Hello everyone. I’m @olivertomolife and I love investing and shareholder benefits!

If you are just starting to invest and are looking for stocks that are easy to buy, I have the perfect stock for you.

Takara Leben, with a purchase price of less than 100,000 yen, is a real estate company with a long history and track record.

I’m going to take a broad look at the company, right down to the stock’s projected price!

It’s also a must-see for those looking for undervalued stocks.

- Want to invest in real estate stocks

- Want to buy affordable Japanese stocks

- Looking for stocks with good dividends

- Takara Leben’s stock price forecast

- What is Takara Leben Corporation?

- Company’s Business

- Company Indicators

- Dividends

- Are there any special benefits for shareholders?

- Three recommended investment trusts for inclusion

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll get to know Takara Leben!

Takara Leben’s stock price forecast

In conclusion, I believe that the stock price will rise again once it reaches nearly 300 yen.

This is because the stock price over the past 10 years has confirmed the phenomenon of three declines below 300 yen, followed by an upward trend.

Therefore, I think it is a good idea to buy the stock when it is close to the standard.

Although there was an unexpected drop due to the abolition of the special benefit in 2021, I don’t think there is any need to sell in a hurry since the dividend is good.

As a company that also sponsors reits, I think it has a sense of stability, and I look forward to its future evaluation.

What is Takara Leben Corporation?

Founded in 1972, Takara Leben grew as a company under the name Takara Corporation, focusing on the rental business.

From 1994, Takara Leben began selling its own condominiums, and in 2000, the company changed its name to its current one, and in 2001, it was listed on the Tokyo Stock Exchange.

In 2013, we started a mega solar business that can be used as a next-generation fuel.

In 2018, the company opened its first overseas representative office in Hanoi, Vietnam, and has begun to engage in business in Southeast Asia.

Company Businesses

The company operates nine businesses, but the three businesses with the highest percentage of sales will be introduced here.

Please make use of the company’s website as well.

1 Real estate sales business

We are engaged in the development and sales of our own brands, LEBEN and NEBEL.

It is a major source of revenue, accounting for about 80% of the company’s sales.

We have the advantage of being able to independently sell real estate that meets the needs of our customers.

2 Power generation business

In the power generation business, which accounts for 9% of the company’s sales, we are working to utilize renewable energy.

We are generating energy at 62 locations in Japan.

This business is making a significant contribution to the utilization of idle land.

3 Real estate leasing business

In the real estate leasing business, which accounts for 4% of our sales, we act as landlord and secure stable earnings.

This business is actively acquiring real estate in various parts of Japan to increase earnings.

Company Indicators

Takara Leben’s main indices are summarized below.

| PER | PBR | Dividend yield | Dividend payout ratio | Equity ratio |

| 7.2 times | 0.66 times | 4.39% | 2021/3 32.4% | 26.5% |

The indicators show that the stock is very undervalued.

I would like to hold it for the long term because of its high dividend and surplus capacity.

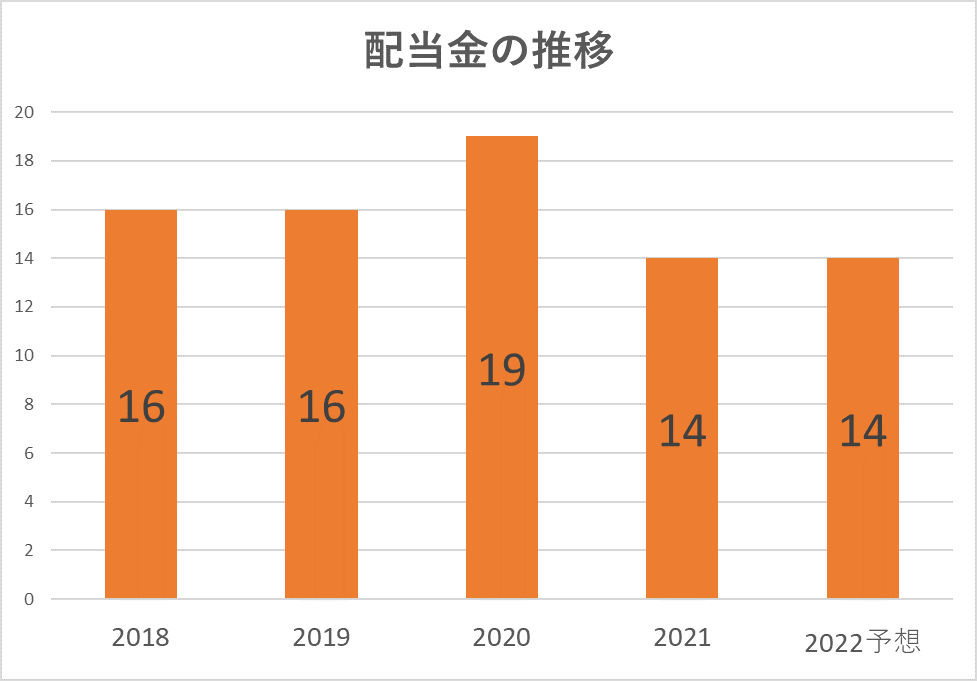

Trends in dividends

The dividend has increased and decreased, but it has been stable.

Once the infection is under control, we can expect a dividend increase.

Are there any special benefits for shareholders?

Takara Leben’s shareholder special benefit plan was discontinued in 2021.

The company used to offer rice coupons as a special benefit, but it seems that the company’s first quarter financial results were affected by losses.

On the other hand, the company has announced plans to raise its dividend payout ratio target to 30%.

Three recommended investment trusts for inclusion

Investment trusts are recommended for those who are anxious about making a sudden investment.

Since professionals invest in a wide range of stocks, you can diversify your risk.

Also, you can start with a small amount.

I have selected three investment trusts that close once a year and include Takara Leben for your reference.

- Mitsubishi UFJ International Investment Trust eMAXIS JPX Nikkei Small- and Mid-Cap Index

- Mitsubishi UFJ International Investment Trust Fund Manager (domestic stocks)

- Nomura Asset Management Topics Index Open

Summary

- Strong real estate development in urban areas

- Good balance of dividend payout ratio

- Easy to buy stock price

I have introduced Takara Leben!

Investment is your own responsibility. Make your own final decision after referring to a variety of information.

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント