Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

In June, my shareholder special benefit package from Ricoh Leasing Company, Ltd. arrived!

This is the first stock I’ve acquired, so I’m happy.

Now, I would like to introduce the shareholder benefits and business description.

- I want to know when I can receive Ricoh Lease’s shareholder benefits.

- Want to know about the business performance of Ricoh Leasing

- Want to know about the benefits of Ricoh Lease.

- When will I receive the benefits of Ricoh Lease?

- Is it possible to receive special benefits with fractional shares?

- What are the special benefits for shareholders?

- The Hidden Benefits of Ricoh Leasing

- How much dividend can I get?

- Ricoh Leasing’s business report

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll get to know about Ricoh Leasing’s special benefits and what makes the company tick!

If you want to know more about Ricoh Leasing, you can read the following article.

When will I receive Ricoh Leasing’s special benefits?

Ricoh Leasing’s special benefits are delivered in late June.

It will be sent to you with the business report after the shareholders meeting.

The rights are vested in March every year, so make sure you change your address before then!

Can I get special benefits for fractional shares?

Unfortunately, fractional shares are not eligible to receive special benefits from Ricoh Leasing.

Some companies offer special benefits for fractional shares, so it would be interesting to look for them.

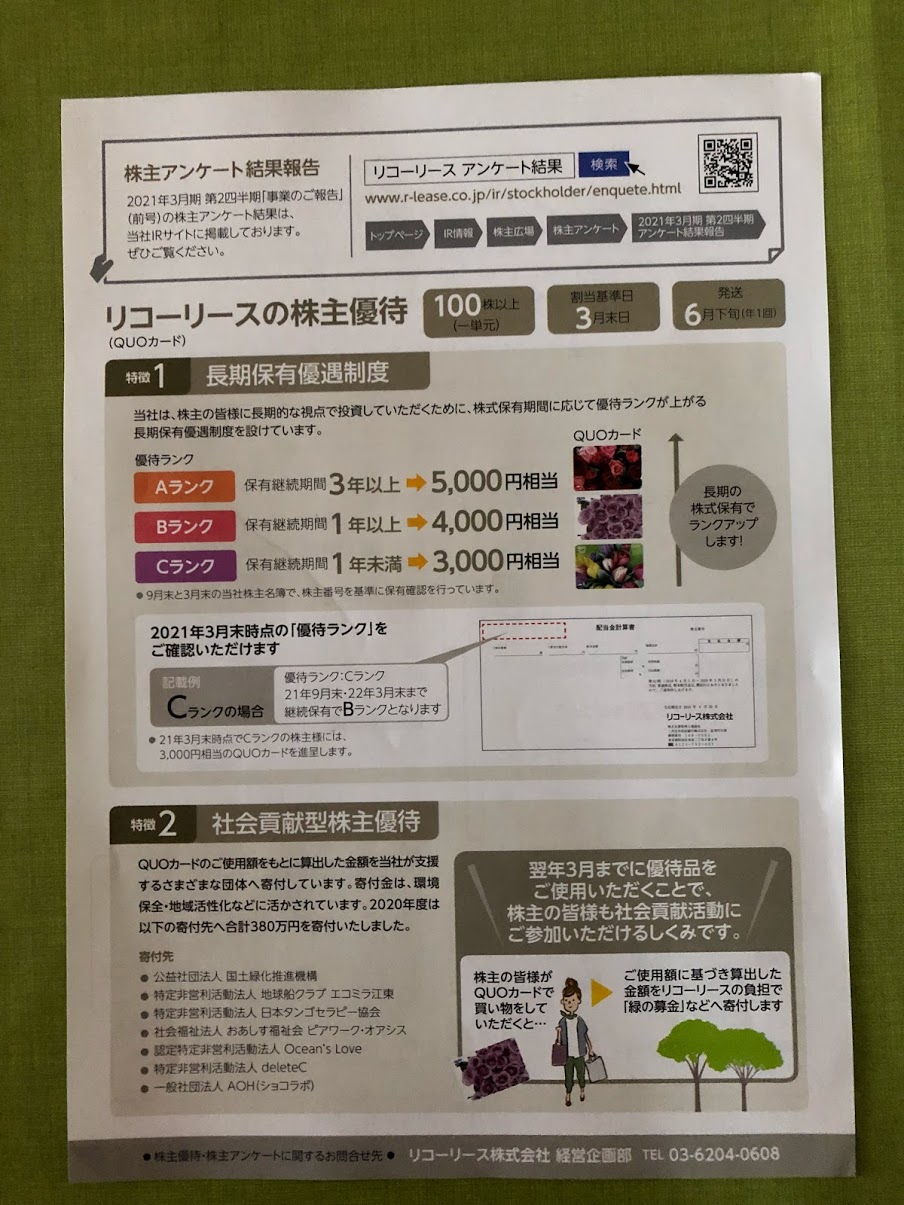

What are the shareholder benefits?

At Ricoh Leasing, you can get quo cards of different amounts depending on the number of years you have held the company.

Since I just acquired the company, I received a quo card worth 3000 yen.

If you hold it for more than three years, you get a quo card worth 5000 yen, which I highly recommend!

Quocards are useful because they can be used at a wide range of places, including convenience stores, bookstores, and gas stations.

Also, by using the Kuo Card you receive within a year, you can participate in social contribution.

This is an initiative in which companies make donations to social contribution organizations based on the total amount spent.

The Quocard doesn’t have an expiration date, but it’s nice to be able to casually participate in this kind of initiative!

Ricoh Leasing’s Hidden Benefits

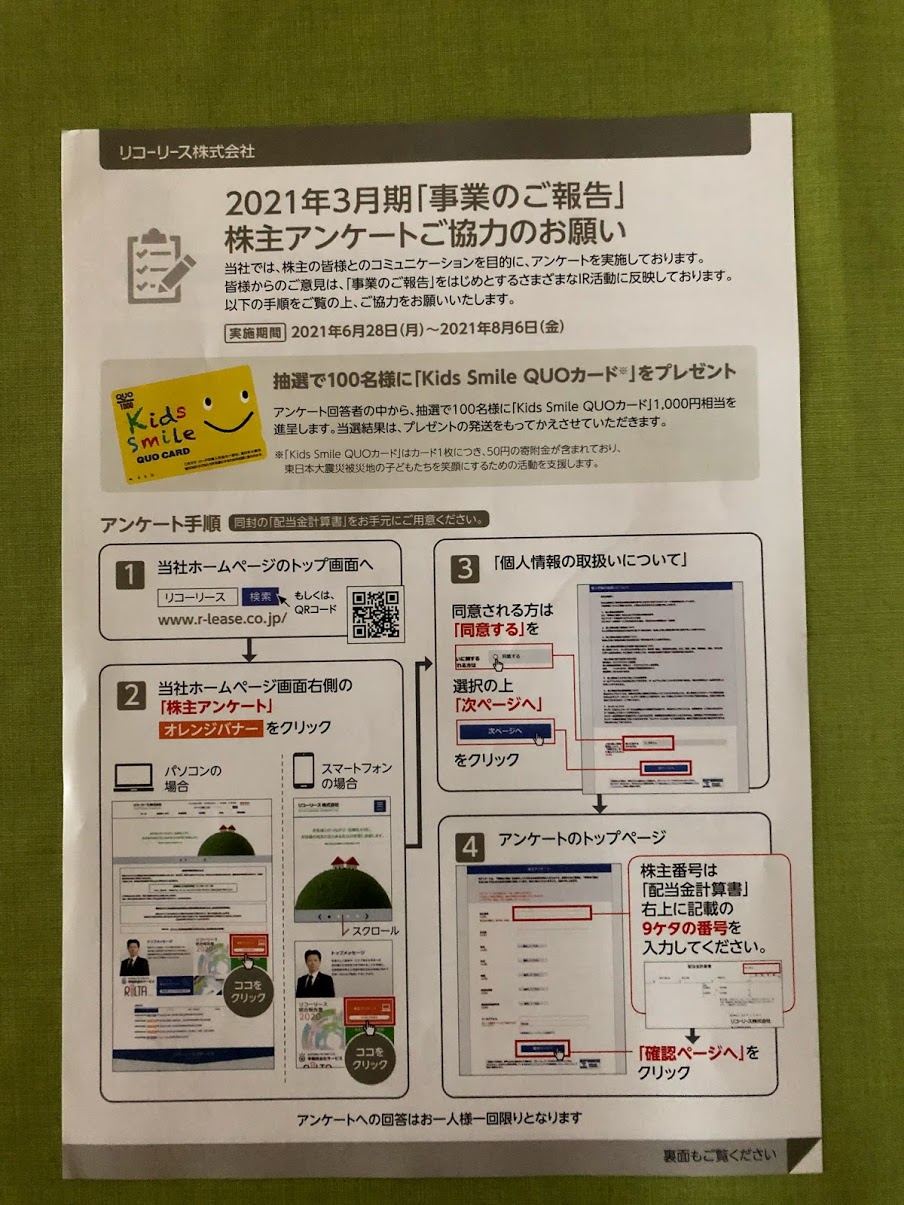

Ricoh Leasing conducts questionnaires to exchange opinions with its shareholders.

The content of the questionnaire is related to business reports and the company.

For those who complete the questionnaire, 100 people will be selected by drawing to win a 1000 yen quo card!

This would be a shame not to participate, so don’t forget!

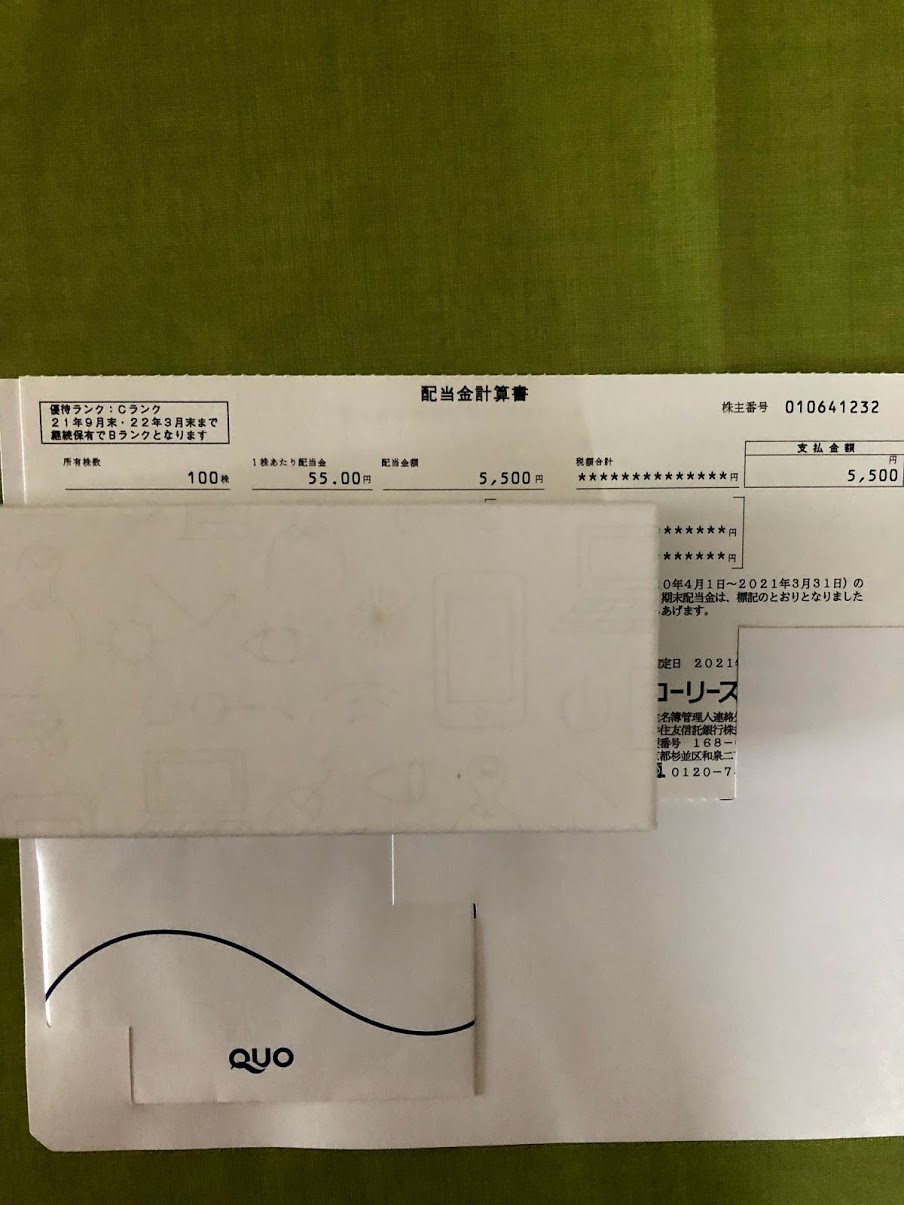

How much dividend will I receive?

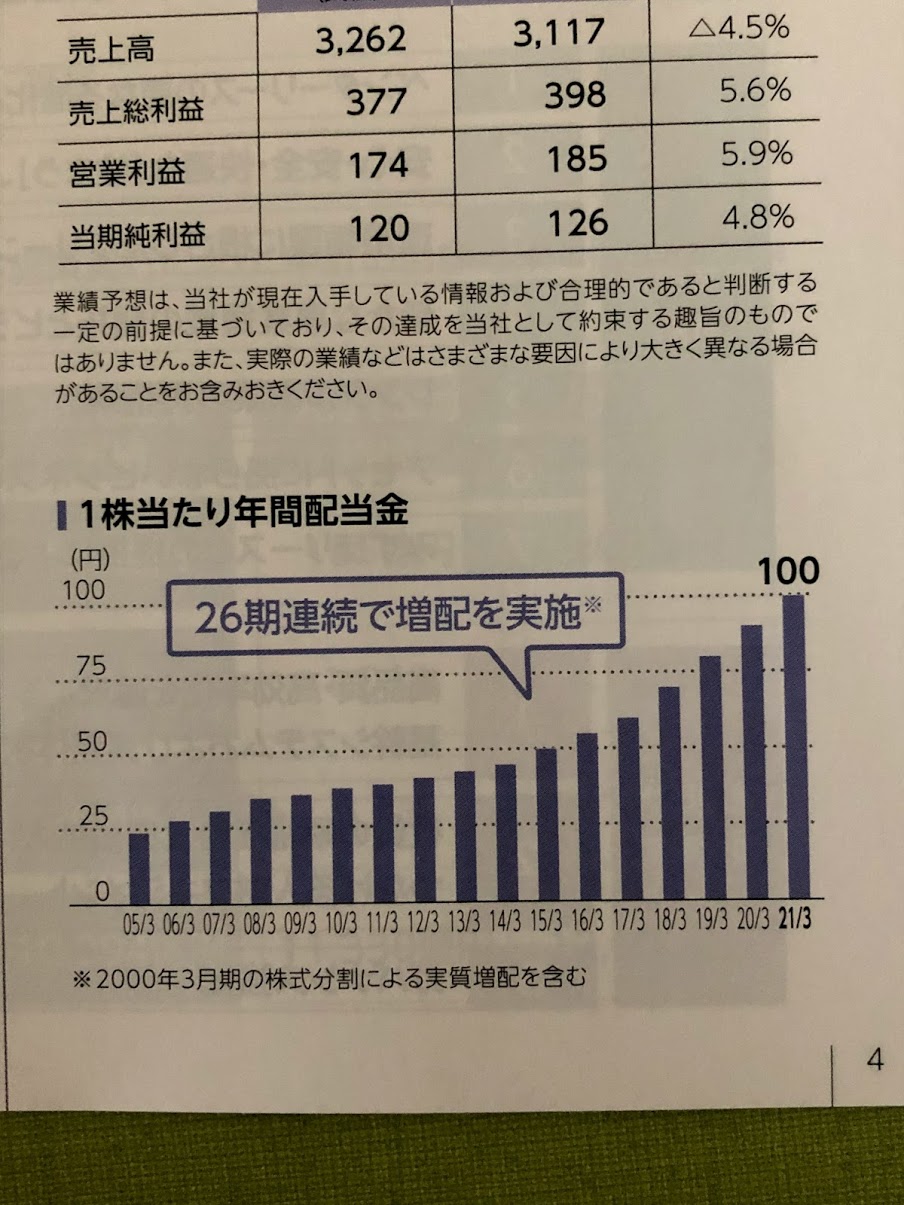

For the fiscal year ended March 31, 2021, the annual dividend was 100 yen per share.

We’ve received a year-end dividend of 55 yen per share.

We have increased dividends for 26 consecutive years, and we are targeting a payout ratio of 30% for the next fiscal year.

Also, they’re targeting a 35% payout ratio in the future, so we can expect more dividend increases in the future!

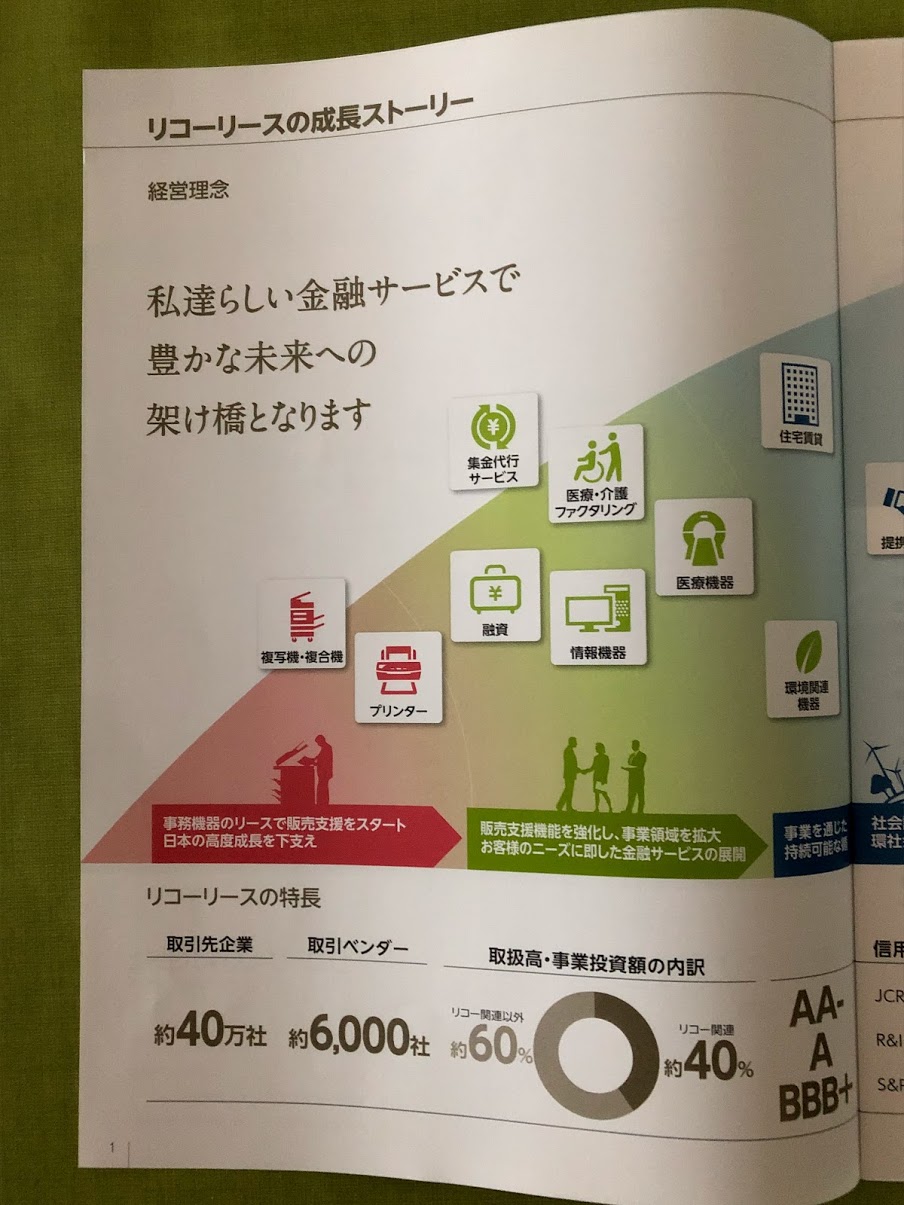

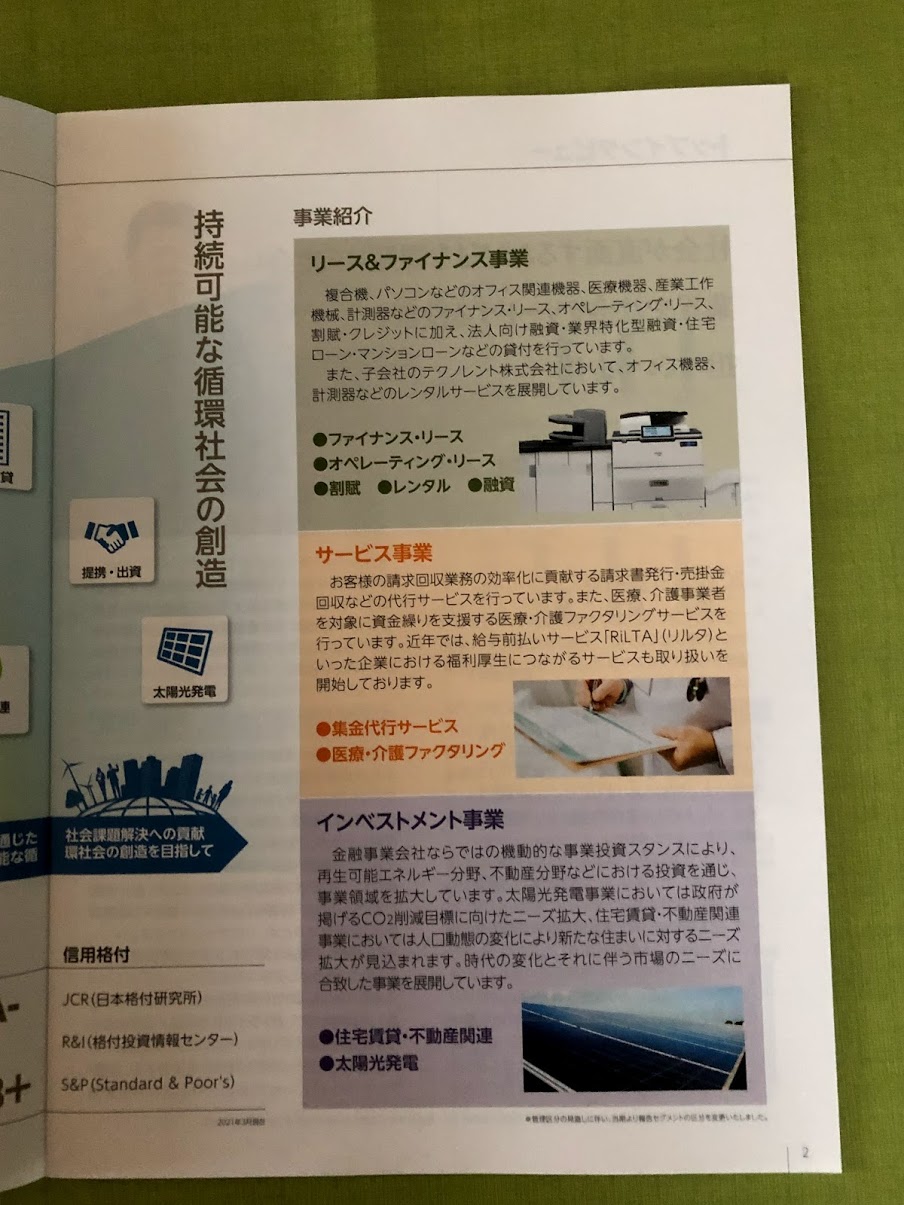

What is Ricoh Leasing’s business report?

It is a beautifully designed report, and I read it for the first time, but the contents were easy to understand.

At the beginning, there was a description of the company’s management philosophy and business activities, and there was consideration for first-time holders.

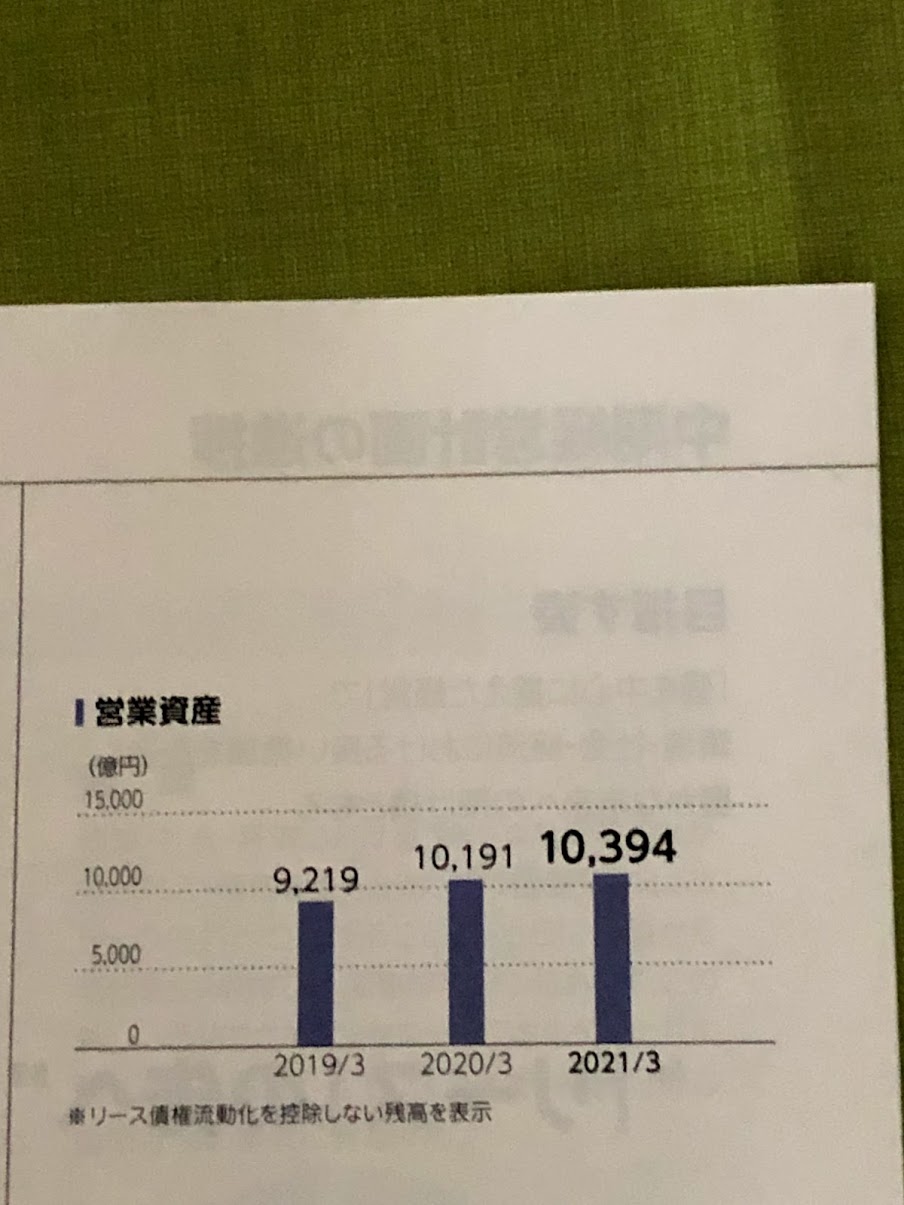

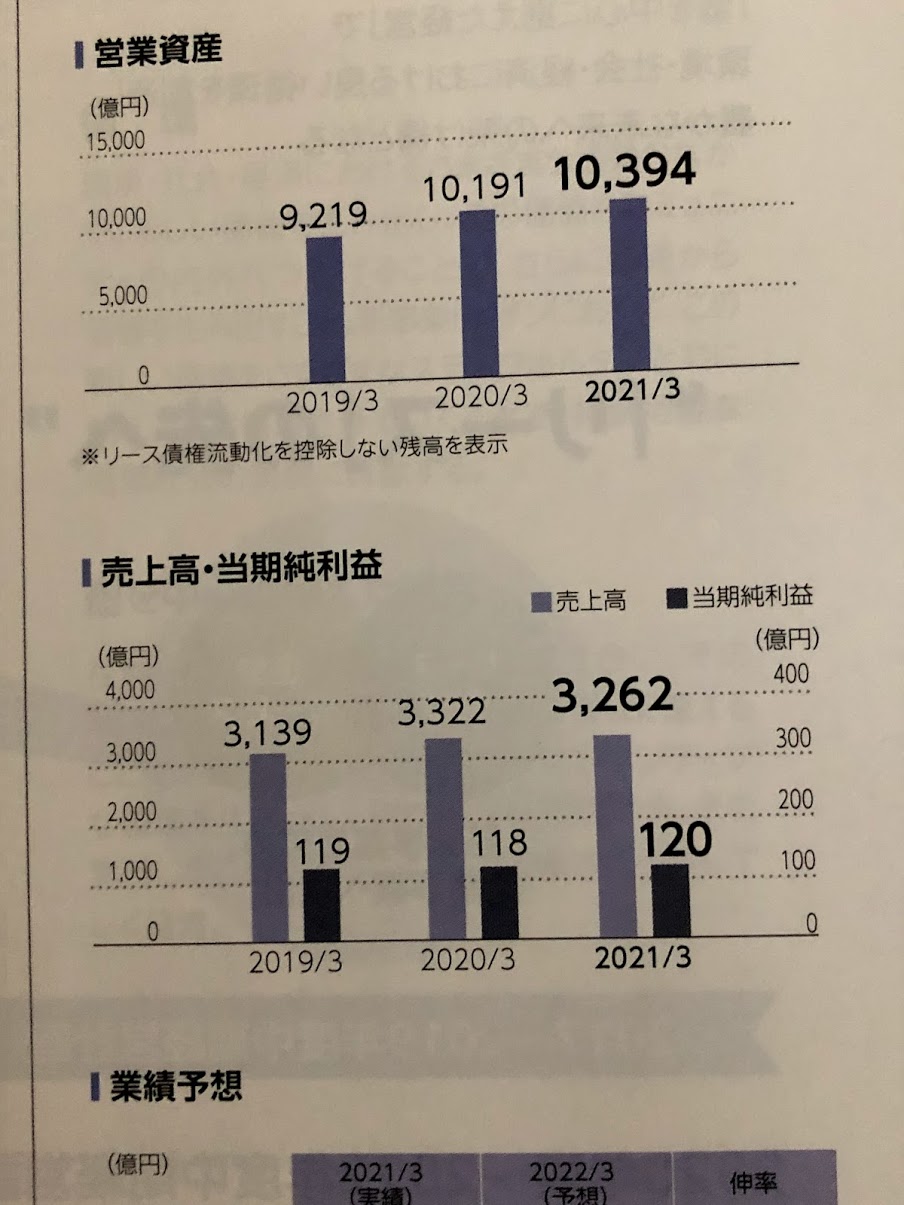

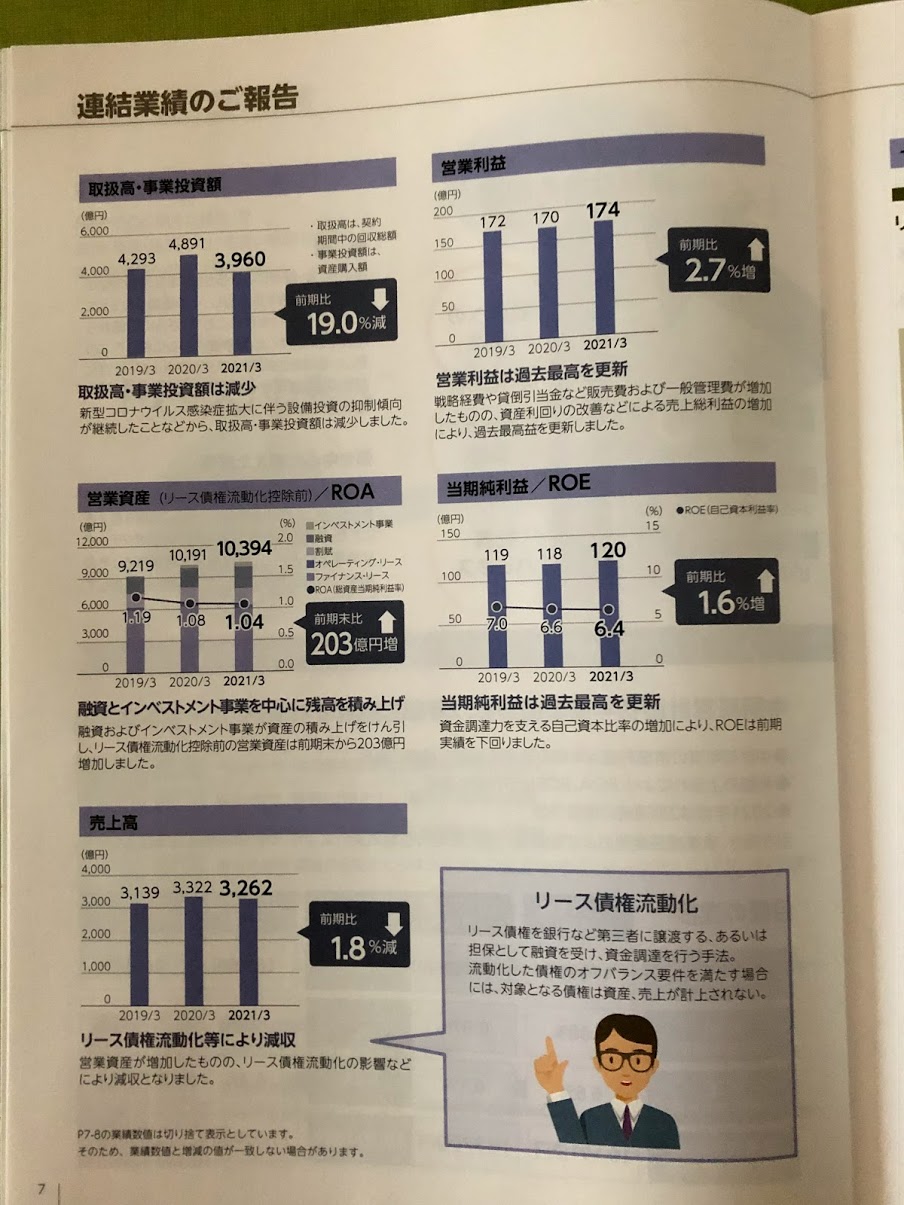

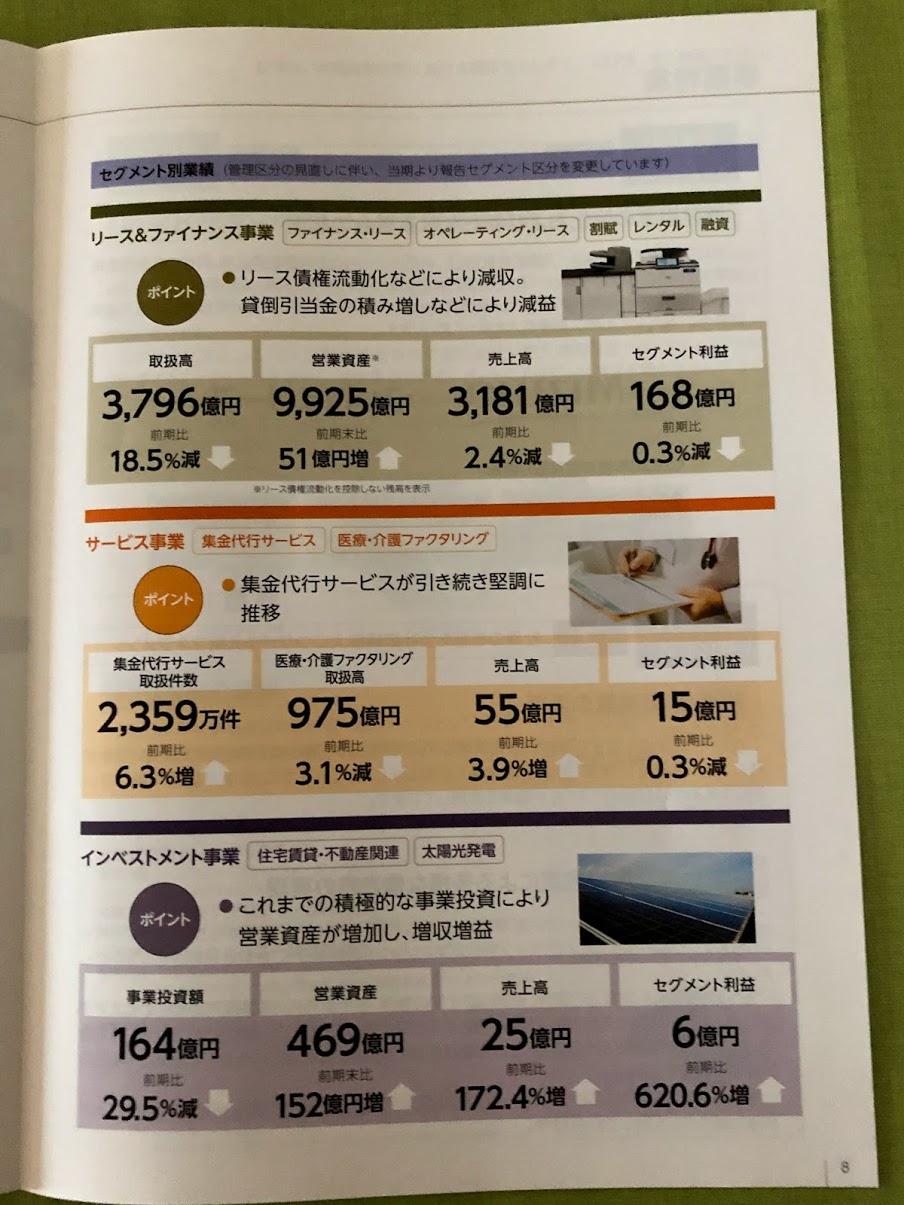

Operating assets for the fiscal year ending March 31, 2021 have increased from the previous year.

Net sales decreased, but net income increased.

And as for the earnings forecast, gross profit, operating income, and net income are scheduled to increase.

The consolidated results are shown below.

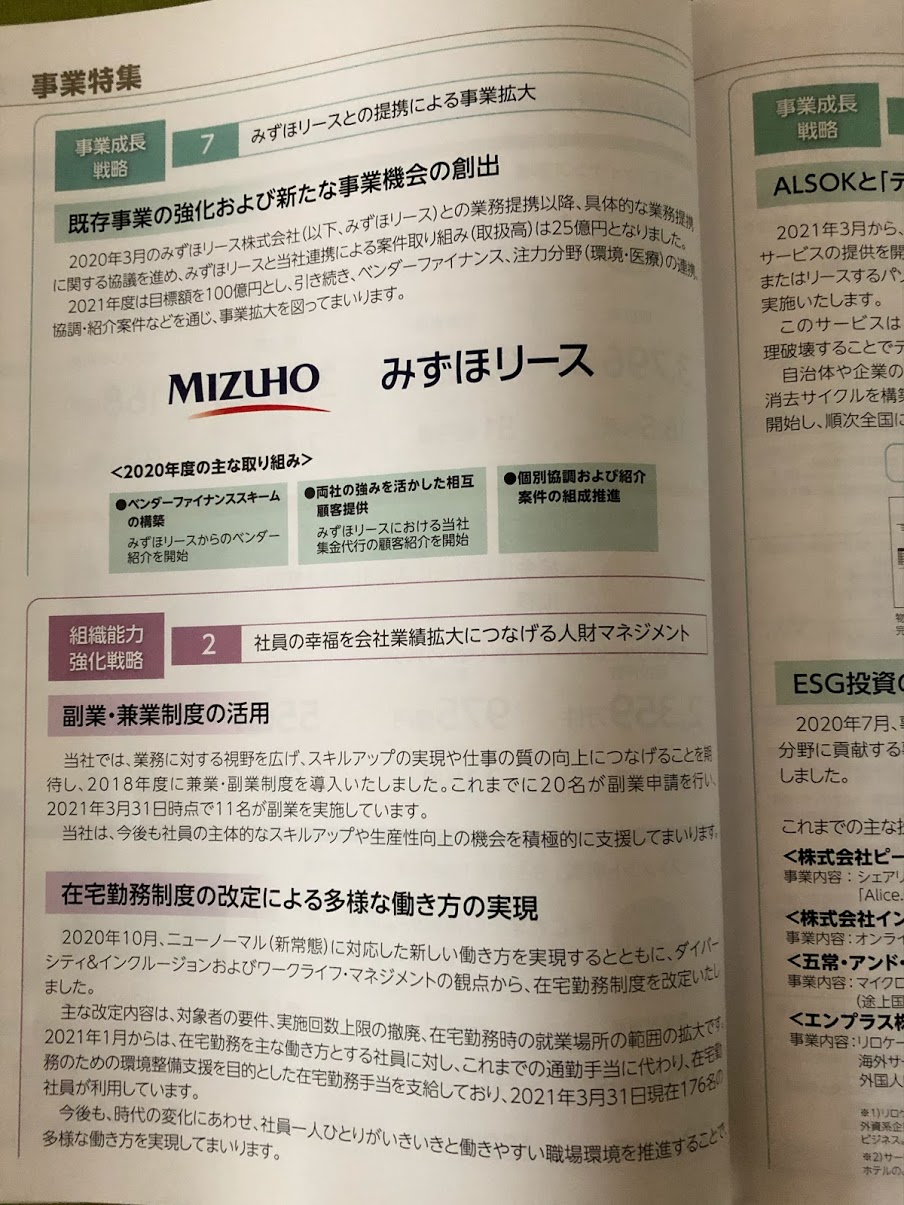

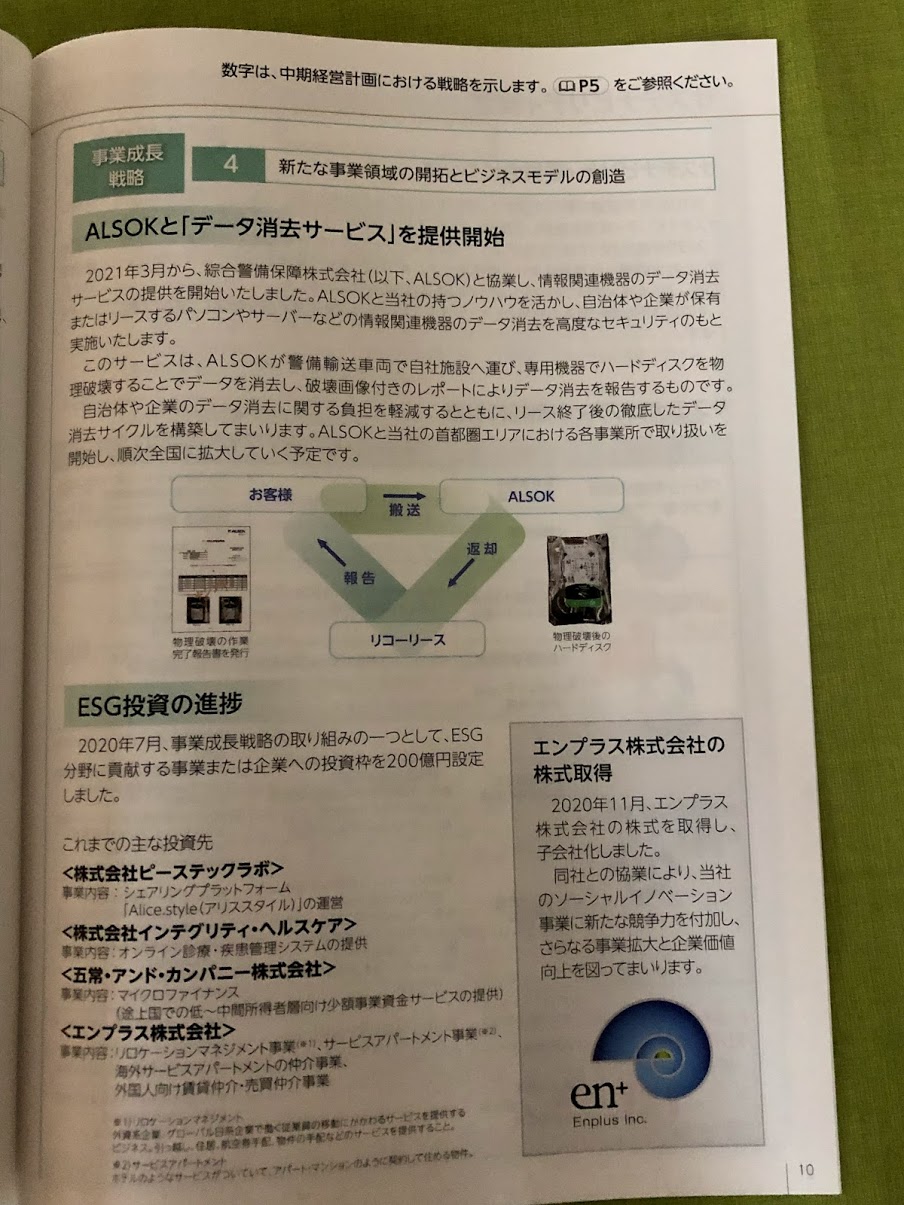

In addition, it also describes the alliance with Mizuho Leasing and the collaboration with ALSOK.

So we can expect future business expansion!

Summary

- Ricoh Leasing’s special benefits arrive in late June.

- The content of the benefit is enhanced by long-term holding!

- A stock that can be held stably

This is a summary of the benefits and attractions of Ricoh Leasing!

I will continue to update this page as soon as I receive the benefits.

Thank you for reading to the end!

コメント