Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

I’m sure there are many people who want to buy undervalued stocks with good dividends and strong performance.

Samty Corporation, which I will introduce here, is a company with a strong sales base in the Kansai region of western Japan and has been attracting attention in recent years.

The company has been attracting attention in recent years, and is planning to increase its dividend by 9 yen in 2021 compared to the previous year, which is an excellent return to shareholders!

I will now introduce the company and when to buy the stock.

- Want to buy Japanese stocks with a good dividend yield

- Want to invest in stocks that are performing well

- Looking for undervalued stocks.

- When is the best time to buy Samty?

- What is Samty Corporation?

- Company’s business

- Company Indicators

- Dividends

- Shareholder Benefits

- Personal Viewpoint

- Three investment trusts for inclusion that I recommend!

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll get to know about Samty!

When is the best time to buy Samty?

In conclusion, I think it is a good time to buy when the price reaches the 1620 yen level.

This is because there have been two major declines in the past five years until 2021, and the average stock price seems to be based around ¥1600.

In 2021, I would like to note that the stock has sold off after reaching an annual high of 2431 yen.

The tendency in recent years has been to sell when the stock price is near the yearly high, so if the stock price exceeds it, it would be a good idea to buy it.

However, I personally think that a situation below 2000 yen is unlikely to happen, so we need to wait and see.

The dividend is good for the stock price, so if you can’t wait, you can try to buy it on a trial basis.

What is Samty Corporation?

3244 Samty Corporation has been engaged in the real estate planning and development business and leasing since it was founded in 1982.

Since 2001, the company has been selling investment condominiums developed by itself, aiming to expand its sales channels.

In 2015, we launched a REIT investment corporation and have a stable revenue base.

The company is characterized by its strength in the western Japan area and is increasing its real estate in the Tokyo metropolitan area every year.

In the mid-term management plan for 2021, they aim to secure stable earnings by adjusting the ratio of development profit to rental income.

There is also a proposal to establish its own hotels as a REIT, so we can expect more from it in the future.

Company’s Business

1 Real estate business

This is the company’s largest business in terms of sales, and it develops and supplies rental condominiums, office buildings, and hotels.

In Japan, we focus on the development of income-producing real estate to meet the needs of different regions and characteristics.

Overseas, we are involved in residential development in Vietnam, where we are using our accumulated technological expertise to support the growth of emerging countries.

2 Real estate leasing business

We lease and manage the real estate that the company owns over 100 buildings in Japan.

This business model enables the group to achieve high occupancy rates by managing the entire process from property recruitment to management.

Since the properties are located mainly in major cities in Japan, the business is not easily affected by the economy and the occupancy rate is maintained at over 90%.

3 Other

This segment is based on hotel income from the company’s holdings. Other sources of income include construction income and condominium management income.

Even after the sale of the assets owned by the company, they are managed by an affiliated trustee company, thereby ensuring continuous and stable revenue.

Corporate Indicators

The following is a summary of the main indices of Samty Corporation.

| PER | PBR | Dividend yield | Dividend payout ratio | Equity ratio |

| 7.1 times | 1.16 times | 3.8% | 2020/3 31.4% | 30.7% |

Overall, I think the index is undervalued.

We have increased dividends for five consecutive fiscal years, and we expect to continue to do so.

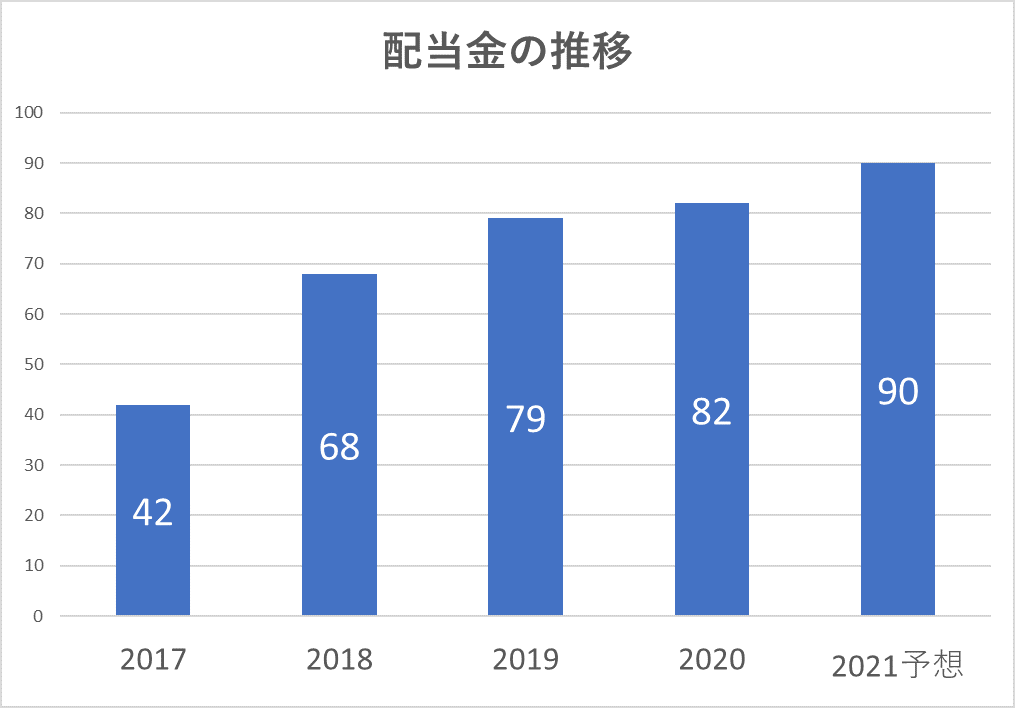

Trends in dividends

Dividends have been increasing steadily.

The dividend payout ratio is in the 30% range, which is well-balanced, so I would like to expect more in the future.

Shareholder benefits

If you hold 200 shares, you can receive a hotel voucher for a stay at a hotel operated by the company.

It used to be possible to get this benefit with 100 shares, but the condition was changed due to infectious diseases.

On the other hand, I am glad that the number of hotels to choose from has been expanded.

Personal perspective

The company is well known as a real estate developer, and since it is an Osaka-based company, it has a strong image in the Kansai region.

The company’s proactive stance in returning profits to shareholders has been highly evaluated, and its stock price, which plummeted due to an infectious disease, is recovering.

The company’s dividend has been increasing year by year, so it is an interesting investment for dividend purposes.

However, since the stock price is still high, it is difficult to buy.

It is a company that will continue to grow in the future, making it ideal for long-term investment.

Three recommended investment trusts for inclusion!

Investment trusts can be started with a small amount of money, so even beginners can start with peace of mind.

You can also diversify your risk by investing in installments!

We have selected investment trusts that close once a year and include SAMTY for your reference.

- Mitsubishi UFJ International Investment Management eMAXIS JPX Nikkei Mid-Size Index

- Nissay Asset Management Nissay TOPIX Open

- Sumitomo Mitsui Trust Asset Management Index Collection (Domestic Stocks)

Summary

- Stable business development

- Overseas business development

- Expectations for future business expansion

This is an introduction to Samty Corporation!

Investing is a personal responsibility. Make your own final decision after referring to a variety of opinions.

We will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント