Hello everyone. I’m @olivertomolife and I love investing and shareholder benefits!

In this day and age when there is much discussion about the importance of asset management, more and more individuals are starting to invest.

Senshukai, which I will introduce here, is a stock with a low minimum purchase price, making it a good choice for beginners.

The company’s financials are stable, so there’s little risk of bankruptcy, which gives you peace of mind!

Let’s take a look at the company and when to buy Senshukai.

- Those who are looking for an affordable and easy-to-buy stock.

- Looking for a stock that will provide shareholder benefits over the long term.

- Want to invest in stocks with stable financials.

- When is the best time to buy Senshukai?

- A personal perspective

- What is Senshukai?

- Company’s business

- Company Indicators

- Company’s shareholder benefits

- Three investment trusts I recommend incorporating into our portfolio!

The author has been investing for three years and has experience in the securities industry.

By reading this article, you’ll get to know Senshukai!

When is the best time to buy Senshukai?

In conclusion, I think it is time to buy at around 350 yen.

Looking at the 10-year chart, the stock has risen sharply since 2012, reaching a high of 995 yen.

Since then, it has been in the 800 yen range, but has been trending downward since the second half of 2017.

There was also a temporary drop of almost 200 yen due to an infectious disease, but the price recovered to 500 yen at one point.

I think the bottom is solid at the 300 yen level, so I expect an uptrend in the future.

Personal Viewpoint

The company provides services based on the know-how it has cultivated over the years in mail-order sales, so it is highly trusted by customers.

Its stock price is also low compared to others, so I think it is a good stock to start investing in.

The company has been involved in online shopping for the past 20 years, and I believe that its forward-thinking business development is contributing to the company’s sales.

The company’s stock price has fallen in recent years, but it has calmed down now, making it an interesting long-term investment.

What is Senshukai?

Senshukai was established in 1955 and is a mail order company.

Since its establishment, the company has been doing business with women’s rice style in mind, and has been supporting Japanese women for a long time.

The company is also expanding overseas, with offices in China, Thailand, Vietnam, India, and Indonesia.

Since we have bases in these growing markets, we are considered to be strong in overseas business.

Company’s Business

The company’s main businesses include mail order, corporate, insurance/credit card, and others.

Of these, the mail-order business accounts for the largest portion (80%), with three company-operated websites.

In the corporate business, we are engaged in supporting businesses from product development to sales, focusing on business support services.

Using the experience the company has accumulated over the years, it provides a wide range of support including cost reduction and customer support.

Company Indicators

The following is a summary of Senshukai’s main indicators.

| PER | PBR | Dividend yield | Dividend payout ratio | Equity ratio |

| 15.9x | 0.56x | 1.76% | 2020/12 0% | 2020/50.2% |

Indicators other than dividend yield are trending well.

The capital adequacy ratio is also above 50%, which gives me a sense of security.

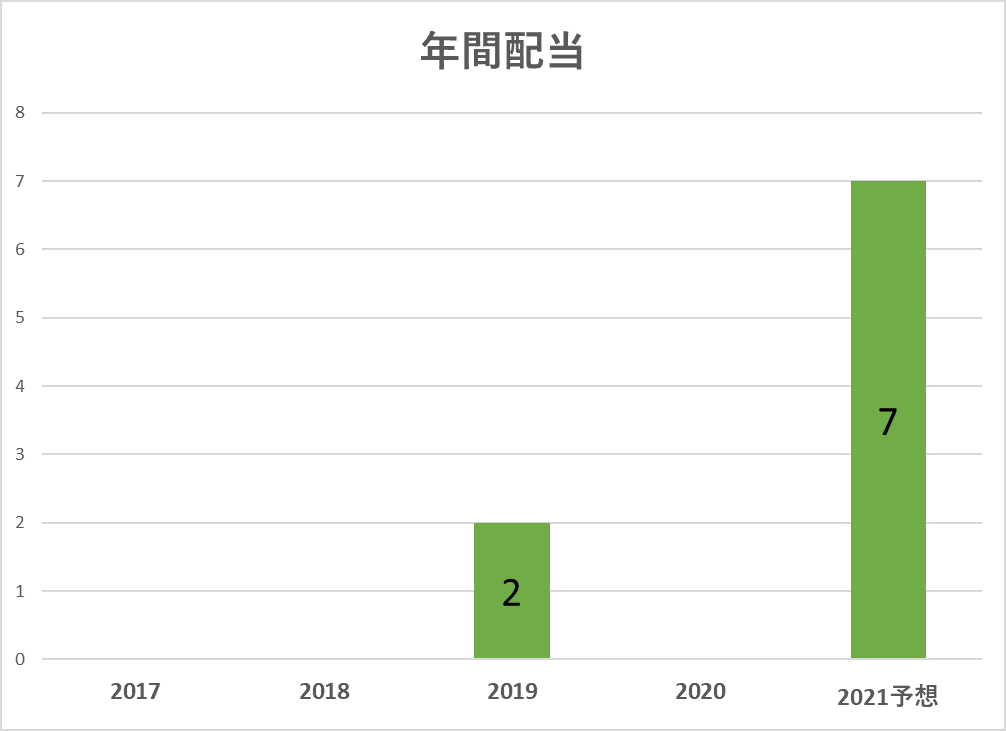

Trends in dividends

You can see that there have been few years in which the company has paid dividends in the last five years.

For this reason, it is not an appropriate stock to buy for dividends.

For 2021, we are forecasting an annual dividend of 7 yen.

Company’s shareholder rights

Shareholders can receive special benefits by owning 100 shares or more on the rights determination dates in June and December every year.

The content of the benefits changes depending on the number of shares and the number of years held, so it is recommended for long-term investment.

The special shopping coupons can be used to purchase a wide range of Senshukai products.

Three recommended investment trusts!

Investment trusts are recommended for beginners who are afraid to start investing right away.

Since you can start with a small amount, you can diversify your risk.

Mutual funds managed by professionals do not need to be constantly checked like stock prices.

I have selected products that close once a year and incorporate Senshukai for your reference.

Tokyo Marine Asset Management Tokyo Marine Selection Japan Equity TOPIX

Mitsubishi UFJ International Investment Trust Fund Manager (Domestic Equity)

Mitsubishi UFJ International Investment Trust eMAXIS Slim Domestic Stock (TOPIX)

Summary

- Easy to buy for beginners

- Should not be bought for dividends.

- The company is financially stable and has a sense of stability.

This article introduced the best time to buy Senshukai.

Investing is a personal responsibility. Make your own final decision after referring to a variety of opinions.

Please stay tuned as I continue to provide useful information for your investment.

Thank you for reading to the end!

コメント