Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

I casually looked at my mailbox and saw a dividend notice from JT the other day!

The stock price has been declining steadily, and people tend to shy away from this stock, but it seems to have stopped declining recently.

In this article, I would like to introduce JT’s dividend and financial results for the first half of 2021!

This is a must-see for those who want to buy JT in the future, so please read through to the end.

- I want to know about JT’s financial results for the second quarter of FY2021.

- Want to know about JT’s earnings report

- Want to know about JT’s dividends

- Dividends have arrived from JT

- Dividend forecast

- Summary of financial results for the second quarter of 2021

- Performance of each business

- New JT news

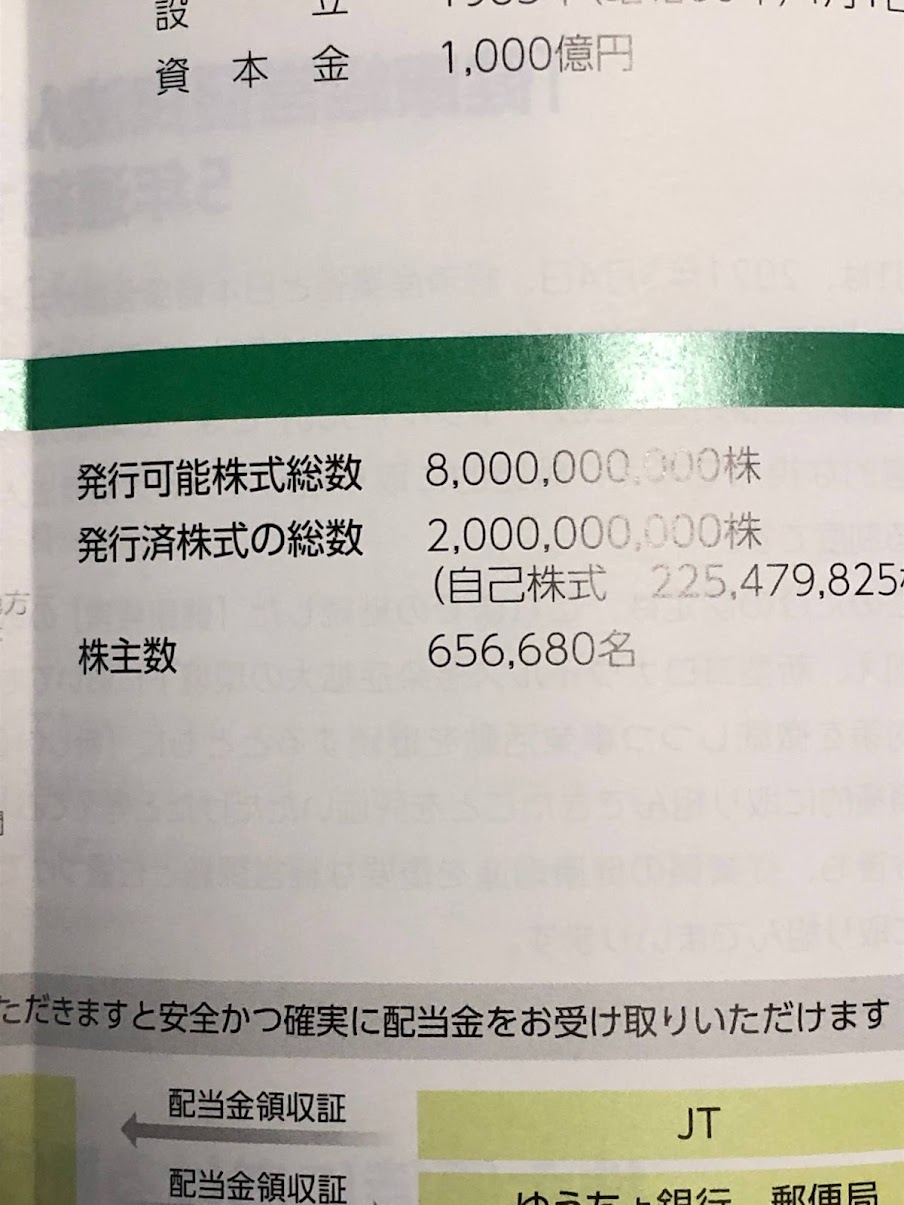

- Latest stock status and number of shareholders

- Share Price Trends and Forecasts

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll learn about JT’s second quarter earnings for 2021!

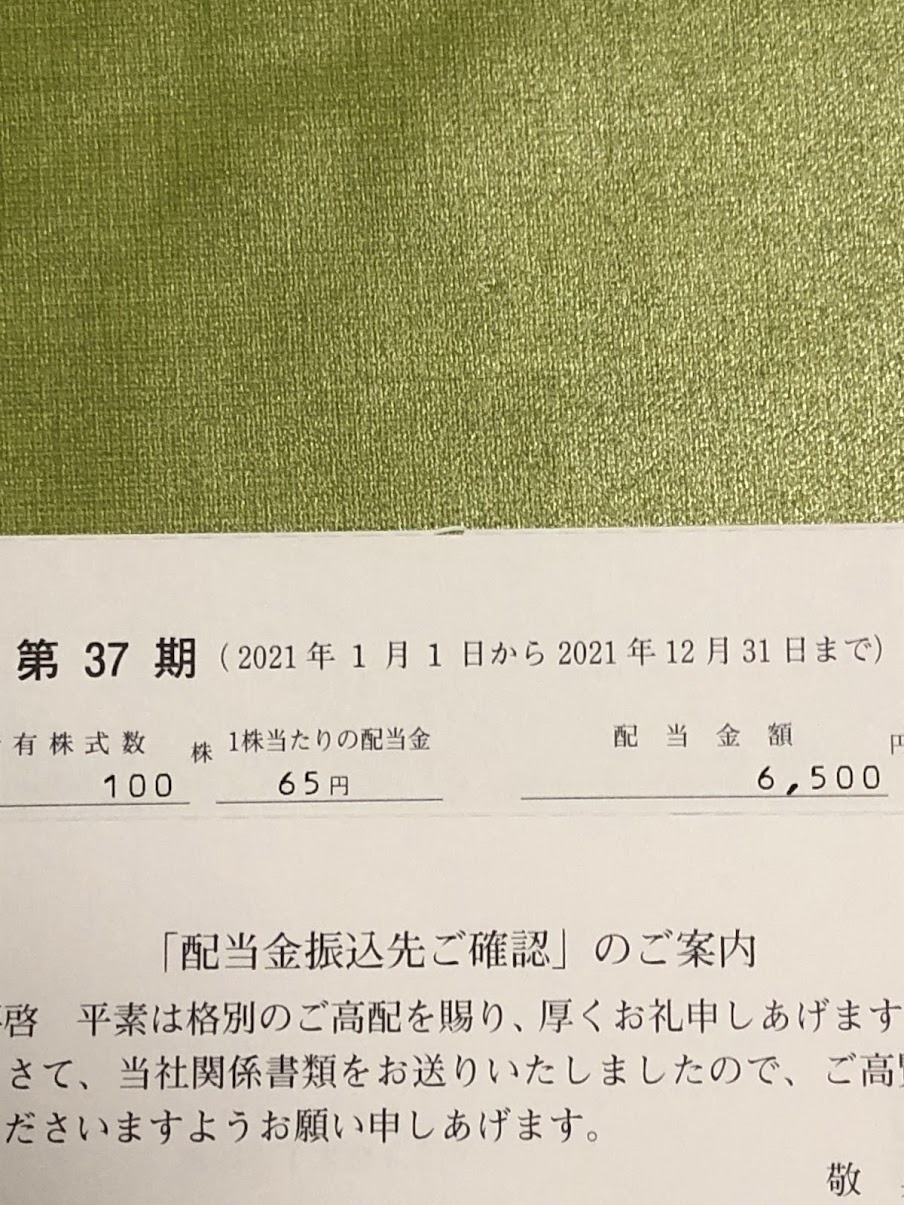

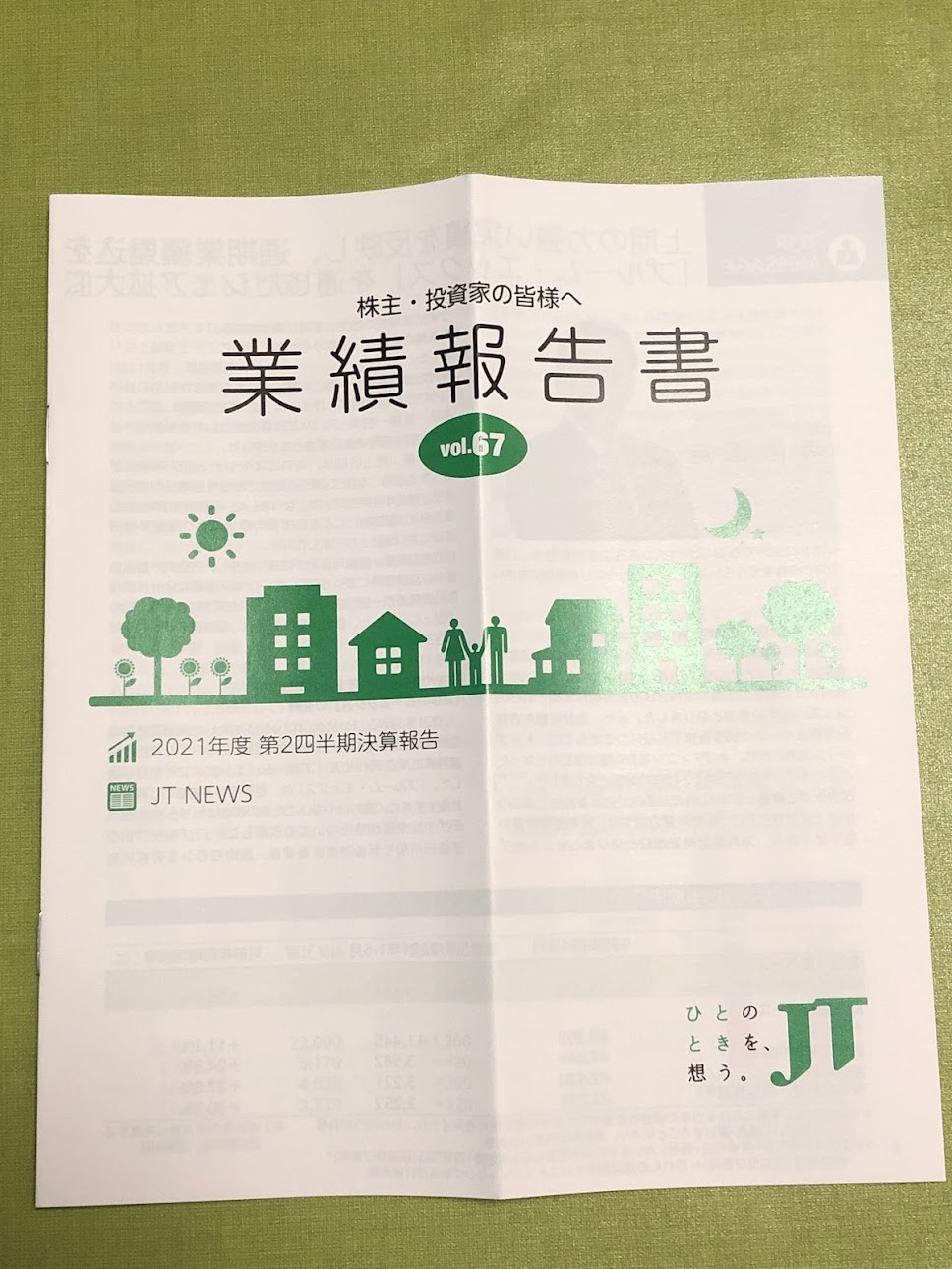

Dividends arrive from JT

The 37th fiscal year has ended and the dividend has arrived.

For the half year of 2021, I received a dividend of 65 yen per share.

Since I hold the stock in NISA, I was able to receive it tax-free.

The stock price is not healthy, but the dividend is high, so I am grateful.

Dividend forecast

The year-end dividend for 2021 is expected to be 65 yen per share.

Until 2020, the company had continuously increased its dividend, but now in 2021, it has decreased its dividend.

We hope that the company will increase its dividend in the future or return to the same standard as before.

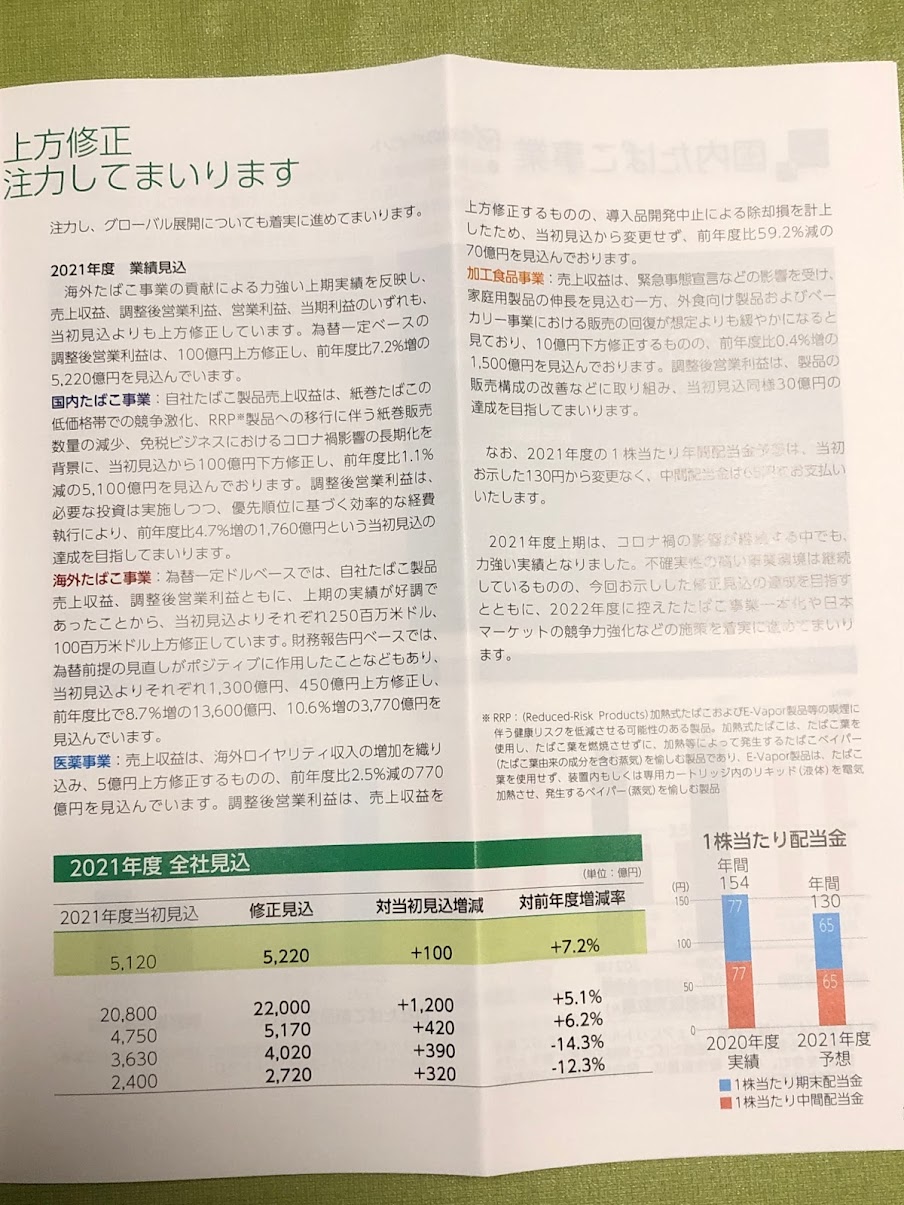

Summary of financial results for the second quarter of 2021

In the first half of 2021, operating income, excluding the impact of foreign exchange, increased by 26.9% year on year, boosted by our overseas tobacco business.

Operating income also increased by 24.5% y-o-y due to limited foreign exchange risk.

For the fiscal year ending March 31, 2021, the company is forecasting an upward revision of 10 billion yen in adjusted operating income to 522 billion yen, up 7.2% from the previous year.

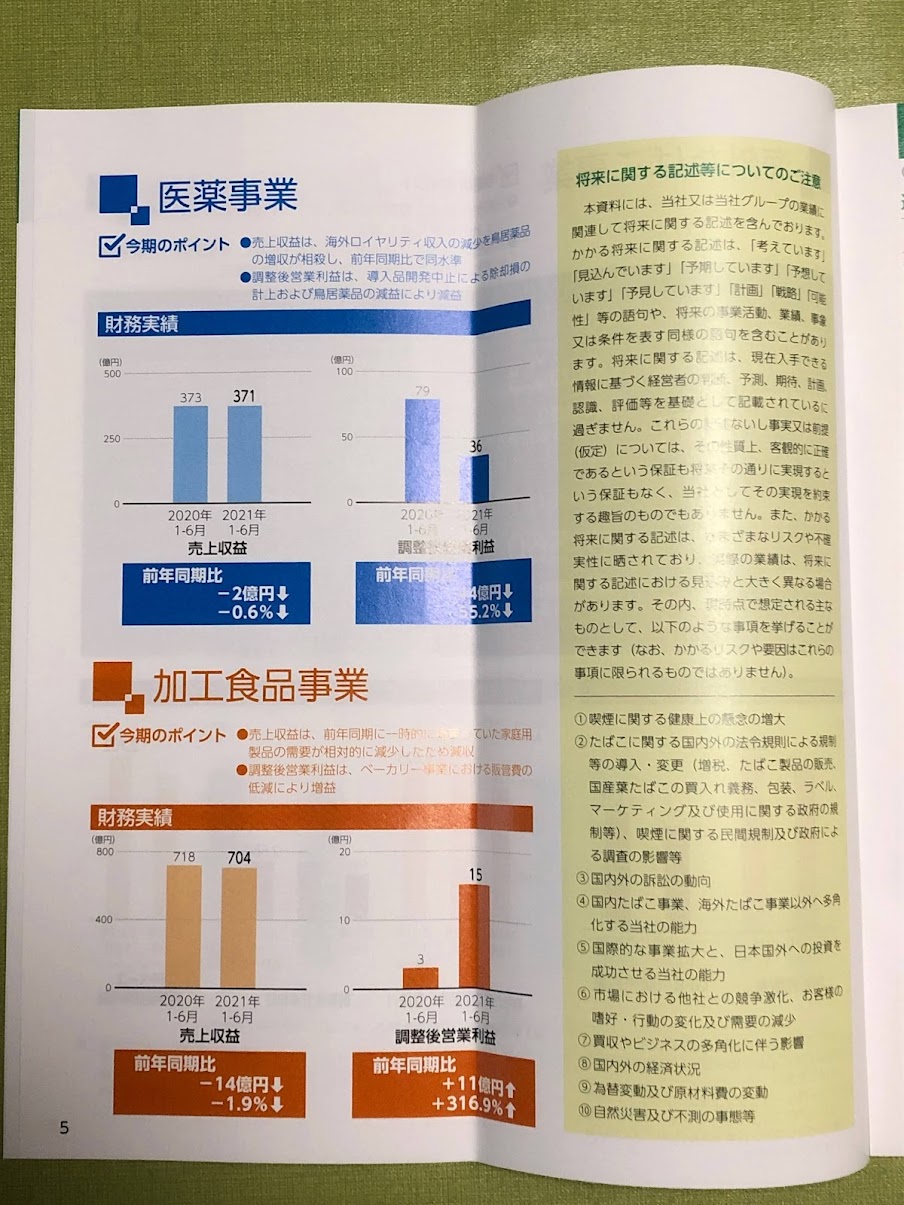

Performance of each business

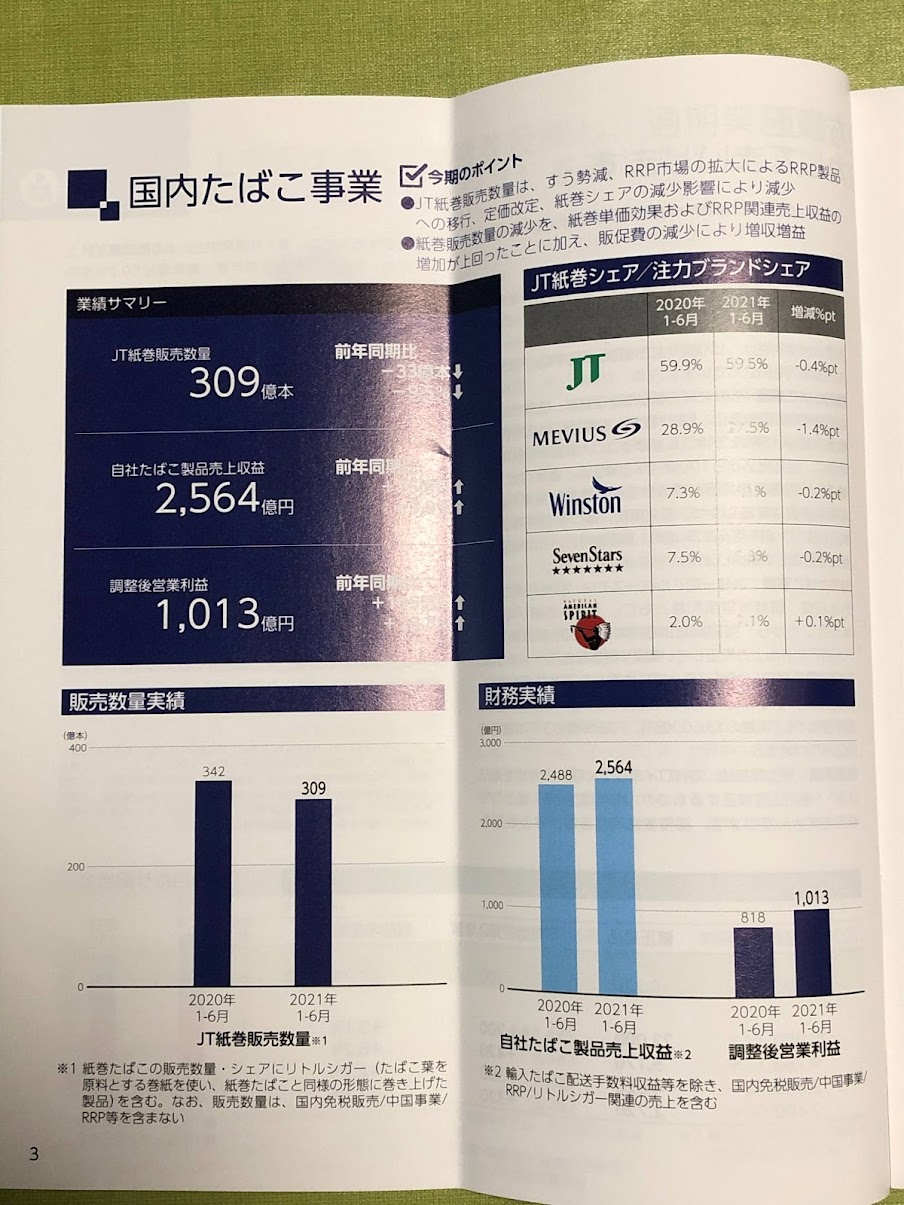

Domestic Tobacco Business

Domestic results show an increase in revenue and adjusted operating income, despite a year-on-year decline in sales volume.

The financial performance is living up to the increase, which is probably a relief.

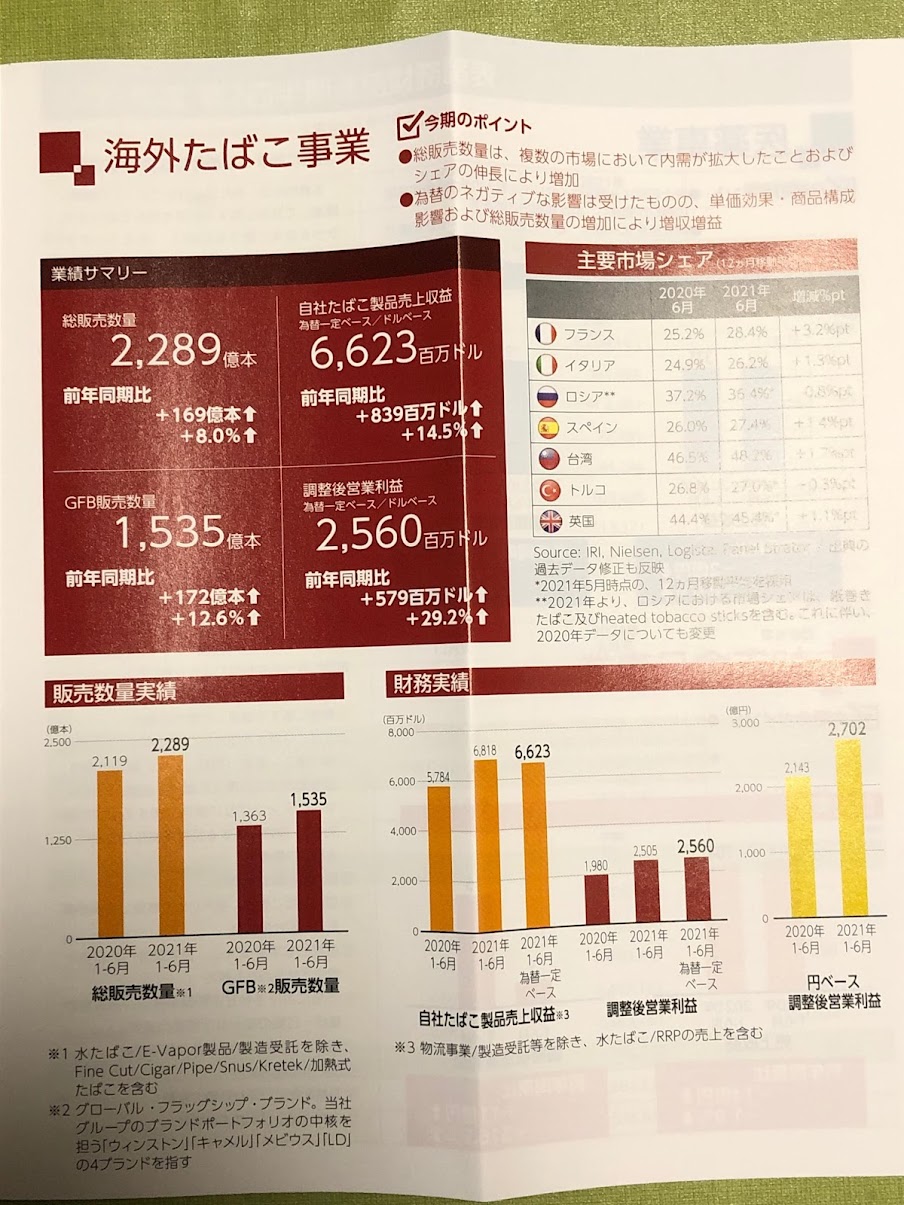

Overseas Tobacco Business

In the overseas business, sales volume, sales revenue, adjusted operating income, and GFB sales volume all increased.

The increase in demand and market share in overseas markets seems to have contributed to the increase.

Despite the impact of foreign exchange rates, revenue increased due to higher unit prices, product mix and sales volume.

Looking at the major overseas market shares, Taiwan and the U.K. have high figures of 40%.

Looking at the increase in market share for this fiscal year, the highest figure was in France, which increased by 3.2 percentage points.

Pharmaceuticals Business

Sales revenue was at the same level as the same period of the previous fiscal year due to overseas royalty revenue and an increase in revenue from Torii Pharmaceutical, a group company, offsetting each other.

Operating income, on the other hand, declined due to the impact of the cancellation of in-licensed product development and a decrease in profit at Torii Pharmaceuticals.

Processed Foods Business

Sales revenue decreased due to lower demand for home use products in the same period of the previous fiscal year.

Adjusted operating income increased due to lower SG&A expenses in the bakery business.

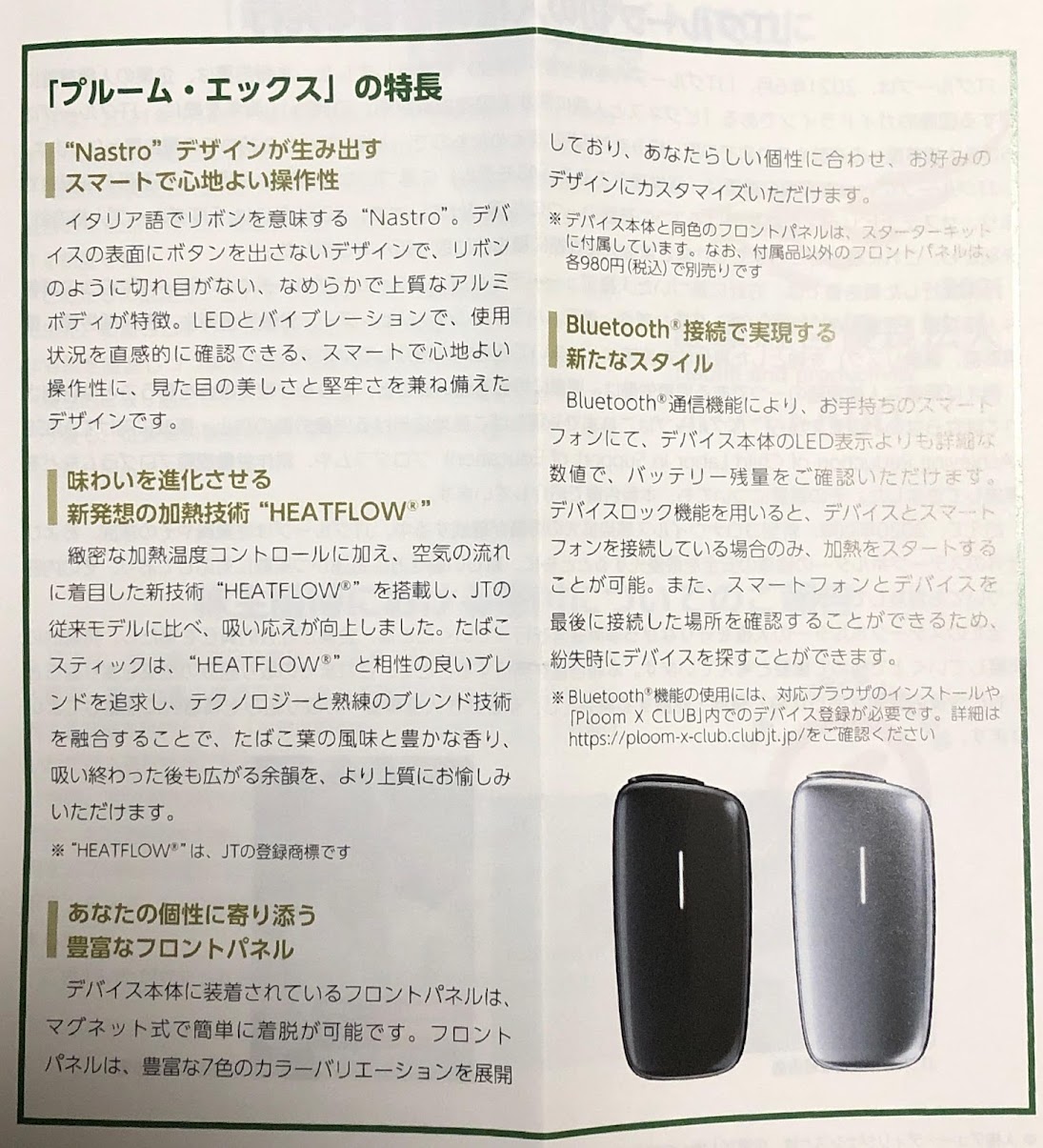

New News from JT

New processed food products and new heated cigarette products were introduced.

JT’s frozen foods are delicious with a wide range of products on sale, especially udon noodles.

The new heated cigarette product can be connected to Bluetooth, and it’s an Iot-conscious product.

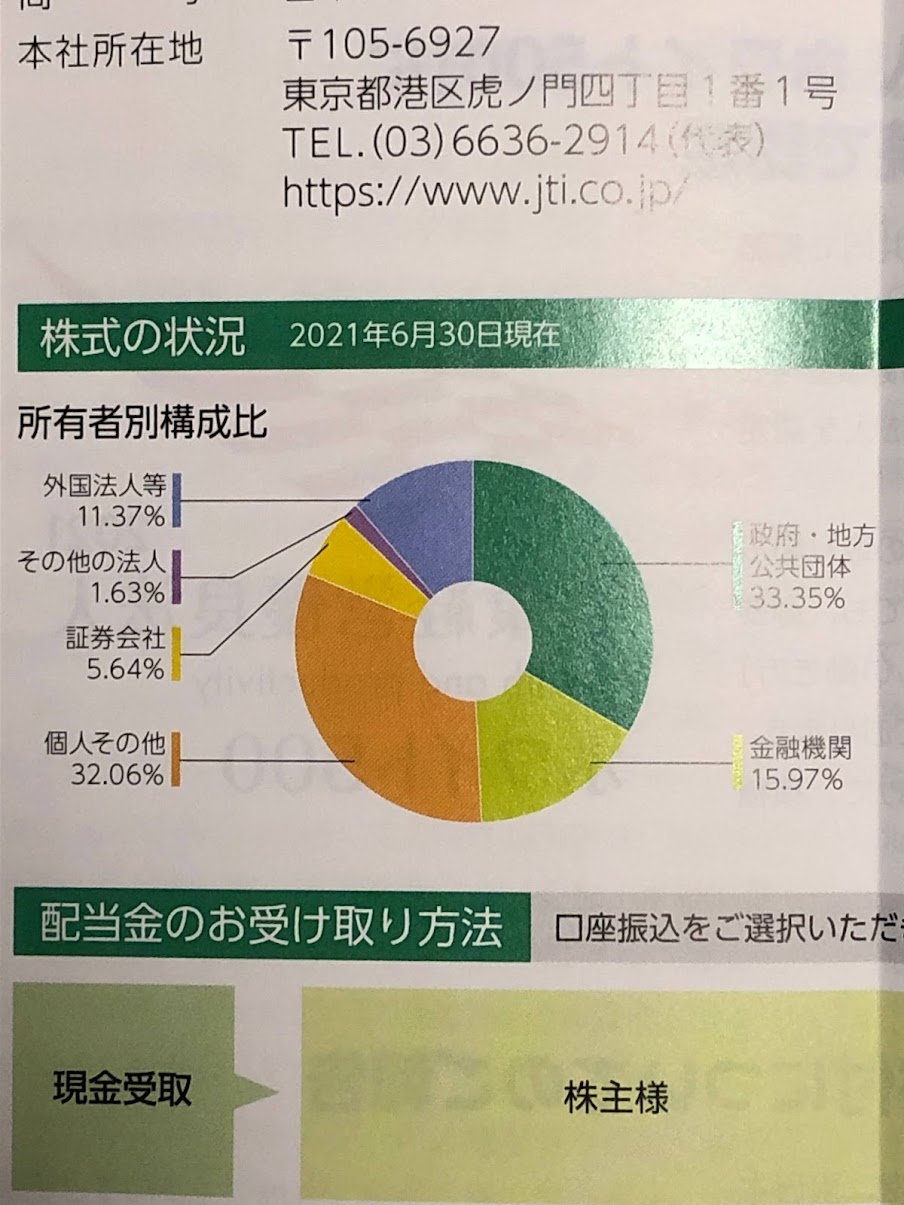

Latest stock status and number of shareholders

As of 6/30/2021, a large percentage of the company’s shares are held by the government (30%), financial institutions (16%), and individuals (30%).

That’s almost no change.

The number of shareholders is 656,680, which indicates that a large number of investors hold Japanese stocks.

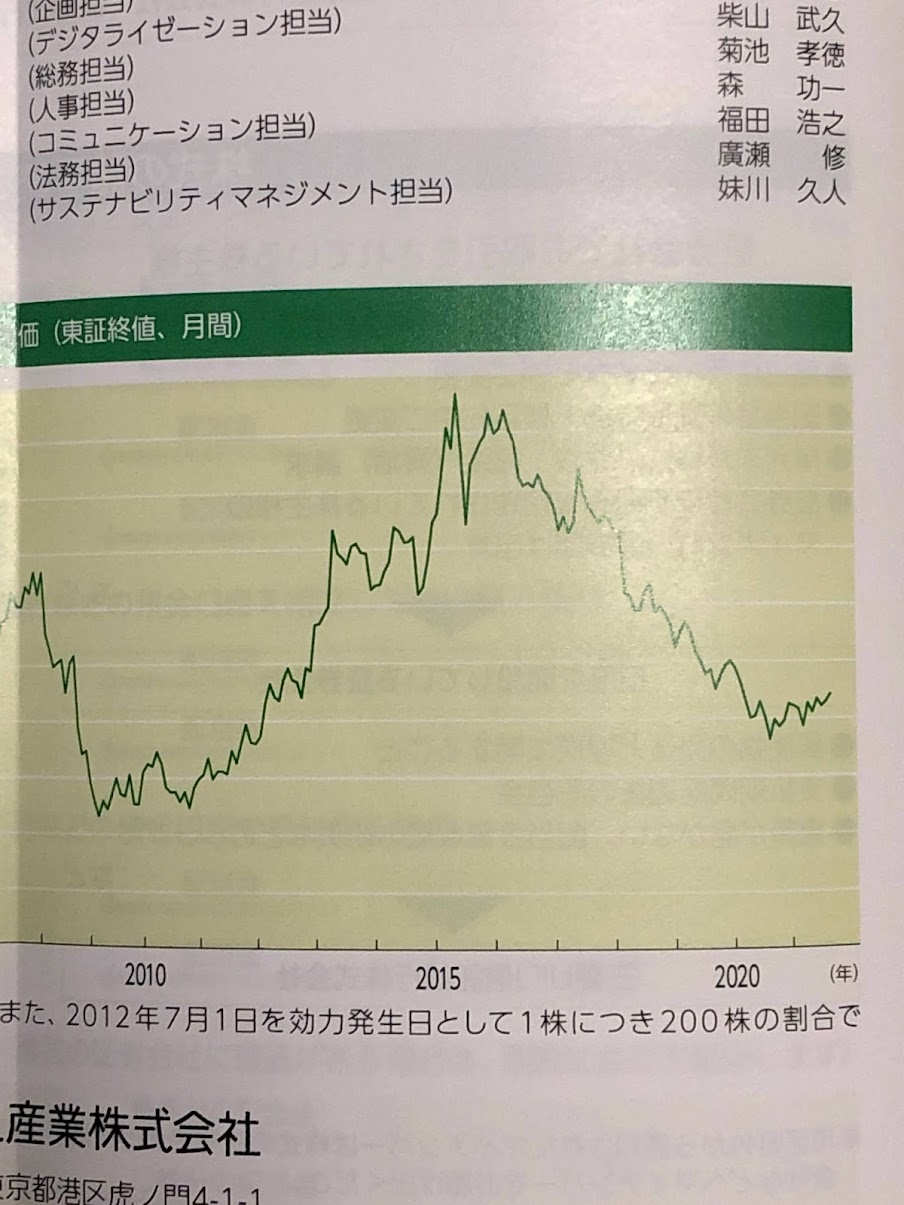

Stock Price Trends and Forecast

The stock price was almost 4,800 yen in 2015 and now it is less than half of that.

For me personally, I think it has stopped going down, so you can try to buy it at the current level.

I believe that the situation will improve in the future and if the price goes above 2,400 yen, it will rise.

Conclusion

- Operating income increased in the first half, driven by overseas business

- Year-end dividend is expected to be 65 yen, the same as the interim dividend.

- Domestic business faces challenges in sales volume

This is a summary of JT’s dividend and first-half results for 2021.

Please stay tuned as we will continue to provide useful information for your investment.

Thank you for reading to the end!

コメント