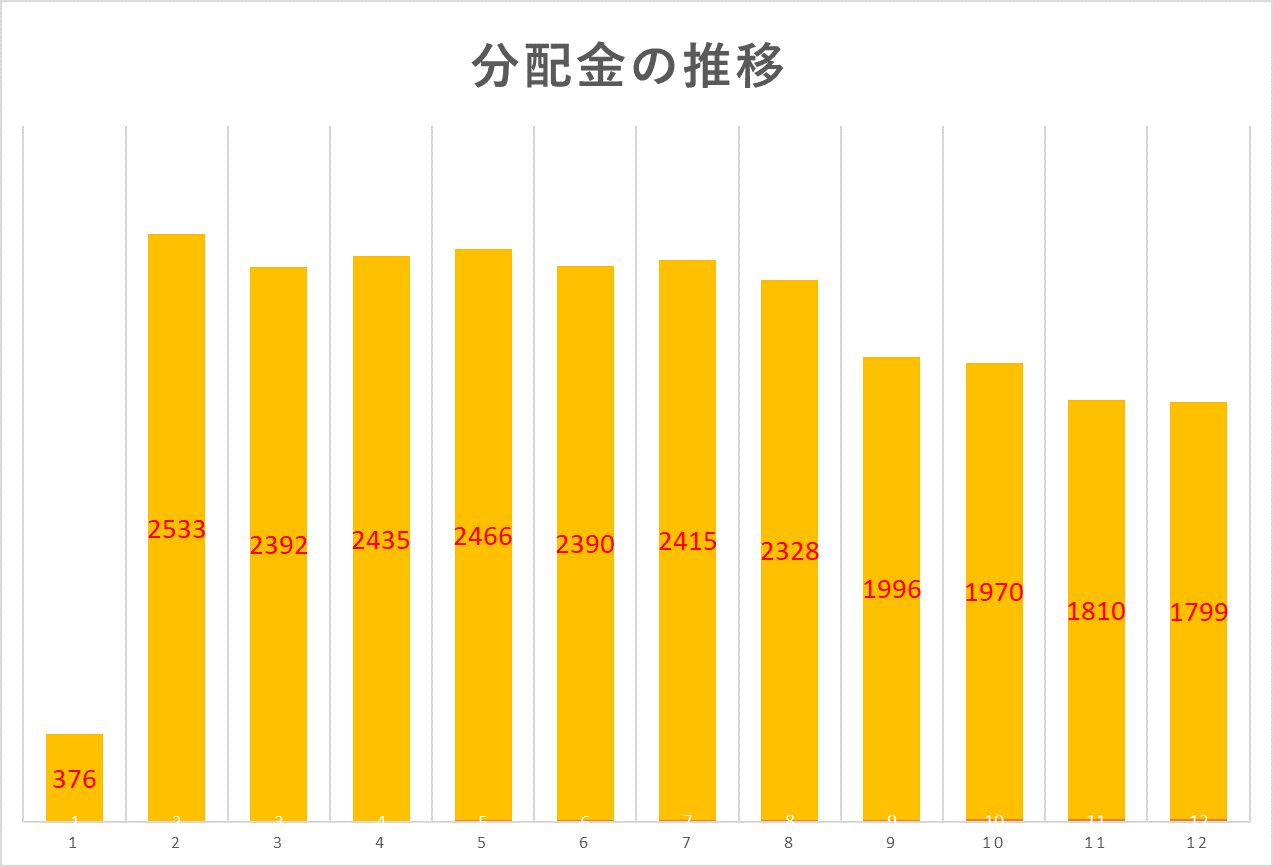

- Changes in cash distributions

- Financial Results and Unitholder Composition

- Are unitholder special benefits discontinued?

- Summary

What is Oedo Hot Spring REIT, Inc.

It is a new REIT that was listed in 2016 as a REIT that invests in hot spring facilities.

It is a REIT managed by the Oedo Onsen Group, which has gained continuous support from people of all ages, so you can expect stable earnings.

The properties are located in various parts of Japan, and its strength lies in its community-based management.

It is possible to invest with as little as one unit, and the high yield is also attractive.

Performance Highlights for the 10th Fiscal Period

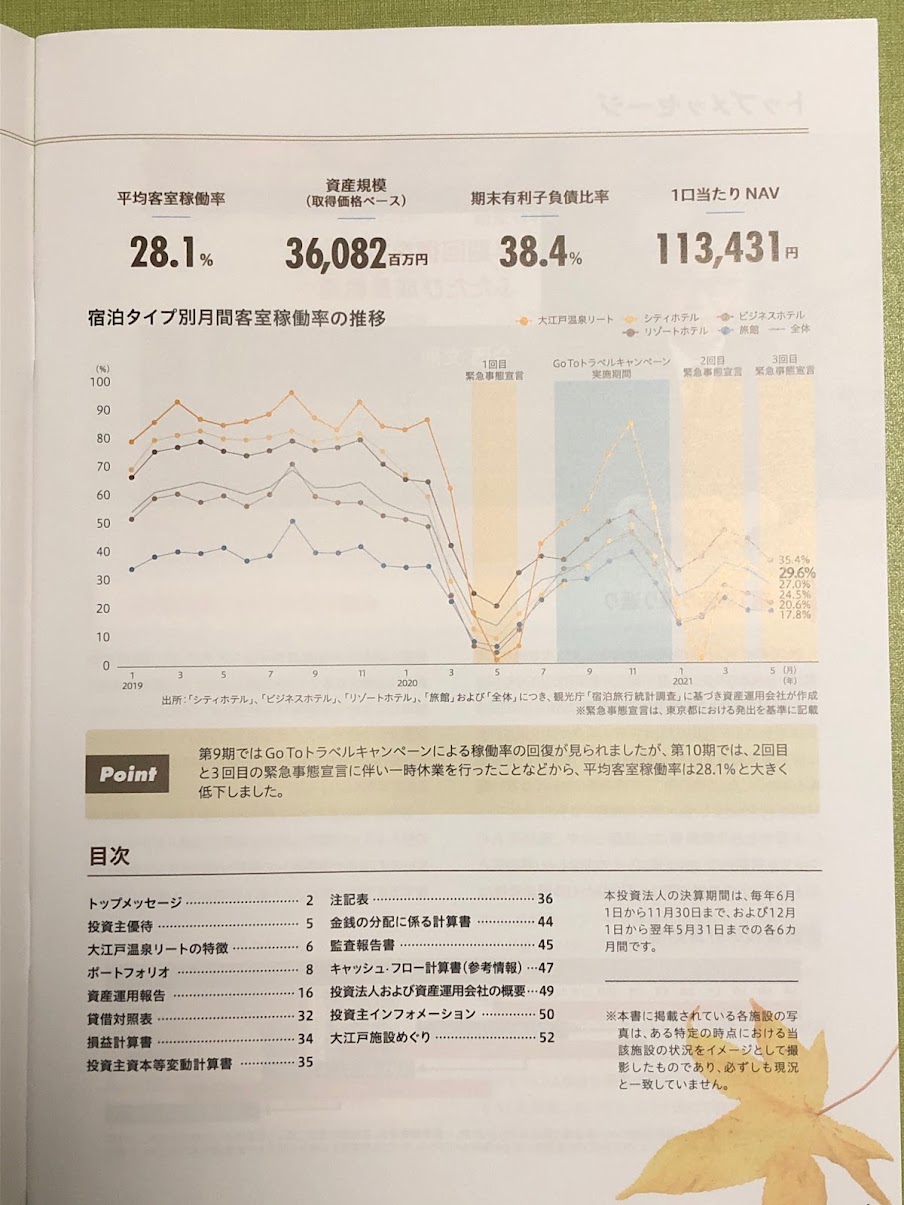

Due to infectious diseases, the average occupancy rate has fallen significantly.

The occupancy rate used to be over 70%, but it has been greatly affected.

It is going to take some time to recover.

Once the situation improves, I believe the occupancy rate will also improve.

Properties owned by Oedo REIT

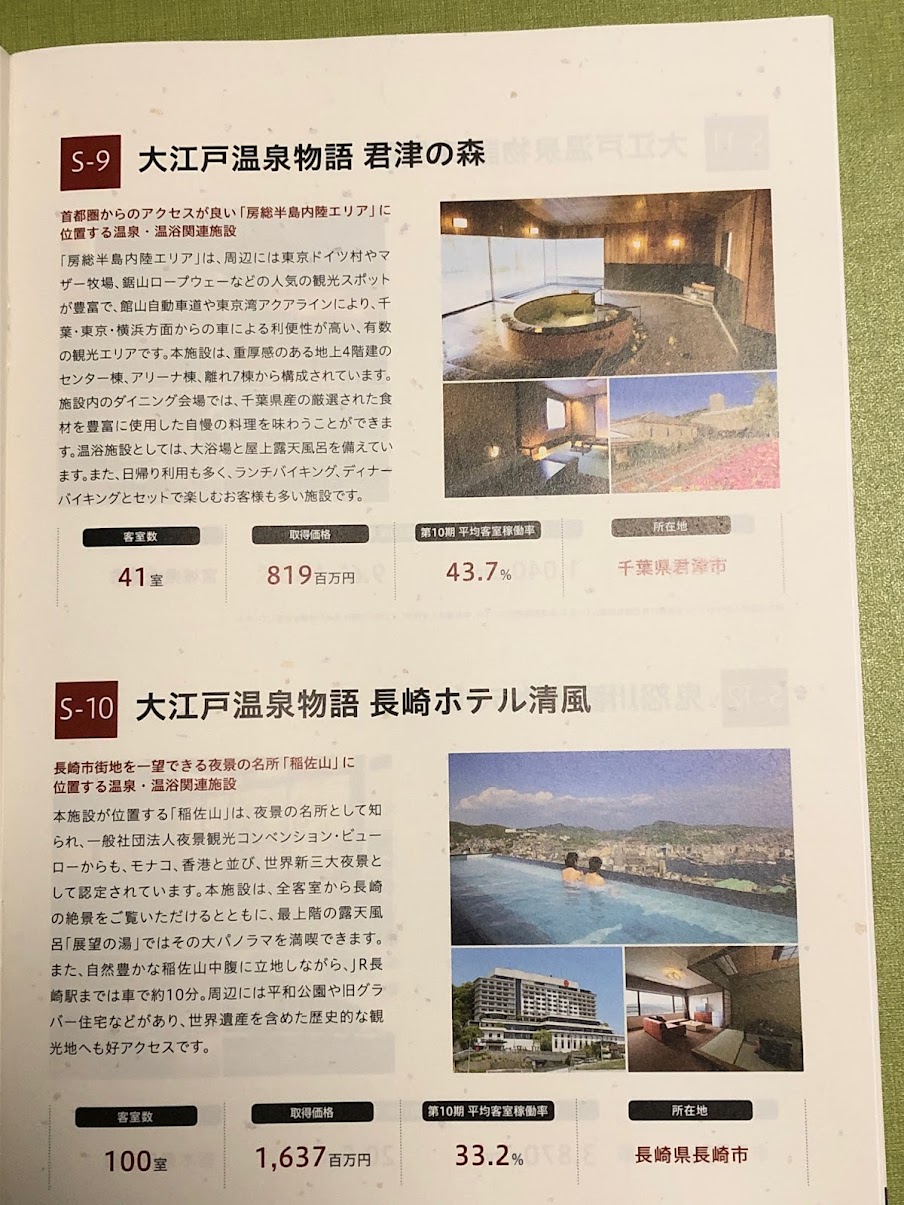

Oedo REIT owns 14 properties in various parts of Japan.

The average occupancy rate for this quarter was 28%.

The characteristics of the locations it owns include many hot spring resorts, and it concentrates on popular travel destinations.

When is the best time to buy Oedo REIT?

Personally, I think it is a good time to buy when the price falls below 7,000 yen.

After hitting a low of 45,000 yen in 2020, it has returned to 87,000 yen, but has started to fall due to the re-emergence of infectious diseases.

Since it is in a downtrend, I think it is better to buy at the bottom.

Dividend Yield and Dividends of Oedo REIT

The yield as of 8/19/2021 is 4.5%, which is the highest yield among REITs with a May/November fiscal year end.

Changes in cash distributions

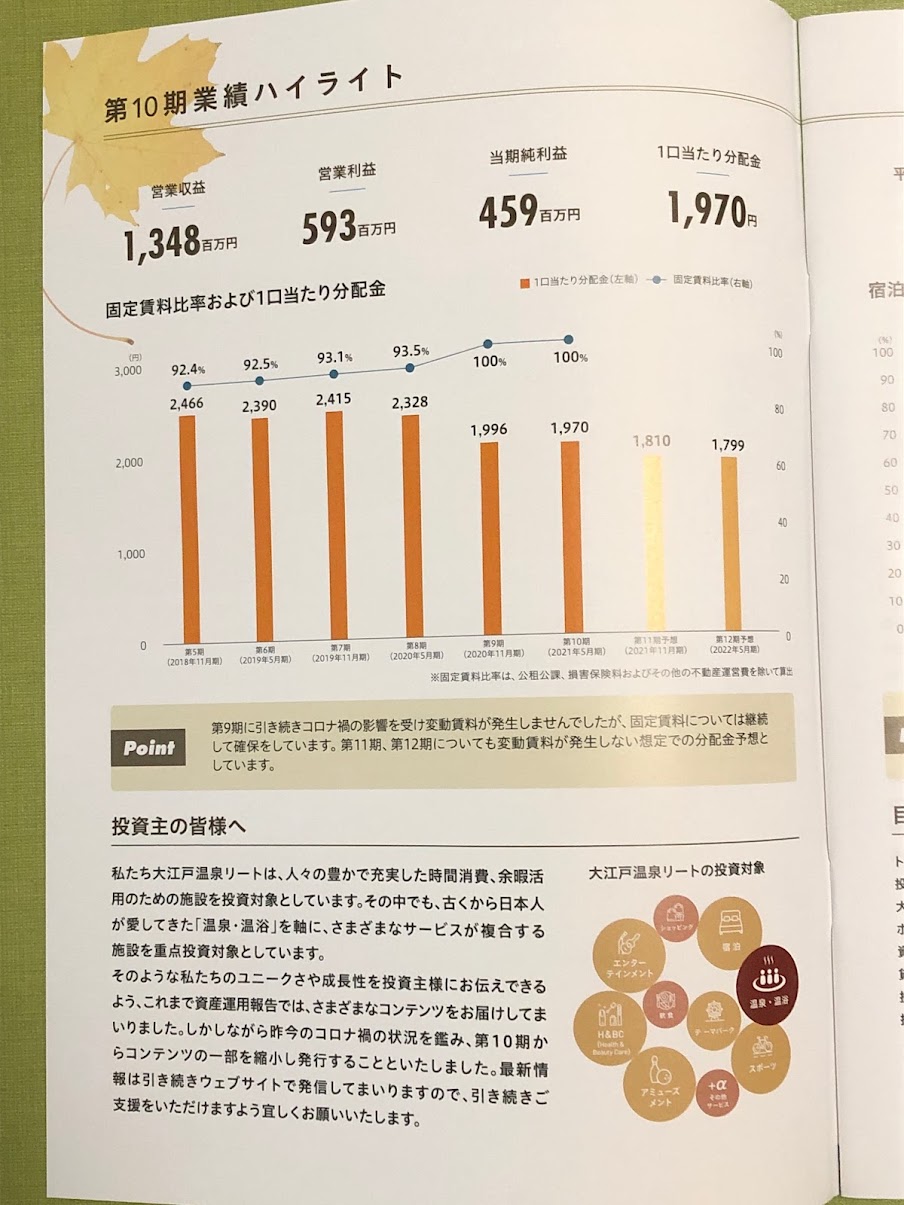

Distributions have been decreasing since the 9th period when the infection spread.

The distribution for this term was 1970 yen per unit.

The forecast for the next fiscal year and beyond is for a decrease to 1,810 yen.

If the situation changes, I believe that distributions will increase.

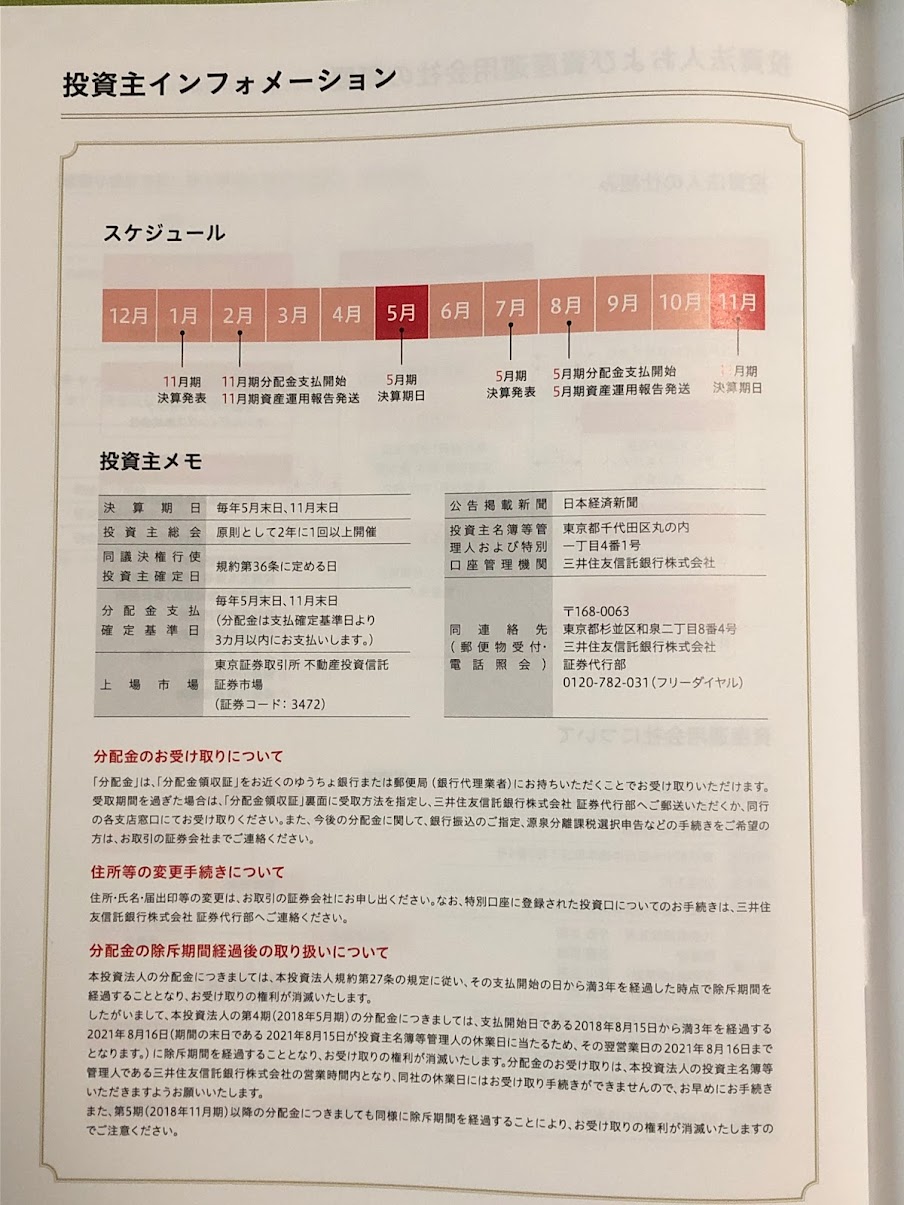

Financial Results and Unitholder Composition

Financial results are announced in January and July every year, and distributions are paid in February and August.

Since the fiscal year ends in May/November, distributions are paid three months later.

Individuals account for 50% of the total number of investment units, and 90% of the unitholders are individuals.

Therefore, it is a REIT that is prone to decline when bad news comes out.

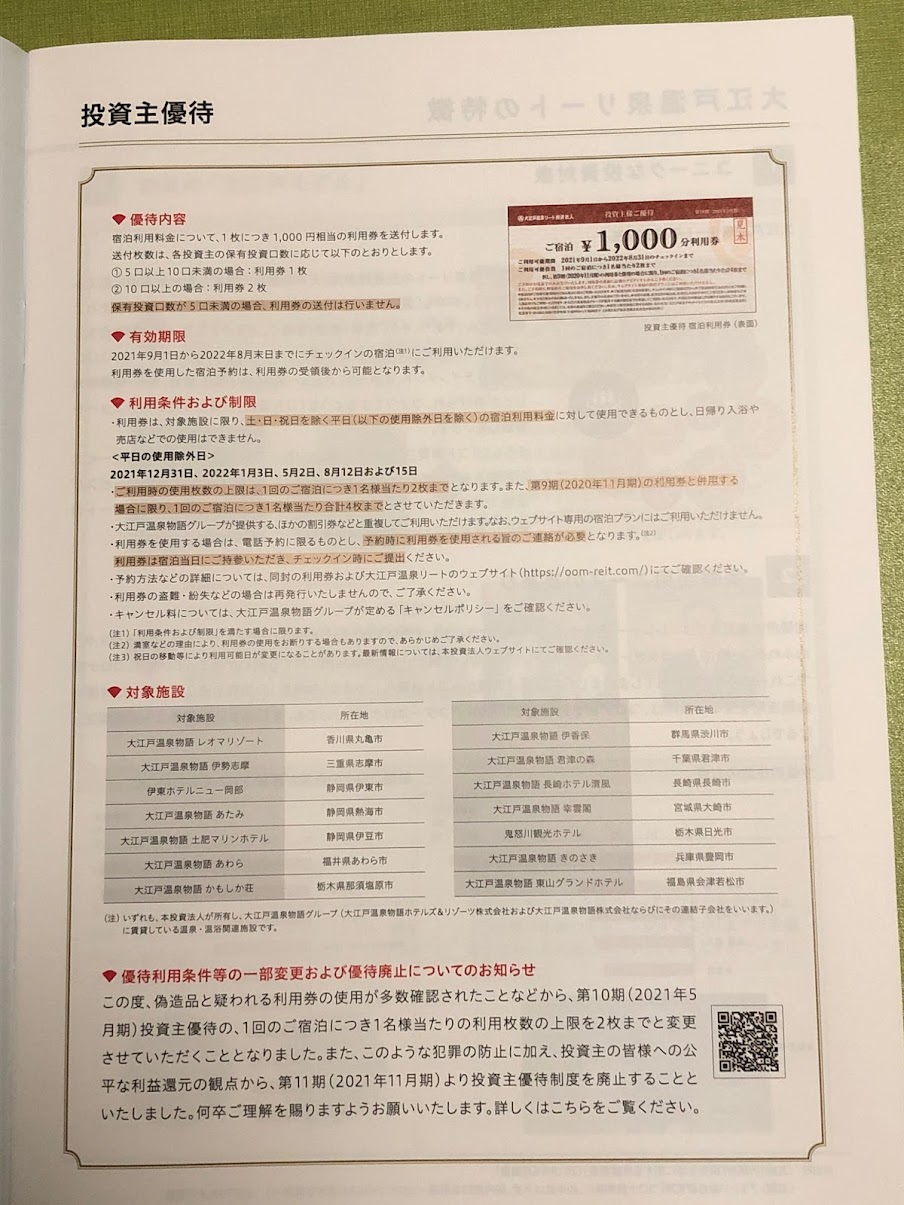

Are unitholder special benefits discontinued?

Oedo REIT used to have a special benefit program, but it was discontinued from the 11th term due to the use of many counterfeit products.

The company used to distribute 1,000 yen use coupons for 5 or more units and 2,000 yen use coupons for 10 or more units.

Incidentally, up until the 10th term, one person could use up to two usage coupons.

I hope that the funds from the preferential treatment program will be added to the distribution in the future.

Summary

- Oedo REIT has the highest yield in May/November.

- Expect share price recovery due to change in infectious disease situation.

- Low price among REITs, easy to buy

I’ve just introduced Oedo Hot Spring REIT, Inc.

We will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント