Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

Unfortunately, many Japanese companies cut their dividends when the economy goes down, right?

But there was one of the company that steadily increased its dividend even during the recession.

The company I am going to introduce here, Ricoh Leasing, has increased its dividend for 26 consecutive fiscal years and did not reduce its dividend even during the Lehman Shock, the global recession.

I am going to analyze this stock extensively, including when to buy it and the company’s business.

- Those who want to invest in stocks that provide returns to shareholders.

- Want to buy stocks of companies related to Ricoh

- Those who are looking for the best stocks for long-term investment.

- When should I buy Ricoh Leasing stock?

- What kind of business is leasing?

- What is Ricoh Leasing Company, Ltd.

- Company’s Business

- Company Indicators

- Dividends

- Attractive shareholder benefits

- Three recommended investment trusts for inclusion

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll get to know Ricoh Leasing!

When should I buy Ricoh Leasing’s stock?

In conclusion, I believe that the time to buy is when the price falls below 3500 yen.

Looking at the stock price over the past 10 years, it has risen quickly since November 2012 and has not fallen below 2000 yen once since then.

Although there have been five major declines, the price is still firm at the bottom and I believe it will continue to move higher.

Although it may be difficult to buy the stock because of its high price, I believe it is a good stock to make a bullish decision.

What kind of business is leasing?

We often hear the word “lease” in our daily life, but what kind of business is it?

Generally speaking, leasing is the process of renting out a new item to someone for a medium to long term contract period according to their needs.

Since it is not a short-term lease, there is a disadvantage in that you cannot cancel the lease in the middle of the contract.

Also, depending on the property, the delivery period may vary, so you need to take that into consideration as well.

The monthly fee is cheaper than renting, but the property is owned by the leasing company, and the lessee needs to take care of repairs.

At the end of the contract, the lessee must return the leased property to the leasing company to terminate the contract.

To put it simply, we can say that leasing is a series of intermediary and lending services for what you want to borrow.

What is Ricoh Leasing Company, Ltd.

Ricoh Leasing Company, Ltd. was established in 1976 as a company to handle Ricoh’s credit card business.

The following year after its establishment, the company developed its leasing business focusing on office equipment.

Since then, it has expanded into a wide range of businesses including vehicle leasing, housing loans and power generation.

With the formation of a three-way business alliance with Ricoh and Mizuho Leasing, we can look forward to future business.

Company’s Business

The company is engaged in two major business segments.

1 Leasing and Installment Business

We lease a wide range of products, from copiers to automobiles.

We have a wide range of products that we can deliver, so we can do business with our customers.

There are various types of leases, so you can choose the product that best suits the size of your company.

2 Financial service business

One of the most distinctive features of this service is the collection agency service, which allows you to make one invoice without any installation fees.

It also offers full support, and there are no fees for months when the service is not in use.

We also issue prepaid cards that can be used for studying or working abroad.

The card is compatible with ATMs in 200 countries around the world, so you don’t have to worry about sudden trips abroad.

Since it is a prepaid card, you don’t have to worry about overspending, which I think is a safe point.

Company Indicators

The following is a summary of Ricoh Leasing Company, Ltd.’s main indices.

| PER | PBR | Dividend yield | Dividend payout ratio | Equity ratio |

| 9.2 times | 0.59 times | 3.07% | 2021/3 25.6% | 16.5% |

It can be said that the company is undervalued in terms of indicators.

Although the dividend yield has decreased due to the rise in the stock price, I think it is reasonable since the company has increased its dividend.

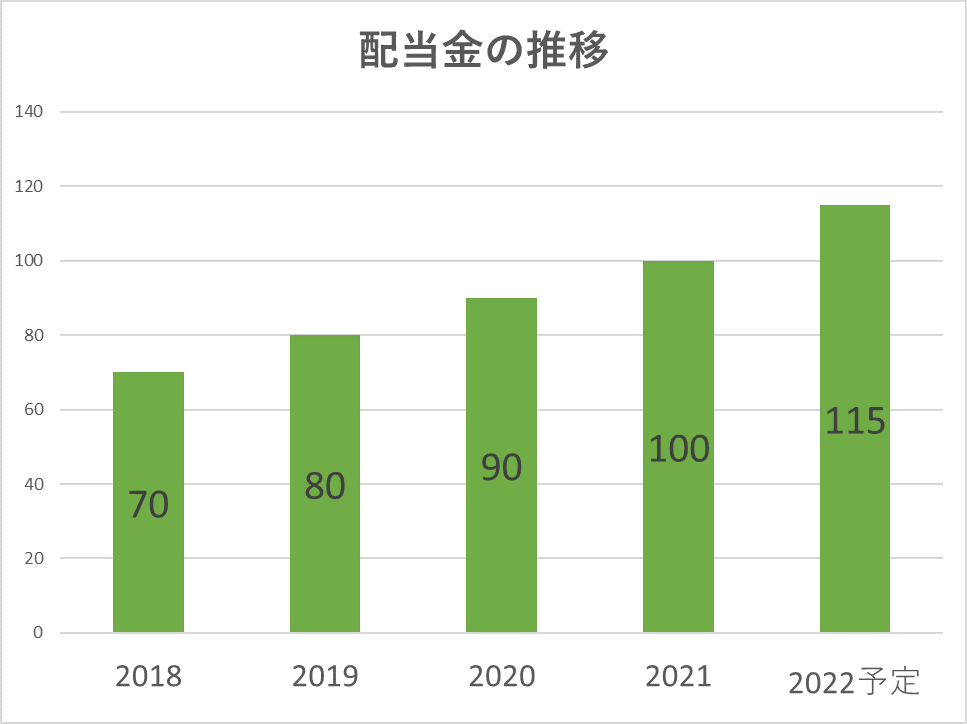

Dividend Trends

The company has increased its dividend for 26 consecutive fiscal years up to the fiscal year ending March 2021, and has been paying out stable dividends.

The company is also recession-proof as it plans to increase its dividend again in FY2022.

There is a sense of trust in the fact that the company has continued to raise its dividend even in the midst of the world’s great recession.

Attractive shareholder benefits

You can receive a special benefit of a quo card by vesting 100 shares at the end of March every year.

The initial amount is equivalent to 2000 yen, but the amount increases with long-term ownership!

If you hold 300 shares, you will receive a catalog gift worth 5,000 yen, and if you hold for three years, the benefit will increase to 10,000 yen!

Three recommended investment trusts for inclusion

Investment trusts can be started with a small amount of money, making them safe even for beginners.

You can also diversify your risk by buying on a monthly basis!

I have compiled a list of investment trusts with annual settlement dates that Ricoh Leasing is included in for your reference.

- Sumitomo Mitsui DS Asset Management Nippon Small- and Mid-Cap Equity Fund

- Mitsubishi UFJ International Investment Trust Fund Manager (Domestic Equity)

- Mitsubishi UFJ International Investment Trust eMAXIS Slim Domestic Stock (TOPIX)

Summary

- Undervalued indices

- Proactive shareholder returns

- Stable leasing business development

This is an introduction to Ricoh Leasing Co.

Investment is your own responsibility. Make your own final decision after referring to a variety of opinions.

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント