Hello everyone. I’m @olivertomolife and I love investing and shareholder benefits!

Among stock investments, REITs are known to be a popular investment method.

Among them, ES-CON Japan REIT boasts of its high dividend payouts and holds properties in diversified regions.

In this article, I’m going to introduce you to my first acquisition of Escondido Japan REIT, its distributions and the REIT!

If you are looking to buy a REIT, this is a must-see!

- Looking for a REIT with a high yield

- Want to buy a REIT with a good portfolio balance

- Want to buy REITs recommended in January/July

- Distributions Arrive from Escondido Japan REIT!

- Changes in Distributions

- What is S-CON Japan REIT?

- Financial Highlights for the 9th Fiscal Period

- Portfolio of REITs

The author has three years of investment experience and has a background in the securities industry.

By reading this article, you’ll get to know about Escon Japan REIT!

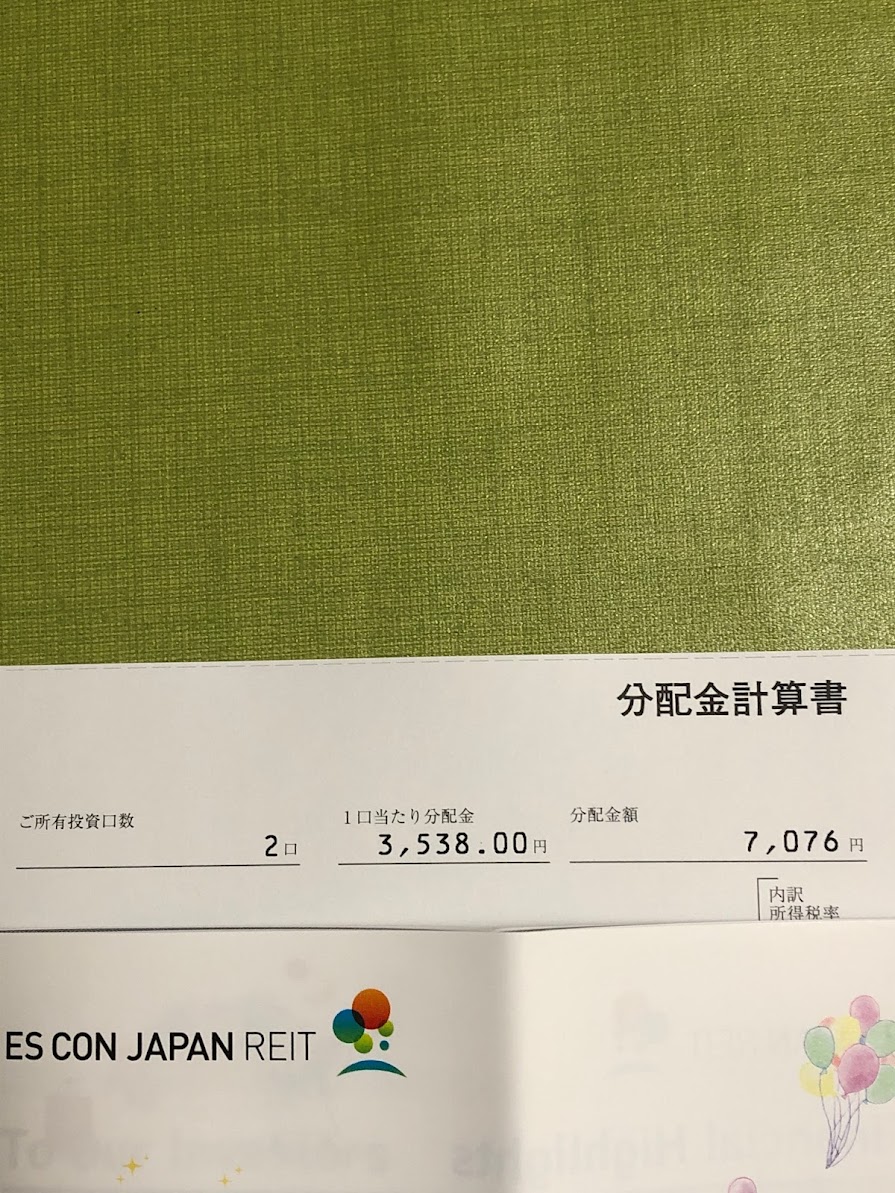

Distributions have arrived from Escon Japan REIT!

After the July 2021 closing, the distribution from ES-CON Japan REIT has arrived!

This time, there was a distribution of 3538 yen per unit.

I own two units, but they are not tax-exempt, so the tax was deducted…

I will consider buying more units since the yield is high on a monthly basis.

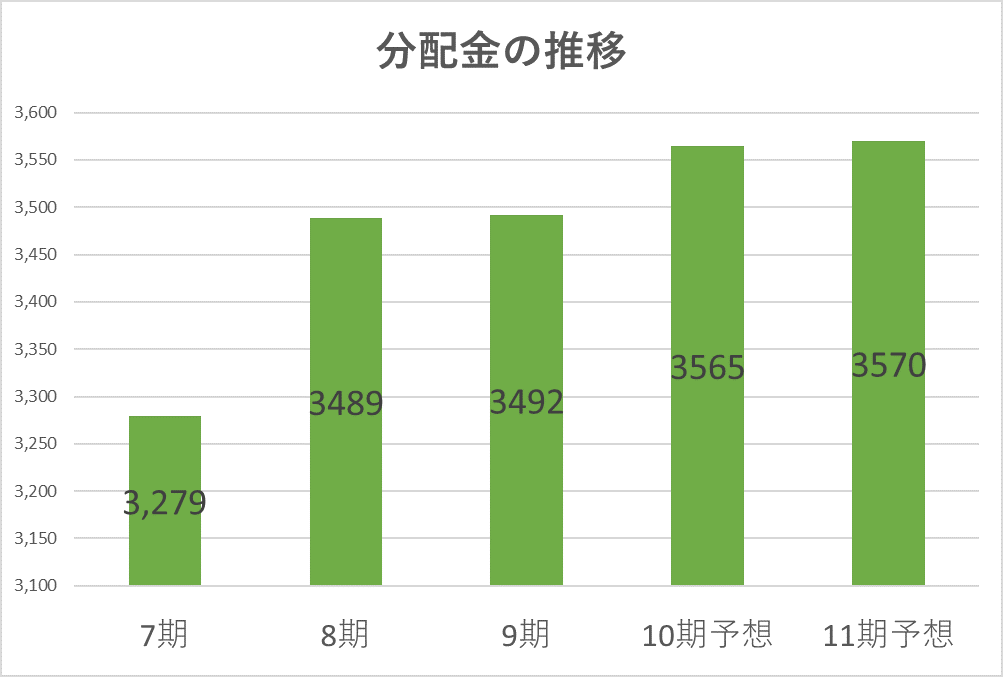

Changes in distributions

I have the impression that the company is paying out stable distributions.

However, it should be noted that the distributions, which were in the range of 5,000 yen in the fourth period, have decreased significantly and are now in the transition.

While the dividend is higher than that of stocks, there is also the risk of a dividend cut.

What is ES-CON Japan REIT?

ES-CON Japan REIT, Inc. is a REIT established in 2016 that invests mainly in commercial properties.

It is led by its sponsor company, ES-CON Japan, and its support company, Chubu Electric Power Co.

The characteristics of the REIT are that it invests in community-based commercial facilities and land with leasehold interest.

The real estate development and management capabilities of the group companies can also be said to be a strength directly linked to earnings.

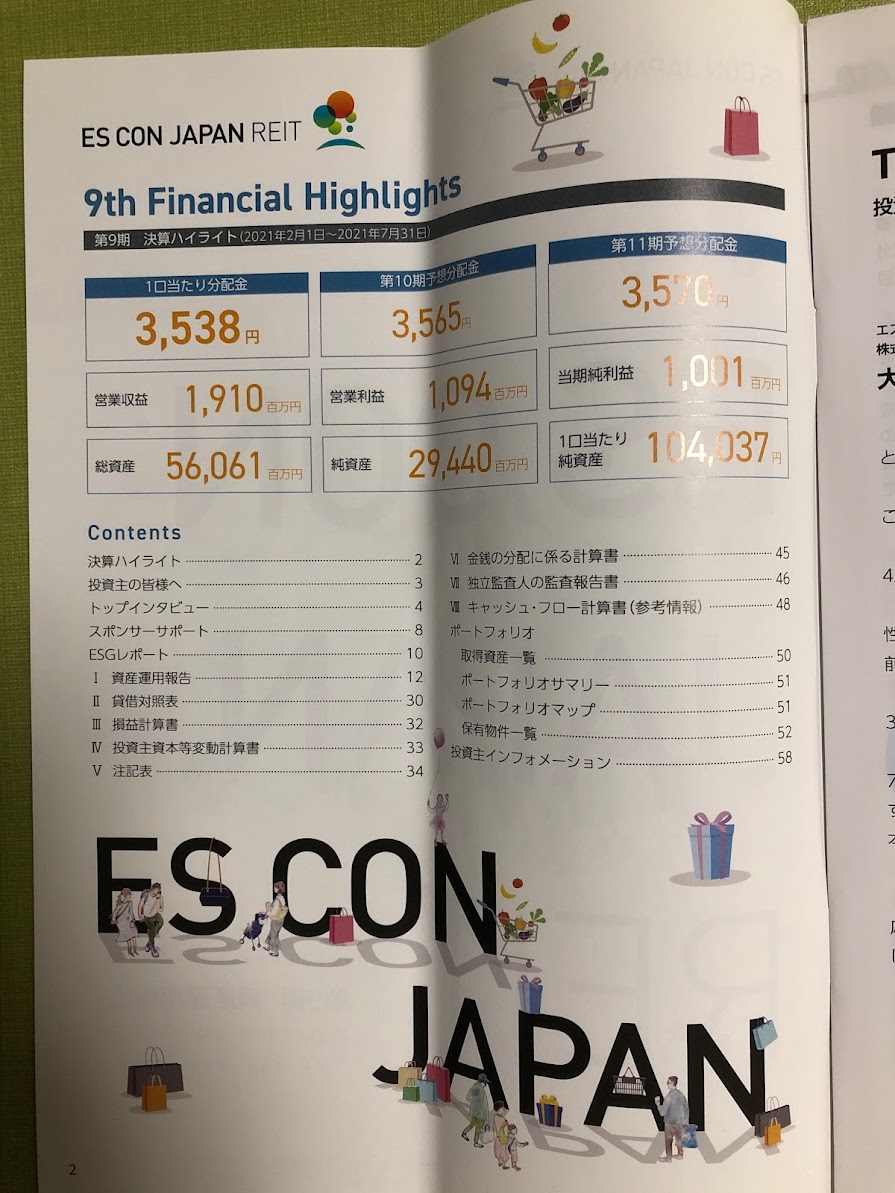

Financial Highlights for the 9th Fiscal Period

We increased our dividend by 46 yen compared to the previous fiscal year and raised capital through a public offering, so we are steadily increasing our asset size.

We are addressing environmental issues through our commercial facilities, so we are working to solve problems.

I have high expectations for the future.

REIT Portfolio

We own commercial facilities in various parts of Japan, mainly in the Kinki region.

We have acquired 38 properties and have maintained a high occupancy rate of over 90%.

We would like to keep an eye on future expansion.

Summary

- Distribution for the 9th fiscal period was 3,538 yen.

- Diversified property holdings make it resistant to the economy.

- Ideal for long-term investment

I’ve introduced you to ES-CON Japan REIT’s distributions and the REIT!

Investment is your own responsibility. Make your own final decision after referring to a variety of opinions.

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント