Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

As a comprehensive manufacturer of metalworking machinery, Amada (6113) boasts the world’s largest market share, accounting for 60% of the Japanese market.

I would like to explain about Amada’s business and when to buy its shares.

- You want to invest in a Japanese company that is expanding its business globally.

- Want to know about stocks with high dividends when starting to invest

- Want to know the outlook for Amada’s stock price.

- What is Amada Corporation?

- Amada’s business activities

- Company index

- When is the best time to buy Amada?

- Recommended Mutual Funds

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll learn all you need to know about what makes Amada tick!

What is Amada Corporation?

Amada Co., Ltd. was founded in 1946 and has a history and track record of 70 years.

The company has about 90 subsidiaries and affiliates, and is engaged in a comprehensive range of metal processing-related services, from manufacturing to inspection.

Amada’s products are used in a wide variety of fields, from automobiles to space-related products, and the company provides a comprehensive range of products and services necessary for manufacturing.

Amada has also established a research base where it conducts daily research into cutting-edge technologies.

In recognition of its high level of technology, the company is involved in the development of machinery and software in Germany, Italy, and India.

Amada also has sales and manufacturing bases around the world, contributing to manufacturing all over the world on a daily basis.

Amada’s Business Activities

Amada’s business activities are divided into five categories.

- 1 Sheet Metal Division

- 2 Cutting Division

- 3 Press Division

- 4 Grinding Machine Division

- 5 Precision Welding Division

Click here for detailed business information

Company Indicators

Amada’s indices are summarized below.

| PER | PBR | Dividend yield | Payout ratio | Equity ratio | Market capitalization |

| 21.25x | 0.88x | 2.64% | 2021/3 56.2% | 80.22% | 11th |

We can see that the capital adequacy ratio and market capitalization are high across industries.

A high capital adequacy ratio indicates that the company is financially sound, which means that it can conduct stable business.

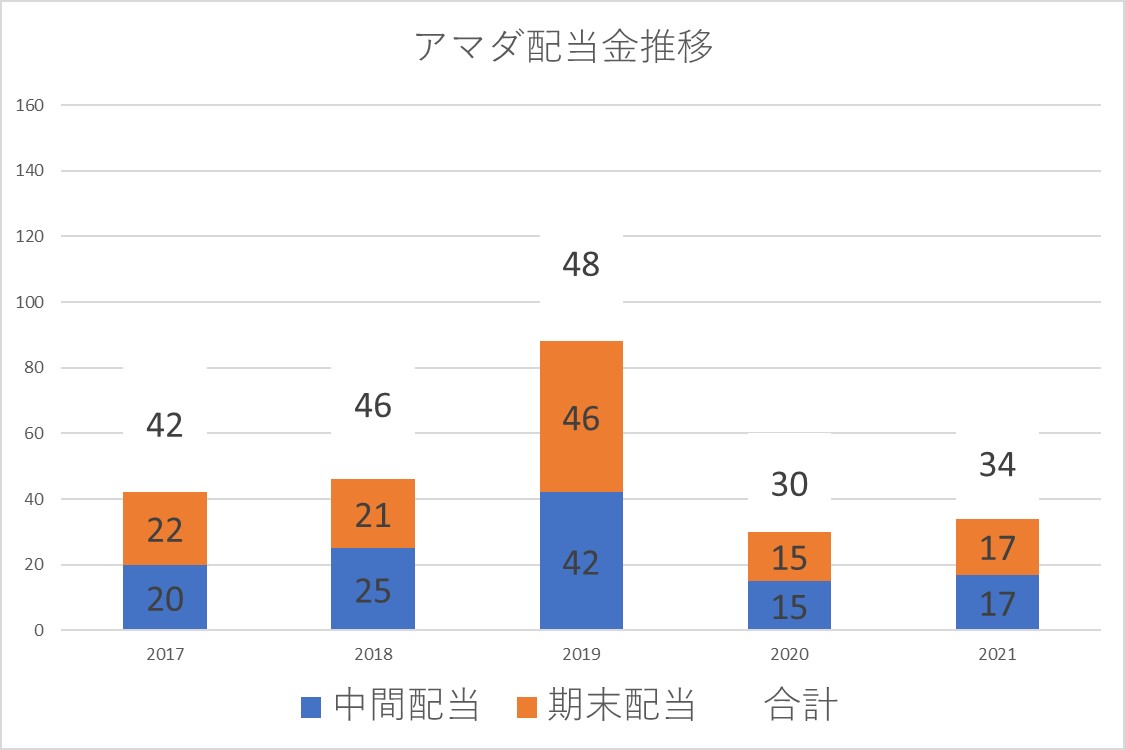

The following table shows the trend of dividends.

The dividend has been significantly reduced since the beginning of 2020.

This is probably due to the impact of global infectious diseases.

The company is expected to increase its dividend next year, in 2021, so it will return to its previous level in the future.

When is the best time to buy Amada?

For me personally, I think it should be bought at around 1,050 yen.

The reason is that the stock has risen substantially through the 1050 yen window as we enter 2021.

However, there was an announcement of a dividend cut and the stock has fallen substantially.

The most recent movement of the stock price has been in a box between 1040 yen and 1200 yen.

The stock price has a tendency to sell off when it gets close to 1,200 yen, so if the stock price exceeds 1,200 yen as a benchmark, we believe it will start an uptrend.

Recommended investment trusts

Mutual funds are recommended for those who are anxious to start investing.

Since mutual funds can be started with a small amount of money, even a beginner can get started!

You can also make a stable investment by accumulating monthly.

The following is a list of recommended mutual funds that I have selected.

- Nissay Japan Equity Fund

- Japan High Dividend Stock Open

- GW7 Egg

Summary

- Amada has strength as a global company

- When the stock price reaches 1,050 yen, it is a good time to buy.

- Financially sound and shareholder-oriented company

I have explained about Amada Corporation!

Investing is your own responsibility. Make your final decision after referring to a variety of opinions.

I will continue to introduce more Japanese companies in the future, so please stay tuned.

Thank you for reading to the end!

コメント