Hello everyone. I’m @olivertomolife and I love investing and shareholder benefits!

REITs, which allow you to invest in real estate with a small amount of money, are one of the investment methods that have been attracting attention in recent years.

I’m sure there are many people who have a desire to receive a certain amount of dividends every month.

Samty Residential Investment Corporation, which I will introduce this time, is a REIT with a yield of 4%, which is one of the highest among REITs, and has a good balance of occupancy rates and properties.

Now, let me introduce you to the distributions for the 12th period and the REIT!

- Those who are planning to buy Samyi’s REITs

- Are looking for a REIT with high distributions

- Want to know which REITs have a good balance in their portfolio

- Dividends Arrive from Samty Residential Investment Corporation!

- Trends in cash distributions

- What is Samty Residential Investment Corporation?

- Financial Highlights for the 12th Fiscal Period

- Features of the REIT

- Property Portfolio

- Investor Ratio

The author has three years of investment experience and has a background in the securities industry.

By reading this article, you’ll get to know Samty Residential Investment Corporation!

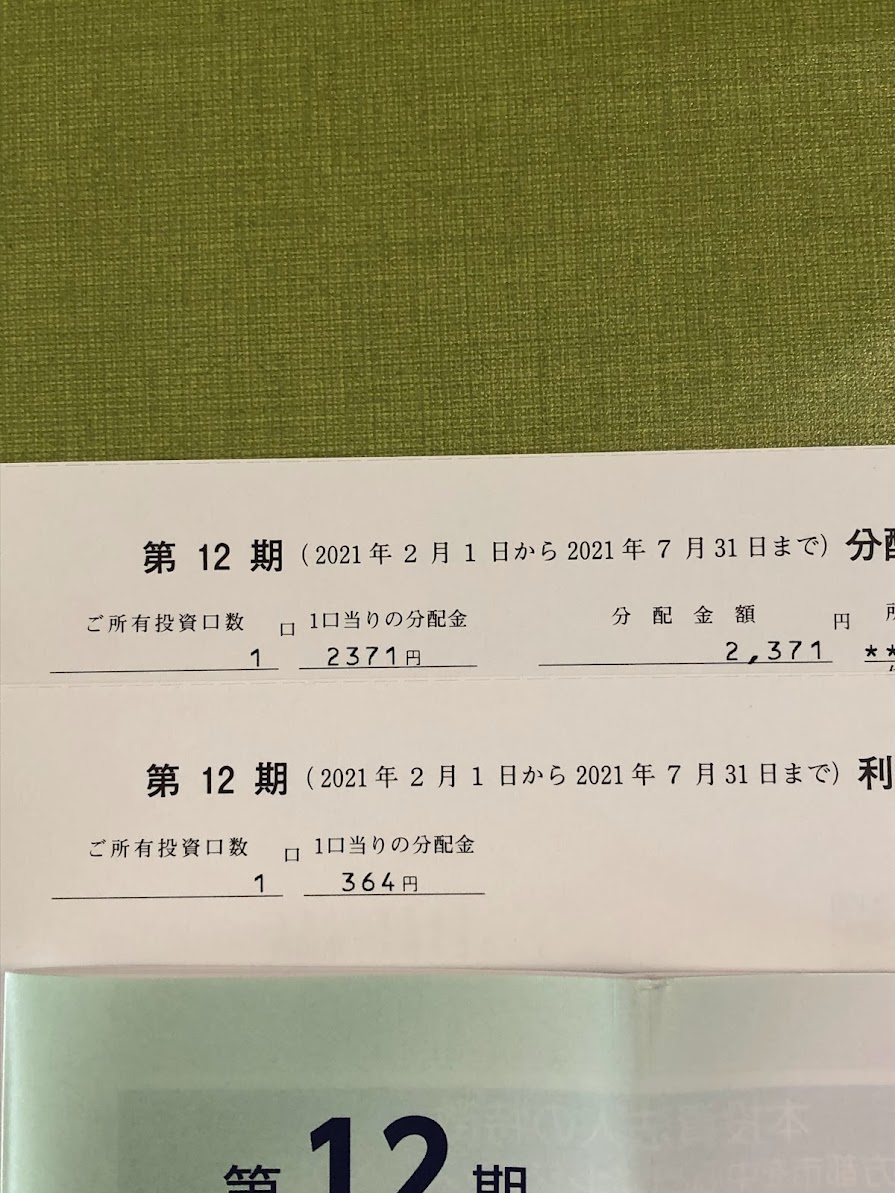

Dividends have arrived from Samty Residential Investment Corporation!

Our 12th fiscal period ended in July 2021, and I received a distribution of 2,735 yen per unit!

There is a high dividend yield of 4.56% as of 10/22/2021, which is very attractive.

There are plans to increase the dividend for the next fiscal year as well, so I have high hopes for this.

Trends in cash distributions

I have the impression that distributions are increasing little by little.

There was a dividend cut in the 11th term due to an infectious disease, but I think it will return to the same level as time goes by.

The yield is high among listed REITs, making it ideal for long-term ownership.

What is Samty Residential Investment Corporation?

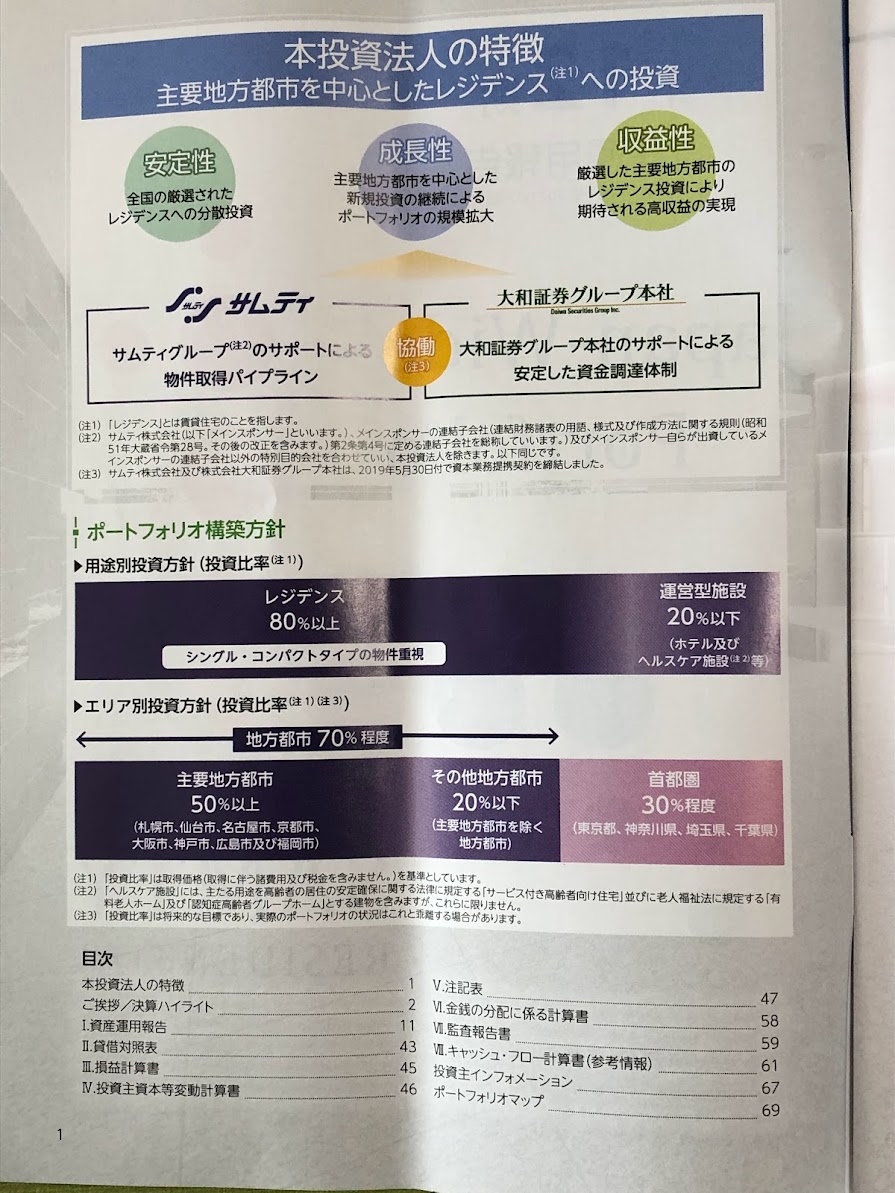

Samty Residential Investment Corporation, #3459, is a REIT established in 2015 and is sponsored by Samty and Daiwa Securities.

It is a REIT with properties held all over Japan and a high occupancy rate due to its well-balanced management.

With 80% of its holdings being residential properties, it is also a countermeasure for the economy.

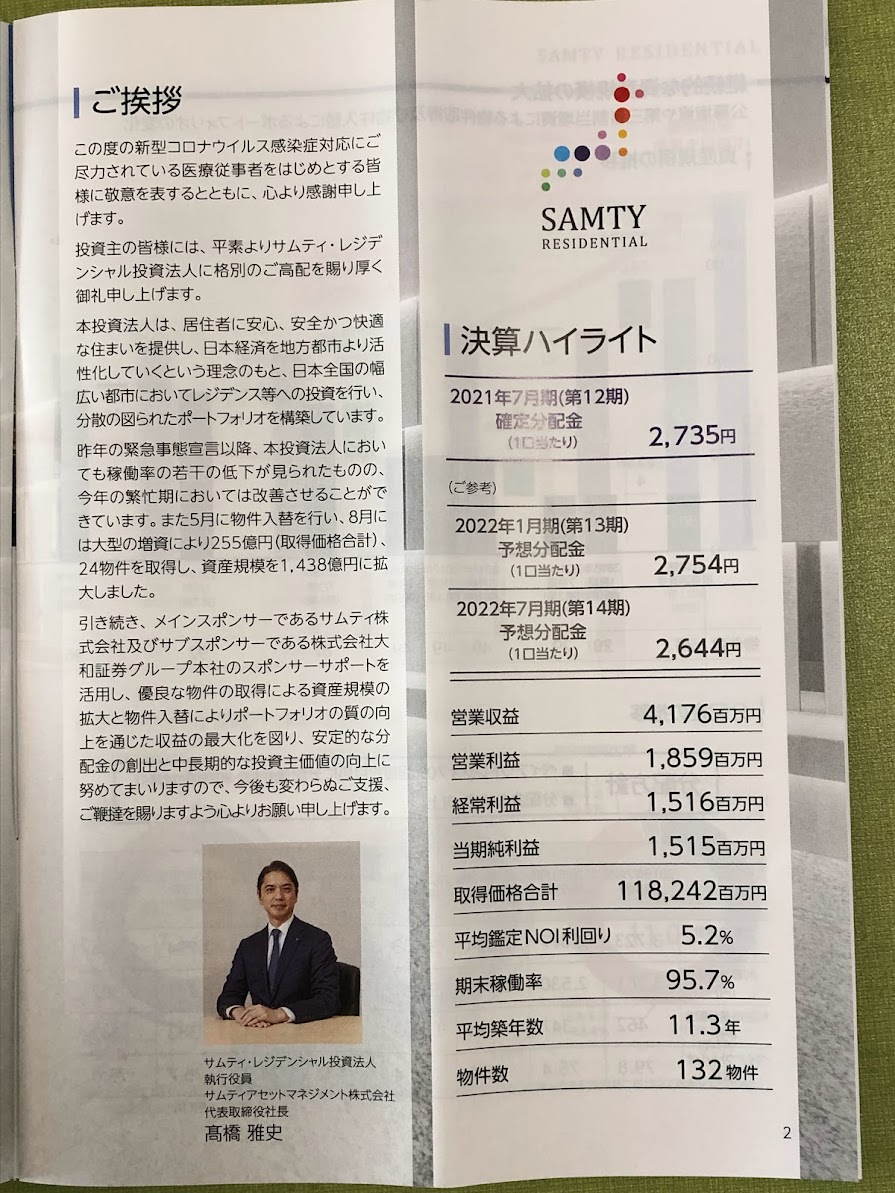

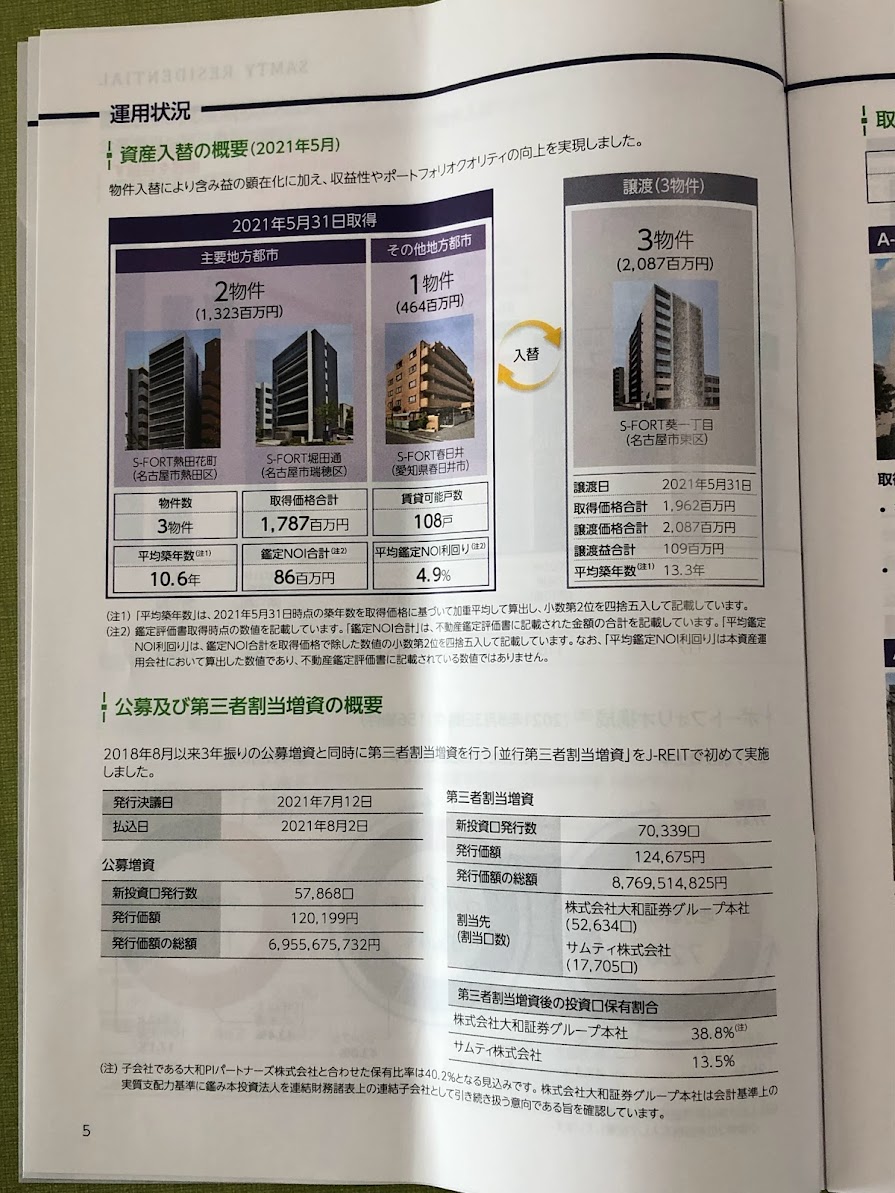

Financial Highlights for the 12th Fiscal Period

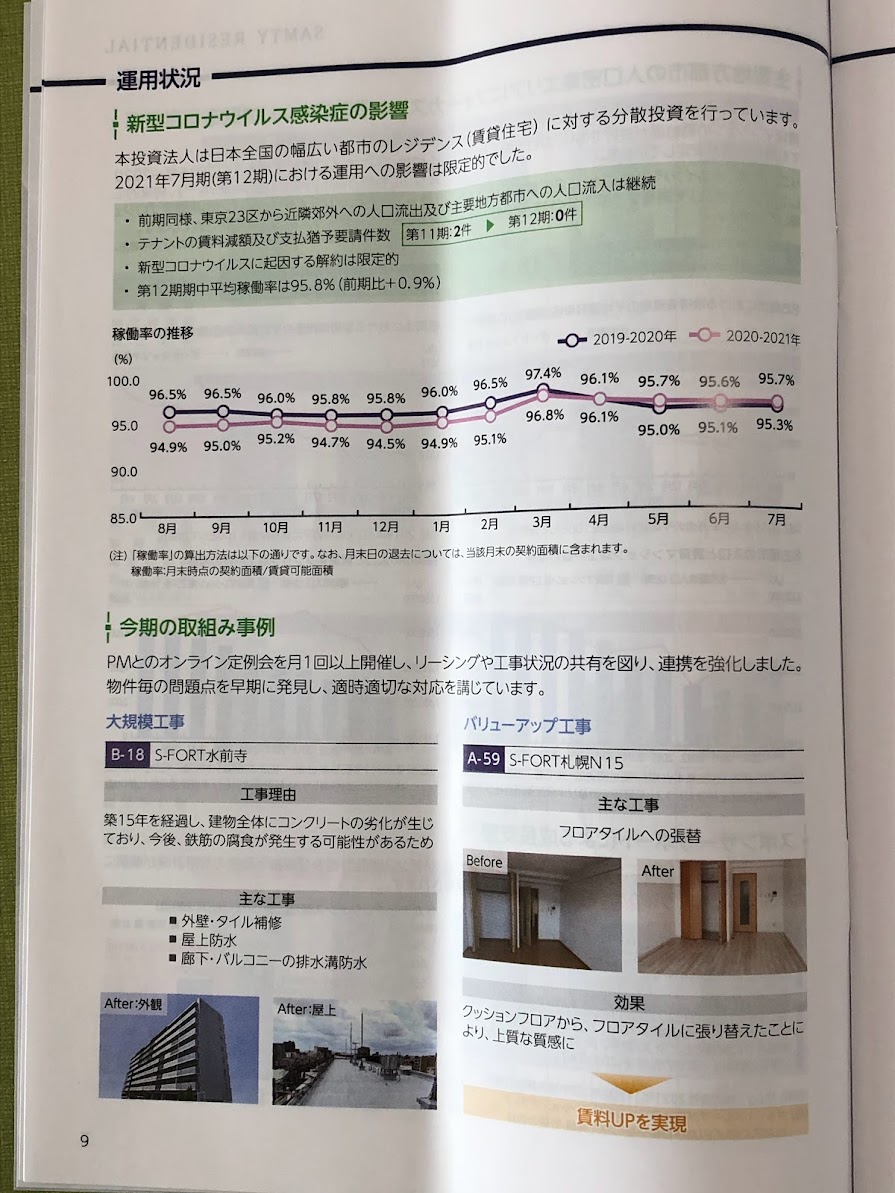

In this fiscal year, we maintained a 95% occupancy rate of our properties and we are replacing three properties in May 2021.

This replacement has rejuvenated the building age and expanded profitability.

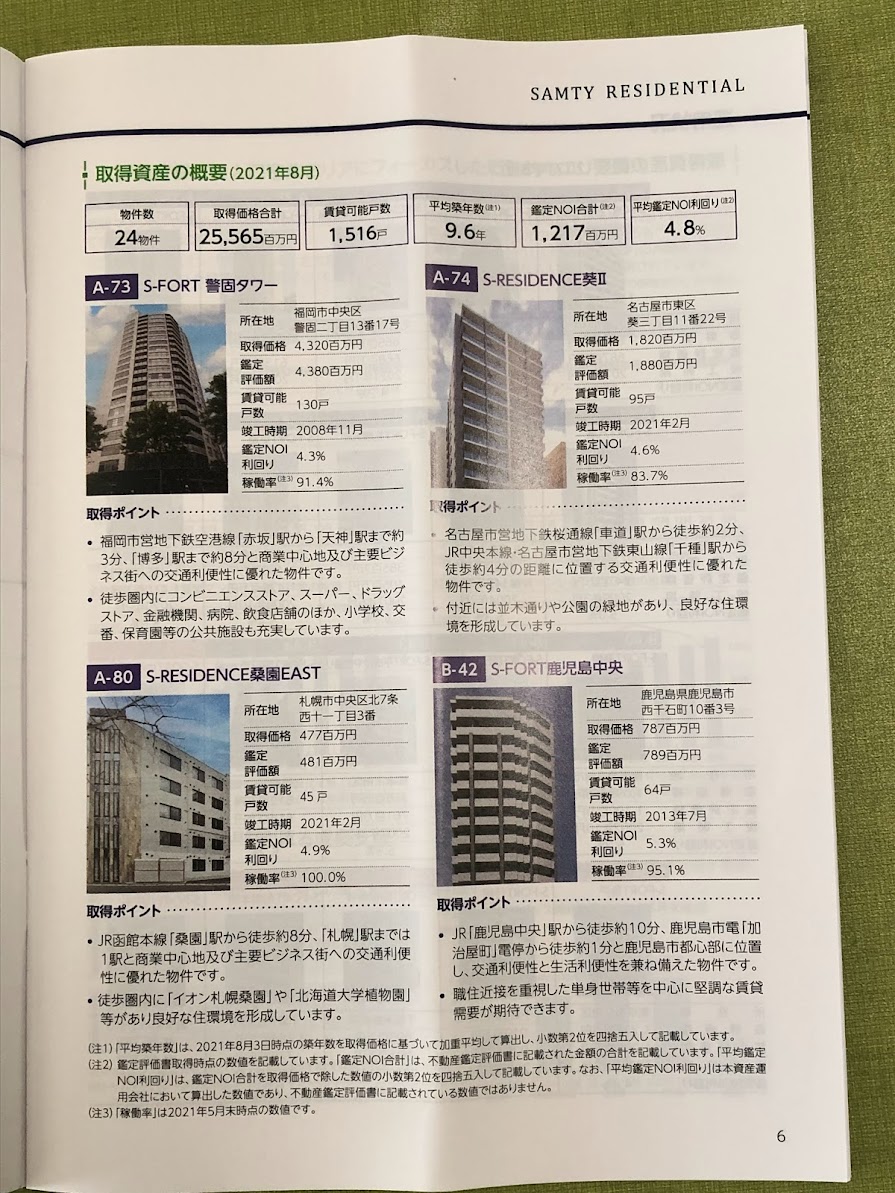

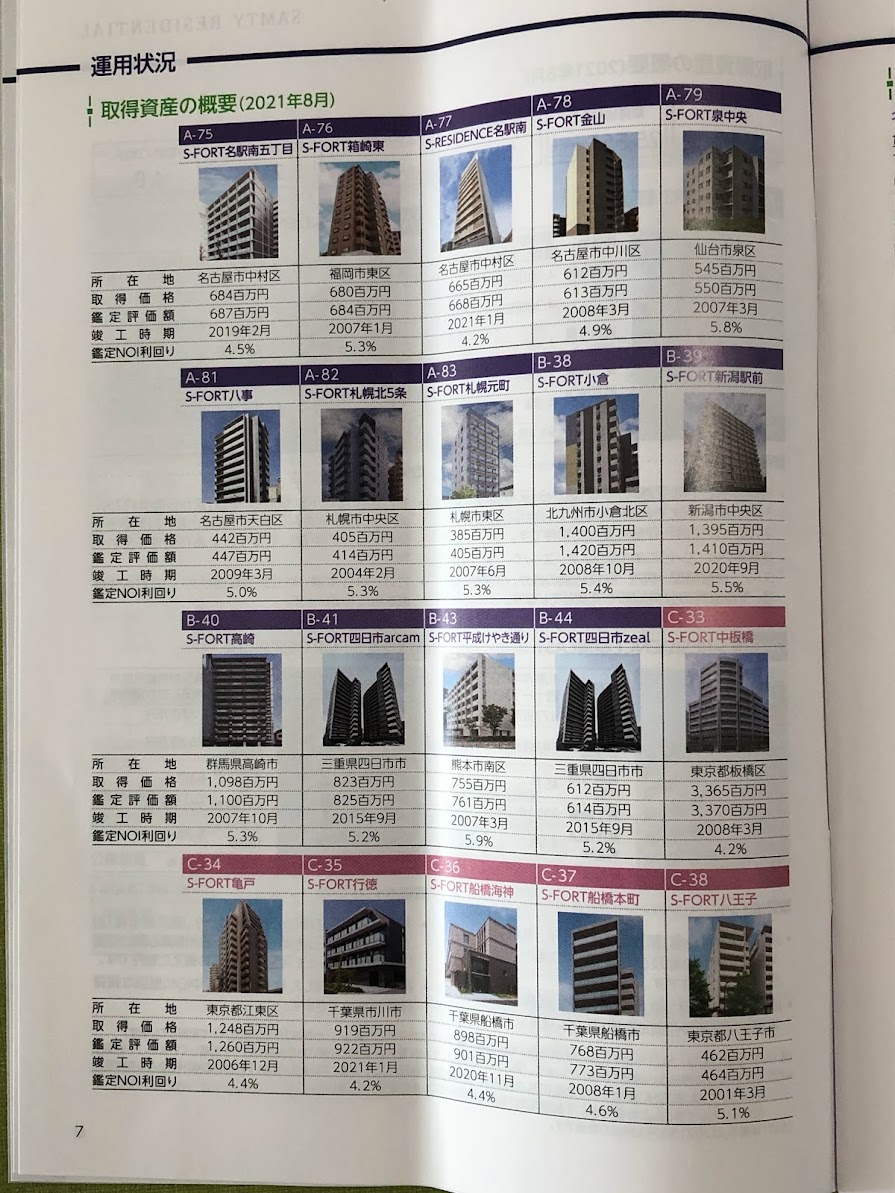

In August 2021, we acquired 24 properties to strengthen our portfolio holdings.

We also carry out construction work on properties on a regular basis, aiming to increase earnings.

Features of the REIT

We make maximum use of properties developed by the Samty Group and invest in a diversified portfolio of properties that can secure stable rents.

By holding properties mainly in major regional cities, we avoid the risk of concentration.

We also consider the convenience of owning properties, which leads to stable earnings.

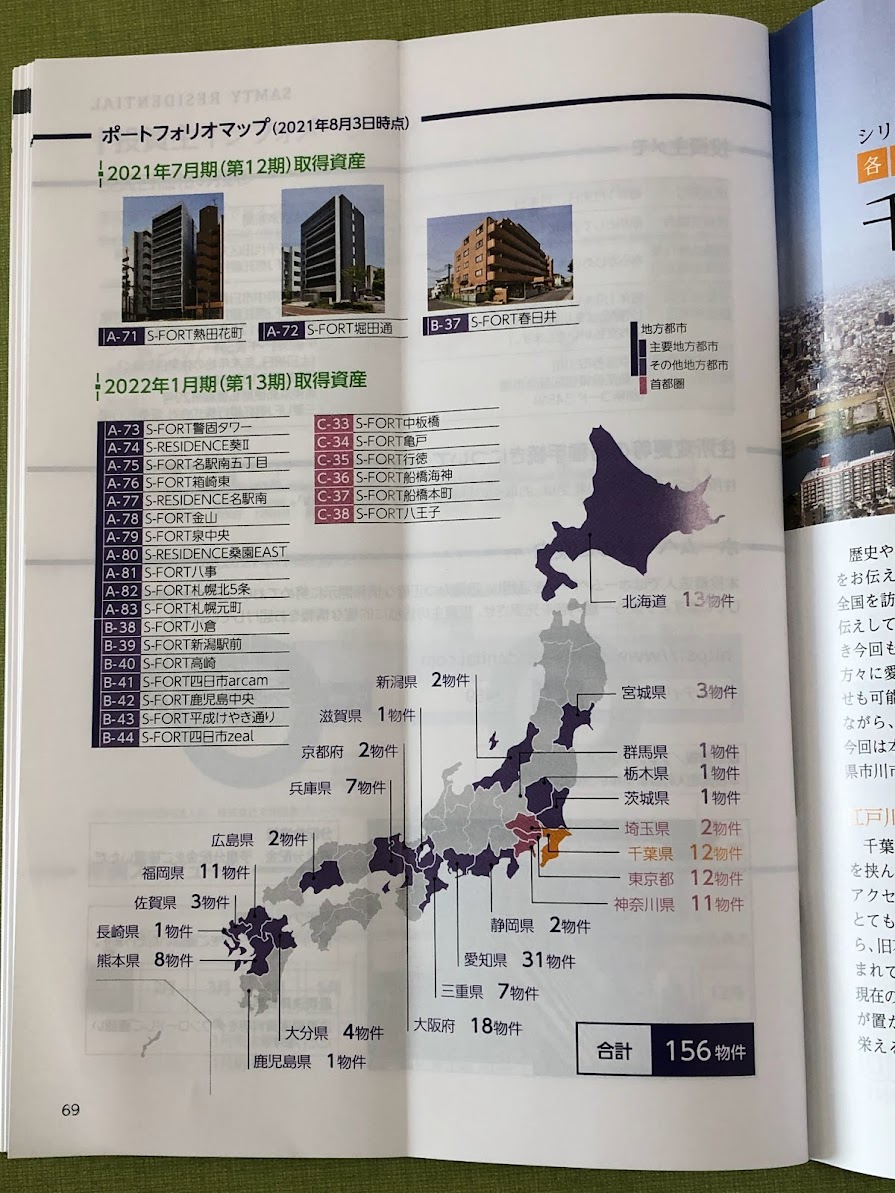

Property portfolio

We own properties all over Japan, but we have a particularly high percentage of properties in western Japan.

I think this is due to the fact that we are a company based in Kansai.

We believe that we will continue to increase the number of properties in consideration of strata and other risks.

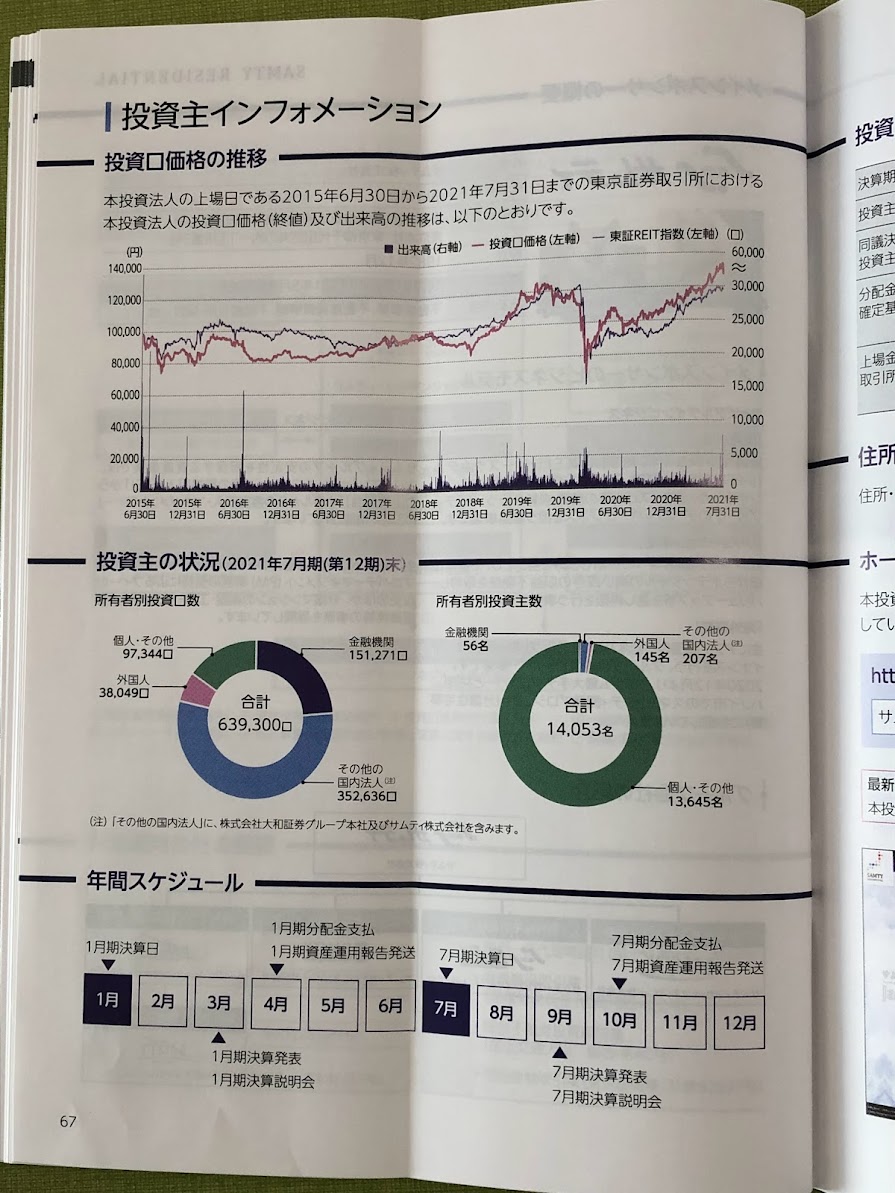

Investor ratio

In terms of the number of investment units, there are many corporations, but in terms of unitholders, most of them are individually owned.

Therefore, there is a disadvantage that the stock price is likely to fall if there are concerns about the economy.

However, I think there is no need to worry too much since many people hold stocks for long-term investment.

Conclusion

- Stability of the Samty Group

- Many local properties

- High occupancy rate and high profitability

This is an introduction to Samty Residential Investment Corporation!

Investing is a personal responsibility. Make your own final decision after referring to a variety of opinions.

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント