Hello everyone. This is Olivertomo!

I received a dividend notice from Takara Leben REIT, which I currently hold.

It’s an attractive REIT with the highest yield in the fiscal months of February and August.

Now let’s take a look at the management report!

- Distributions for the 6th fiscal period and subsequent forecasted distributions

- What is Takara Leben Real Estate Investment Corporation?

- Company Portfolio

- Share Price Movement

- Shareholder Benefits

I have been investing for three years and have experience in the securities industry.

By reading this article, you’ll learn all you need to know about Takara Leben Real Estate Investment Corporation!

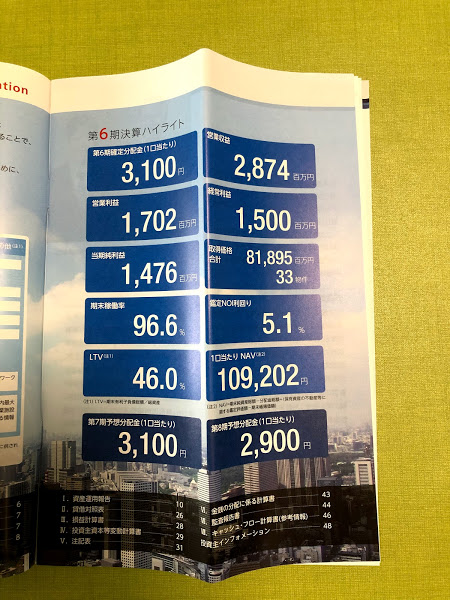

Distribution for the 6th Fiscal Period and Subsequent Projected Distributions

The distribution for this period was 3100 yen per unit, which is quite a nice amount!

The forecasted distribution for the 7th period remained unchanged at 3100 yen per unit, and the forecasted distribution for the 8th period was 2900 yen.

Since this is only a forecast, the amount will probably change a little, but I’d be happy if they could pay out as much as possible!

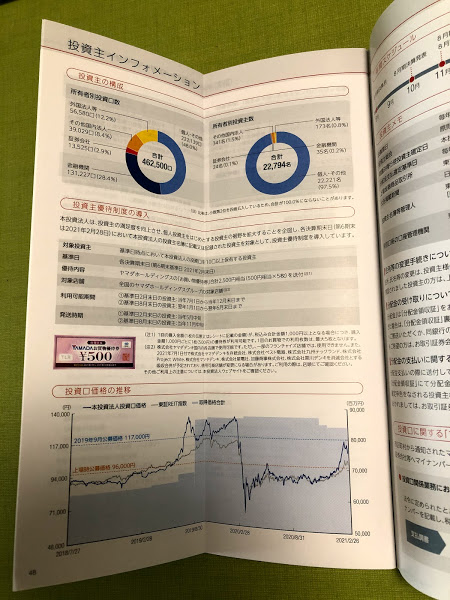

One thing to keep in mind is that the percentage of individual investors is high, so if there is a sell-off, the stock is likely to fall.

I would like to see more financial institutions own this stock in the future.

What is Takara Leben Real Estate Investment Corporation?

Takara Leben Real Estate Investment Corporation is a J-REIT that was listed in 2018 and was established in 2017.

It is sponsored by Takara Leben, PAG, a Hong Kong real estate fund, Kyoritsu Maintenance, and Yamada Holdings.

It invests more than 70% in office buildings and residential properties, and less than 30% in hotels and commercial facilities.

The company’s portfolio

The company has properties in major cities such as Tokyo, Nagoya, and Osaka, and the occupancy rate is over 80%, which gives us a sense of security.

It has been slightly affected by the new infectious disease, but it will recover in the future.

Stock price movement

The stock price had fallen significantly due to the infection, but it is gradually recovering.

I personally believe that the stock is still undervalued, as the yield is still above 5%.

However, the impact of the infectious disease is still significant, so we should not be complacent.

Shareholder Benefits(abolition)

We are one of the few REITs that have a special benefit program.

If you hold 10 or more units, you can receive a shopping coupon of 2,500 yen from Yamada Holdings for February and August vesting.

Although the program is limited to residents of Japan, the yield is good and the annual benefit of 5,000 yen is great.

I want to save so that I can get the benefit in the future!

Summary

- The most recent distribution was 3100 yen per unit.

- The dividend yield is high and attractive.

- Since it is still new, I have high expectations for its future management.

This is a summary of Takara Leben Real Estate Investment Corporation’s dividends!

I’ll be reporting on other REITs as needed!

Thank you for reading to the end!

コメント