Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

Did you know that there has been a recent upsurge in the number of Japanese trading companies?

In the past, Mitsubishi Corporation (MC) was the sole leader in terms of market capitalization, but in recent years, ITOCHU Corporation has jumped to the top spot.

Knowing this fact, I decided to do some analysis on Itochu!

If you are practicing long-term investment or just want to know more about the company, this is a must-see.

- People who want to know about ITOCHU Corporation

- Interested in trading company stocks

- Are looking for stocks that are resistant to the economy

- Is ITOCHU Corporation recommended for long-term investment?

- What is ITOCHU Corporation?

- Company’s Business

- Company Indicators

- Dividends

- Investment trusts included

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll get to know ITOCHU Corporation!

Is ITOCHU Corporation recommended for long-term investment?

In conclusion, ITOCHU Corporation is a recommended stock for long-term investment.

This is because the ratio of non-resources in its business accounts for 90% of its business, so it has the advantage of not being defeated by the economy.

In general, trading companies have a high ratio of resources in their business, and there is a risk that their performance will fluctuate greatly depending on the economy.

In this respect, ITOCHU is diversifying its risks, so it can be said to have a source of security.

What is ITOCHU Corporation?

8001 ITOCHU Corporation is a trading company founded in 1858 by Chubei Itoh, a merchant from Omi.

At the young age of 15, Chubei, the first founder, was engaged in the wholesale business of products from the Osaka area to Tokyo.

In 1918, also opened a branch office in New York, USA.

The company’s corporate philosophy is to make three things better: the seller, the buyer, and the world.

The company operates eight broad businesses and has 100 offices in 62 countries overseas.

Company Businesses

The company has eight businesses, including textiles, machinery, metals, energy, and chemicals, and engages in domestic import and export and trilateral trade.

It also conducts business in a wide range of fields, including business investment in Japan and overseas.

Corporate Indicators

The following is a summary of ITOCHU’s main indices.

| PER | PBR | Dividend yield | Payout ratio | Market capitalization |

| 8.8 | 1.37 | 2.9% | As of March 2021 32.6% | 1st |

PER and PBR are cheaper than average, and the dividend payout ratio is well balanced.

With its market capitalization recently ranked No. 1, the company’s relationship with its peers may change in the future.

Dividend Trends

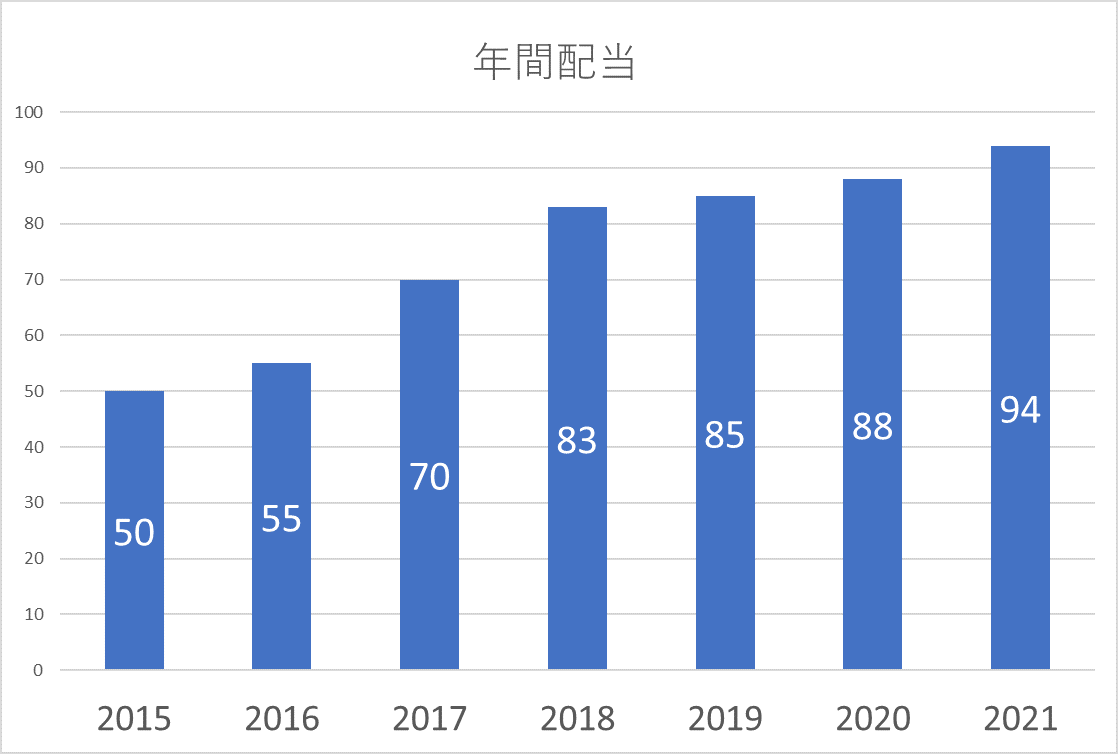

ITOCHU has increased its dividend for six fiscal years through 2020, and we can expect a dividend increase in the seventh fiscal year.

This is because the dividend payout ratio is low, making it easy for the company to distribute dividends.

It is ideal for long-term investment.

Three recommended investment trusts for inclusion

I have selected investment trusts that close once a year and include ITOCHU Corporation for your reference.

Nikko Asset Management Nikko Japan Open (Zipangu)

Nikko Asset Management Index Fund 225

Nissay Asset Management Nissay Nikkei 225 Index Fund

Summary

- Non-resourceful and not easily influenced by the economy

- High productivity of employees

- Good stock price performance

I have introduced ITOCHU Corporation!

Investing is your own responsibility. Make your own final decision after referring to a variety of opinions.

We will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント