Hello everyone. I’m @olivertomolife and I like investing and shareholder benefits!

The trucks that we see in our daily lives are made with a product from Nippon Light Metal.

That’s the body of the truck, and they produce the silver parts on the outside!

NLM has a high reputation for its processing technology for truck bodies, which can be used for refrigerated products.

In this article, I’m going to introduce you to the company and when to buy Nippon Light Metal!

- Want to buy NLM shares

- Want to know when to buy Nippon Light Metal Company, Ltd.

- Want to know more about Nippon Light Metal Company, Ltd.

- When is the best time to buy Nippon Light Metal Company, Ltd.

- What is Nippon Light Metal Company, Ltd.

- Company Business

- Company performance

- Company Indicators

- Dividends

- Three recommended investment trusts for inclusion

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll learn all you need to know about Nippon Light Metal!

When is the best time to buy NLMK?

In conclusion, I believe that the best time to buy NLMK is around 1890 yen.

This is because if you look at the stock price over the past 10 years, you will see that the stock price above is the average price, and some changes are taking place.

Since the 10:1 reverse stock split in October 2020, the stock price has been recovering little by little.

It is still far from its 10-year high of 3,530 yen, but the high dividend is attractive.

I expect the stock price to rise further as its performance expands.

What is Nippon Light Metal Company, Ltd.

Nippon Light Metal Company, Ltd. was established in 1939 through a partnership between Furukawa Electric and Tokyo Electric.

Since its inception, the company has expanded its business with a focus on aluminum smelting, and has also formed capital tie-ups with companies in Canada and the United States.

We have five production bases in various parts of Japan, and have stable production capacity.

We also have a research and development base in Japan, where we conduct daily research on new products.

Business Segments of the Company

There are four major segments, but I will introduce the two with the highest sales.

Please also make use of the website above.

1 Processed products and related businesses

In this business segment, which has the highest sales scale, we manufacture truck bodies and refrigerator panels by utilizing the abundant processing technologies of our group companies.

We also manufacture aluminum wires for automobiles, using materials with superior strength and durability that are fuel-efficient and environmentally friendly.

We provide mainly products that are indispensable for logistics in Japan.

2 Alumina, chemical products and ingots business

This business, the second largest in terms of sales, manufactures raw materials for ceramics, paper pulp, and chemicals for factory materials.

We also use our proprietary technologies and data to develop and manufacture a variety of aluminum alloys.

We have the technology to meet the needs of a variety of fields.

Company Performance

Sales had been rising steadily until 2019, but have been declining after the outbreak.

On the other hand, the company’s equity capital has been rising, so we expect the company to use its financial base to recover its performance.

It is also a great policy to return profits to shareholders through regular share buybacks.

Company Indicators

The following is a summary of Nippon Light Metal’s main indices.

| PER | PBR | Dividend yield | Dividend payout ratio | Equity ratio |

| 6.5 times | 0.61 times | 4.5% | 2021/3 119.6% | 37.6% |

Looking at the indicators, we can say that the stock is undervalued.

The dividend yield is high and the capital adequacy ratio is over 30%, which gives us a sense of security.

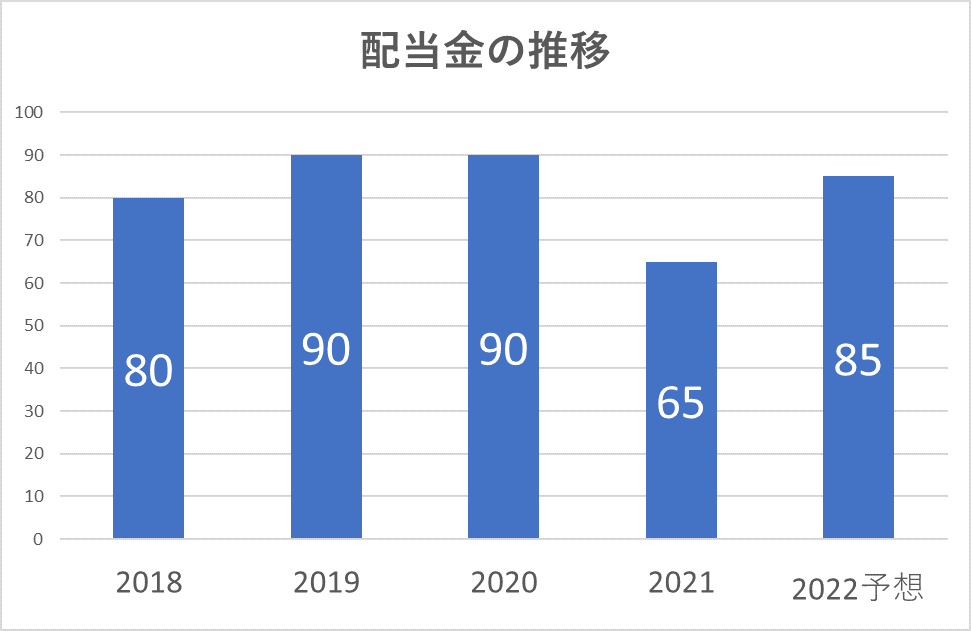

Trends in dividends

Dividends are paid out stably.

There was a dividend cut in 2021, but the company is forecasting a dividend increase in 2022.

We hope that it will return to the level before the infection.

Three recommended investment trusts for inclusion

Investment trusts are recommended for those who are anxious about making a sudden investment.

Since professionals invest in a variety of stocks, risk diversification is well taken care of.

We have selected investment trusts that close once a year and include Nippon Light Metal Company, Ltd. for your reference.

- Asset Management One Nikkei 225 No-Load Open

- Mitsubishi UFJ International Investment Trust Mitsubishi UFJ Index 225 Open

- Nikko Asset Management Index Fund 225

Summary

- The best time to buy is around 1890 yen.

- Strong in aluminum parts and high technology

- The dividend yield is 4%.

I introduced Nippon Light Metal Company, Ltd.

Investing is a personal responsibility. Investing is a self-responsibility. Make your own final decision after referring to various opinions.

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント