Hello everyone. I’m @olivertomolife, and I love investing and shareholder special offers!

Our lives have changed dramatically in recent years due to various ways of working, such as remote work.

In this context, the development of computers and electronic devices is also accelerating day by day.

SUMCO Corporation, which I will introduce here, manufactures silicon wafers, which are the root of electronic devices.

I will now analyze the company and when to buy SUMCO Corporation!

- Want to buy semiconductor-related stocks

- Want to buy stocks with a high capital adequacy ratio

- Want to know which stocks are best for long-term investment

- When is the best time to buy SUMCO Corporation?

- Three reasons why SUMCO Corporation is recommended

- What is SUMCO Corporation?Company Business

- Company Indicators and Performance

- Dividend Trends

- Three investment trusts we recommend incorporating into our portfolio!

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll get to know SUMCO Corporation!

When is the best time to buy SUMCO Corporation?

In conclusion, we believe that you should buy the stock at close to 1,950 yen.

In the past five years up to 2021, the stock price above appears to be the standard and is changing.

Since the theme of the stock is semiconductors, there are times when price movements are violent, but I believe that demand will continue to increase.

There may be a lot of short selling by institutions, but I believe that this is a stock that can be defeated by long-term investment.

I think it is a stock that is more suitable for making profits over the long term than for making profits in the short term.

Three reasons why SUMCO Corporation is recommended

1 30% of the global market share

SUMCO is a global supplier of silicon wafers, a component necessary for the manufacture of semiconductors.

I believe that the fact that Japanese companies boast a high market share in this field shows that they have technological capabilities.

In the global market for silicon wafers, Japanese companies dominate the top two positions.

The first is Shin-Etsu Chemical Co., Ltd. and the second is SUMCO Corporation.

It is surprising that both of them together have a 50% share of the market.

2 Overseas sales account for 80%.

One of the characteristics of a company is that it has high overseas sales.

Semiconductor-related companies tend to have overseas sales.

Therefore, even in times of economic downturn in Japan, we have the strength of being well-balanced because of our overseas exports.

There is also a sense of stability in this field, as demand is expanding worldwide.

3 Receiving awards from world-class companies

We have received an award from TSMC, a global semiconductor company, as one of 15 selected suppliers for seven consecutive years.

We have also received an award from Intel Corporation of the United States for 20 consecutive years as an outstanding supplier.

This is proof of our ability to be recognized by the world’s leading companies.

What is SUMCO Corporation?

SUMCO Corporation was established in 1999 through the integration of the silicon wafer businesses of Sumitomo and Mitsubishi.

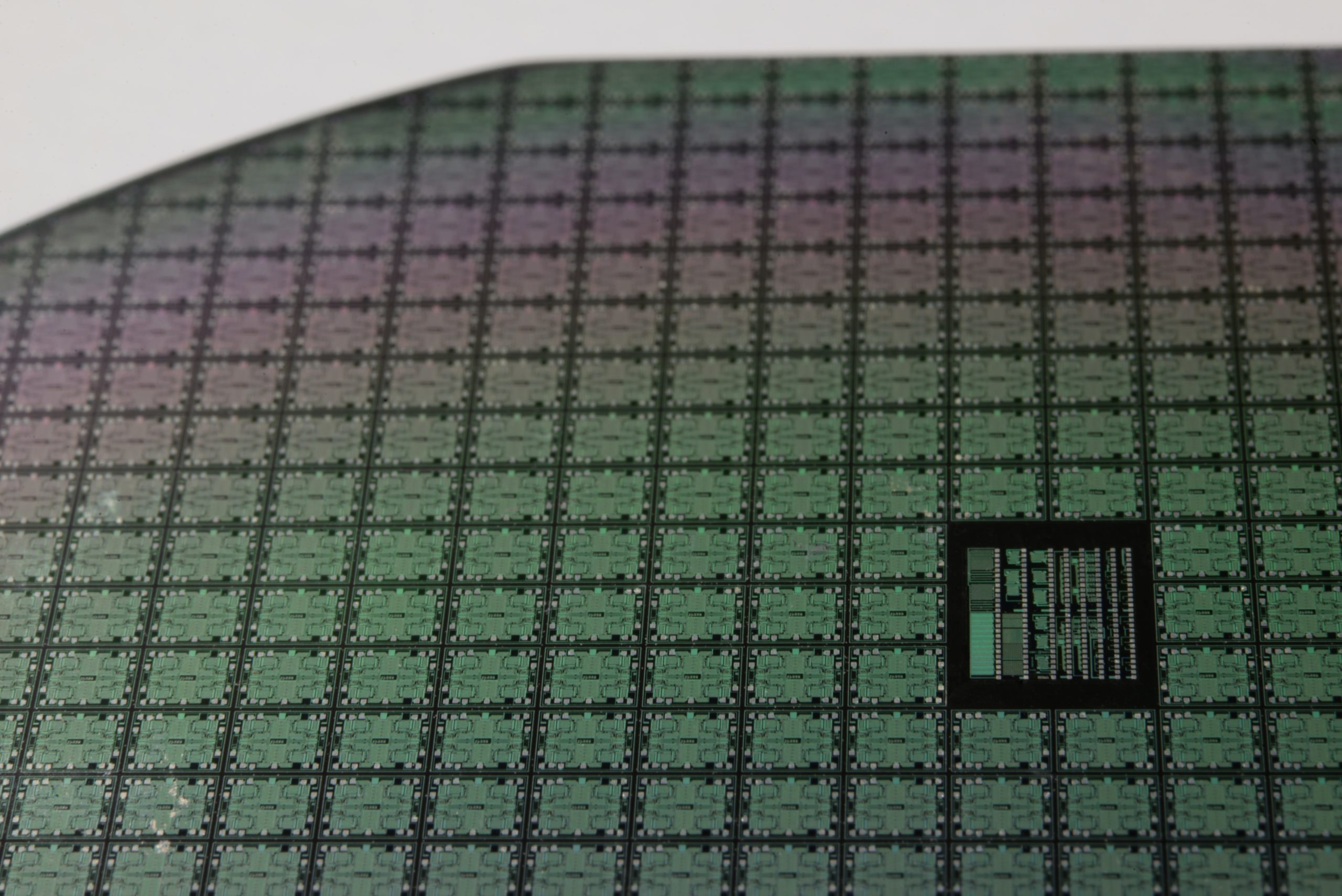

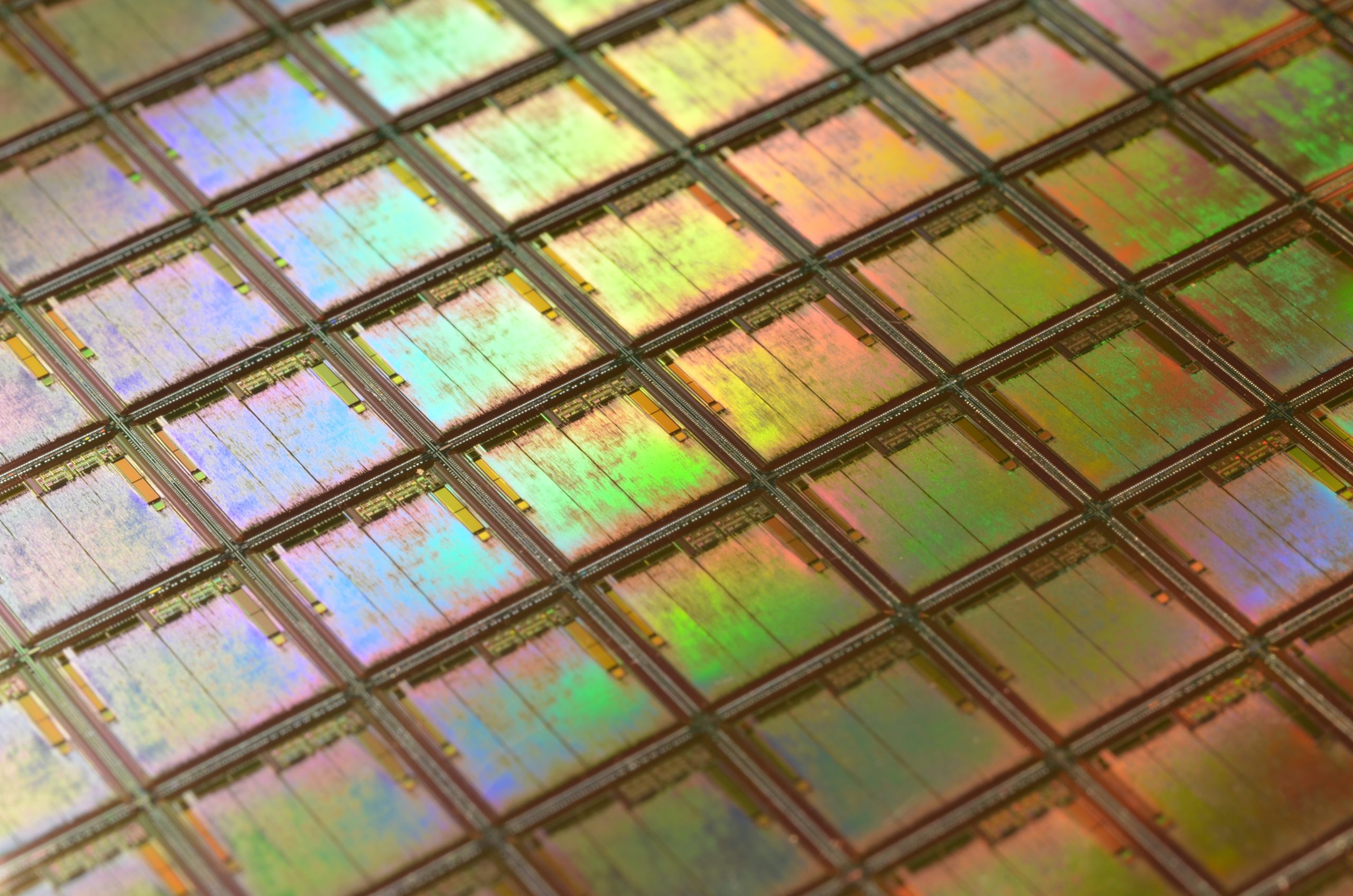

The company manufactures and sells silicon wafers for semiconductors.

These silicon wafers are the foundation of electronic devices and are used in automobiles, smartphones, and other devices.

We are constantly researching and improving our products to make them suitable for a wide range of devices.

Company’s Business

We are engaged in the manufacture and sale of silicon wafers, which are used as materials for semiconductor devices.

The wafers are made by slicing high-purity silicon into 1mm-thin slices, polishing the surface, and cleaning the wafers.

In order to achieve high quality and low cost products, companies are doing a lot of research.

We can think of silicon wafers as the reason why our lives have become more convenient.

Company Indicators and Performance

The following is a summary of the main indices of SUMCO Corporation.

| PER | PBR | Dividend yield | Dividend payout ratio | Equity ratio |

| 19.6 times | 2.08 times | 1.49% | 30.9 % | 53.1% |

Looking at the indexes, the company seems a little expensive, but the equity ratio is high.

If the dividend is also increased, I think the number of shareholders will increase.

The company’s performance in 2019 was down from the previous year, but in 2020, it was higher than in 2018.

Of particular note is the earnings per share item, which increased by 29 yen over the two years.

I hope that the earnings for 2021 will be higher than this.

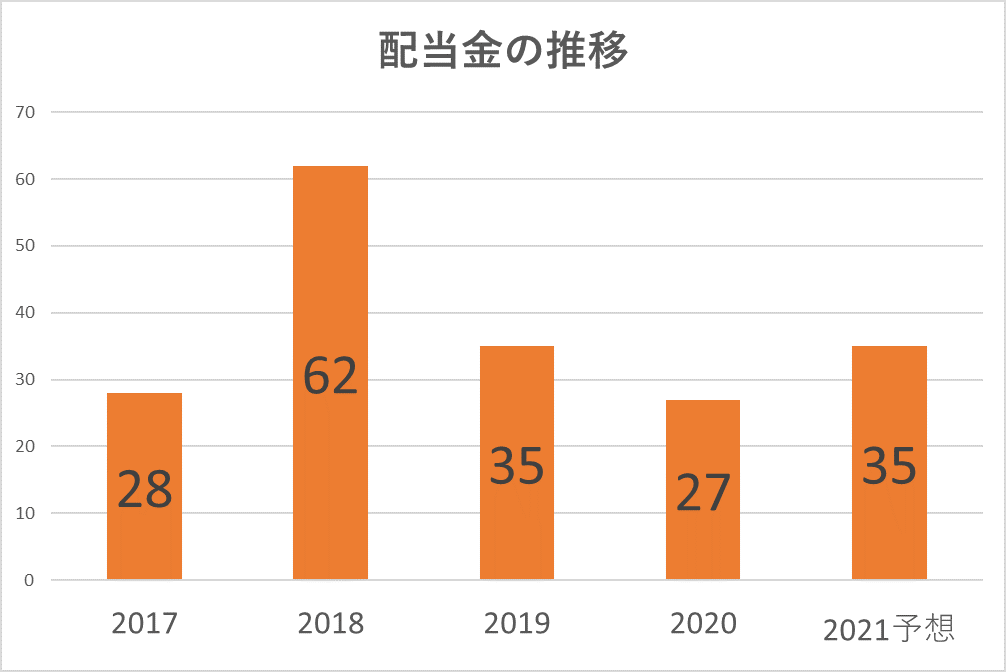

Dividend Trends

There has been a significant dividend cut since 2018, but it has been stable.

The reason why there was a dividend increase in 2018 seems to be related to the fact that the company’s net income doubled.

I think there will continue to be a shortage of semiconductors in the future, so I would like to see a dividend increase.

Three recommended investment trusts to include!

If you are new to investing, you may feel uneasy about suddenly buying stocks.

In such cases, mutual funds are recommended.

Mutual funds are managed by professionals in a wide range of stocks.

Since you can start with a small amount, you can diversify your risk.

I have selected three investment trusts that close once a year and include SUMCO Corporation for your reference!

- JPMorgan Asset Management JPM The Japan

- Nikko Asset Management Index Fund 225

- Sumitomo Mitsui DS Asset Management Sumitomo Mitsui Japan Equity Open

Summary

- Time to buy at 1950 yen

- World’s second largest silicon wafer manufacturer

- Technological strength and high reliability

This article introduces SUMCO Corporation, its buying opportunity and the company!

Investing is a personal responsibility. Investing is your own responsibility. Make your own final decision after referring to various opinions.

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント