Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

Nippon Kanzai, the company I’m going to introduce here, is a noteworthy stock with stable dividends and good performance.

The company comprehensively manages buildings in Japan and provides its technology in Australia and the United States.

The company also has a very high return on equity and a stable financial base, which makes it a recommended company to hold only 100 shares for a long time.

Now, let me explain what kind of business the company is actually doing!

- Looking for stocks with a high capital adequacy ratio

- Want to buy stocks with shareholder special benefits that are recommended for beginners

- Looking for stocks with stable dividends.

- What is Nippon Kanzai?

- Company Business

- Company Indicators

- When is the best time to buy?

- Dividends

- Shareholder Benefits

- Recommended 3 investment trusts for inclusion

- Personal perspective

The author has been investing for three years and has experience in the securities industry.

By reading this article, you’ll learn about Nippon Kanzai!

What is Nippon Kanzai?

Nippon Kanzai was established in 1965 and is a comprehensive building and building management company with 9,700 consolidated employees.

In 1967, two years after its establishment, Nippon Kanzai began comprehensive management of hospitals for the first time, and since then it has also begun comprehensive management of government buildings and facility repairs.

Since 1978, the company has also been providing building security services through a business alliance with security company Secom Co.

As I will explain below, the company is also known for its high return on equity.

Company’s Business

The company’s main businesses are building management and operation, building management services, security services, housing management and operation, environmental facility management, and real estate fund management.

We have group companies in various parts of Japan, each of which has a high level of expertise.

As for overseas business, we are also developing building management business in Australia and the United States.

Buildings, like people, have life cycles, and one of the company’s businesses is to oversee and manage the optimization of these life cycles.

Company Indicators

The following is a summary of the company’s main indicators.

| PER | PBR | Dividend yield | Payout ratio | Return on equity |

| 18.2 times | 1.8 times | 1.99% | 2021/3 36.8% | 68.3 |

PER and PBR are a little higher than average, but I think the figures are well balanced.

In addition, the return on equity is close to 70%, so we can say that the company has good financials.

When is the best time to buy?

In conclusion, I think it is time to buy when the price falls below 2000 yen.

If you look at the 10-year chart, the stock price has been gradually rising from the 800 yen level in August 2013 and reached the ceiling of 1400 yen in October 2014.

After that, there was a gradual rise and again a ceiling of 2,200 yen, but in September 2021, the stock price was at a level close to 2,700 yen.

The stock price is at its highest point in the last five years, so there is a bit of caution, but I think it should be bought in order.

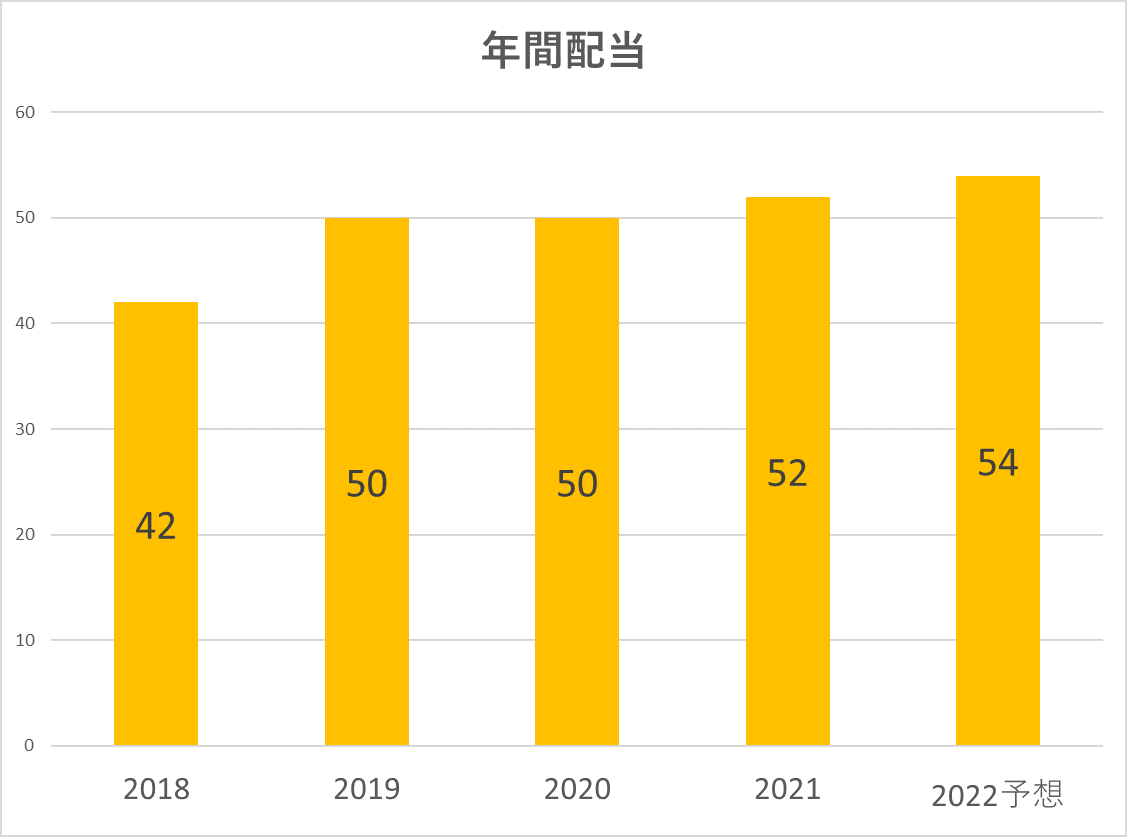

Dividend Trends

Dividends have been paid out steadily over the past five years, haven’t they?

I think the reason for this is the low payout ratio and the high return on equity.

It is an ideal stock for long-term investment.

Shareholder Special Benefit

Shareholders can receive special benefits by holding 100 shares in March and September every year.

If you hold 100 shares for less than three years, you will receive a catalog gift worth 4,000 yen per year, and if you hold 100 shares for more than three years, you will receive a catalog gift worth 6,000 yen per year.

That’s two special offers a year, and a long-term incentive that’s nice to have!

The following article introduces the benefits of Nippon Kanzai that I actually received.

Three recommended investment trusts for inclusion

Investment trusts are recommended for those who are afraid to start investing.

You can start with a small amount of money, and since they are managed by professionals, there is no need to watch stock prices every day.

We have carefully selected mutual funds that close once a year and include Nippon Kanzai, for your reference!

Daiwa Asset Management Daiwa Japan Equity Open

Mitsui Sumitomo DS Asset Management Japan Small- and Mid-Cap Growth Fund

Tokyo Marine Asset Management Tokyo Marine Selection Japan Equity TOPIX

Personal Viewpoint

This is a company with a very long history in building management, etc. It has earned a lot of trust and is an essential company for housing.

However, the average annual salary of the employees is low, which I think is difficult for the workers.

In the future, I believe that the company should strengthen the return to shareholders and employees.

Conclusion

- Diversified business in housing management

- Overseas business development

- Good financials with high return on equity

This is an explanation of Nippon Kanzai.

Investment is your own responsibility. Make your own final decision after referring to a variety of opinions.

We will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント