Hello everyone. I’m @olivertomolife and I love investing and shareholder special offers!

It’s July, and I received a distribution from Mirai Investment Corporation, which has April rights.

This REIT is also famous for having the highest dividend yield among the April REITs.

What’s more, it also offers shareholder special benefits, which is rare for a REIT!

Let’s take a look at the dividends and performance of this attractive REIT.

- People who want to buy REITs, but are not sure which ones to buy.

- Want to know about the dividends paid by Mirai Investment Corporation

- Want to know about the shareholder benefits of Mirai Investment Corporation

- What is Mirai Investment Corporation?

- What is the stock price of Mirai Investment Corporation?

- When can I receive dividends from Mirai Investment Corporation?

- How much dividend can I receive?

- What are the details of the shareholder special benefit plan?

- What is the performance of the REIT?

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll learn all you need to know about Mirai Investment Corporation!

Other recommended REITs are introduced in the following articles.

What is Investment Corporation Mirai?

This REIT is sponsored by Mitsui and Idera Capital, which provides management services.

Incidentally, Idera Capital used to be a listed company.

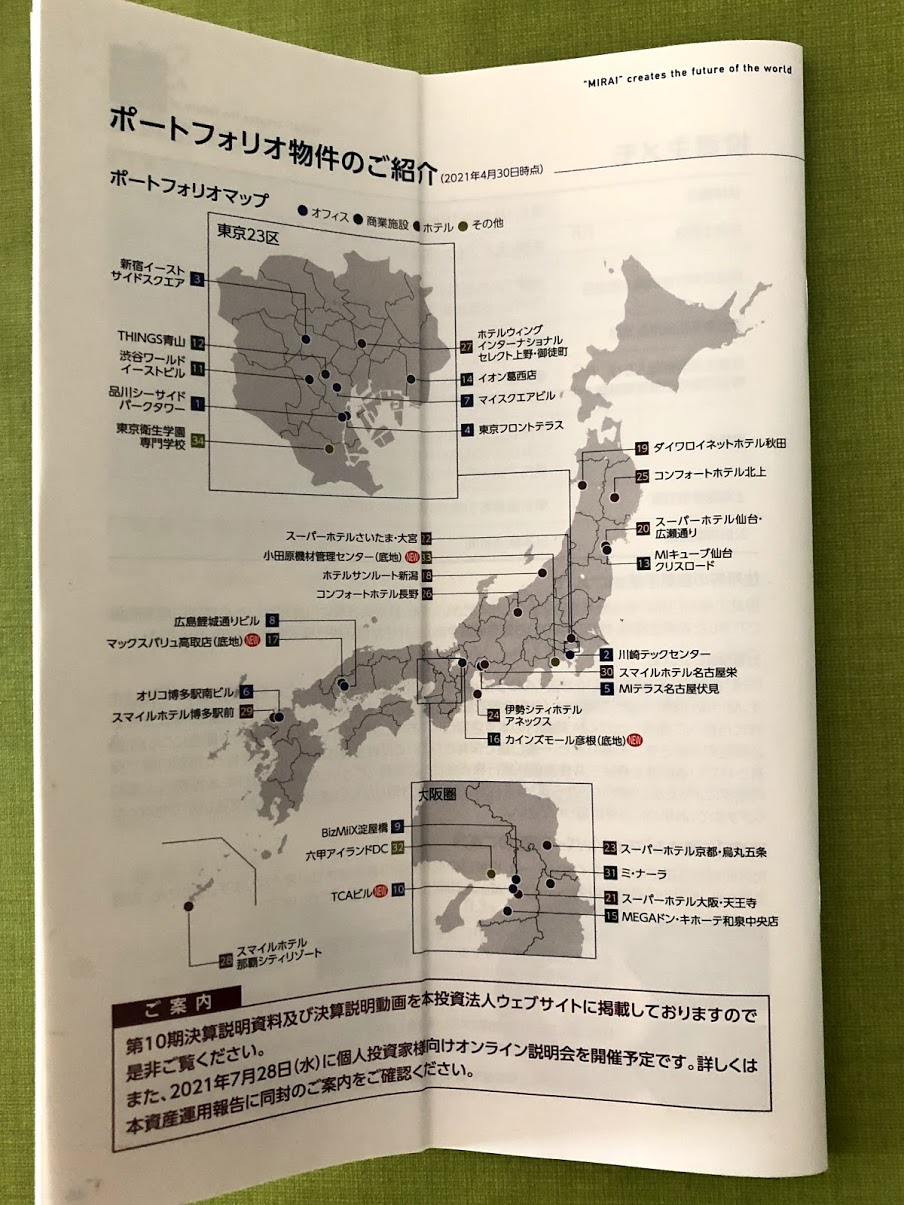

It holds real estate mainly in the Tokyo and Osaka metropolitan areas, and features a high ratio of office buildings.

It has maintained a high average occupancy rate of 98%, and has a good operating performance.

The price per unit is lower than other REITs, making it easy for beginners to buy!

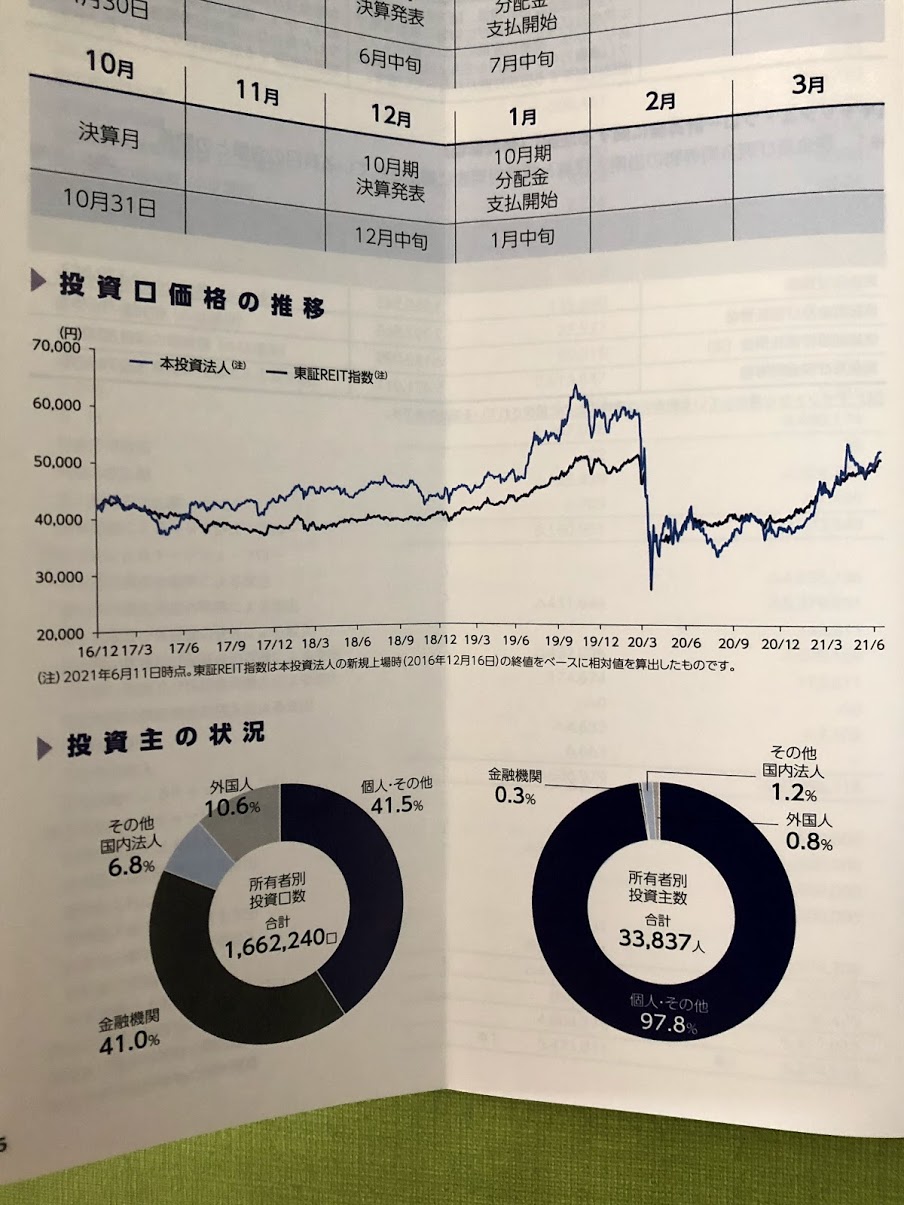

What is the stock price of Mirai Investment Corporation?

As of 7/15/2021, the stock price is 57700 yen per unit.

The share price of the REIT is not a fraction, so it’s easy to see.

The most recent high is 67,200 yen, so I get the impression that it is getting closer little by little.

Looking at the chart, we can see that it’s making a gradual rise, so we may as well try to buy on a push!

When can I receive dividends from Investment Corporation Mirai?

Mirai Investment Corporation closes its accounts in April/October and receives its dividends three months after the close of accounts.

The dividends are higher than those of other listed companies, so they are very popular.

Receiving dividends through a securities account is most recommended.

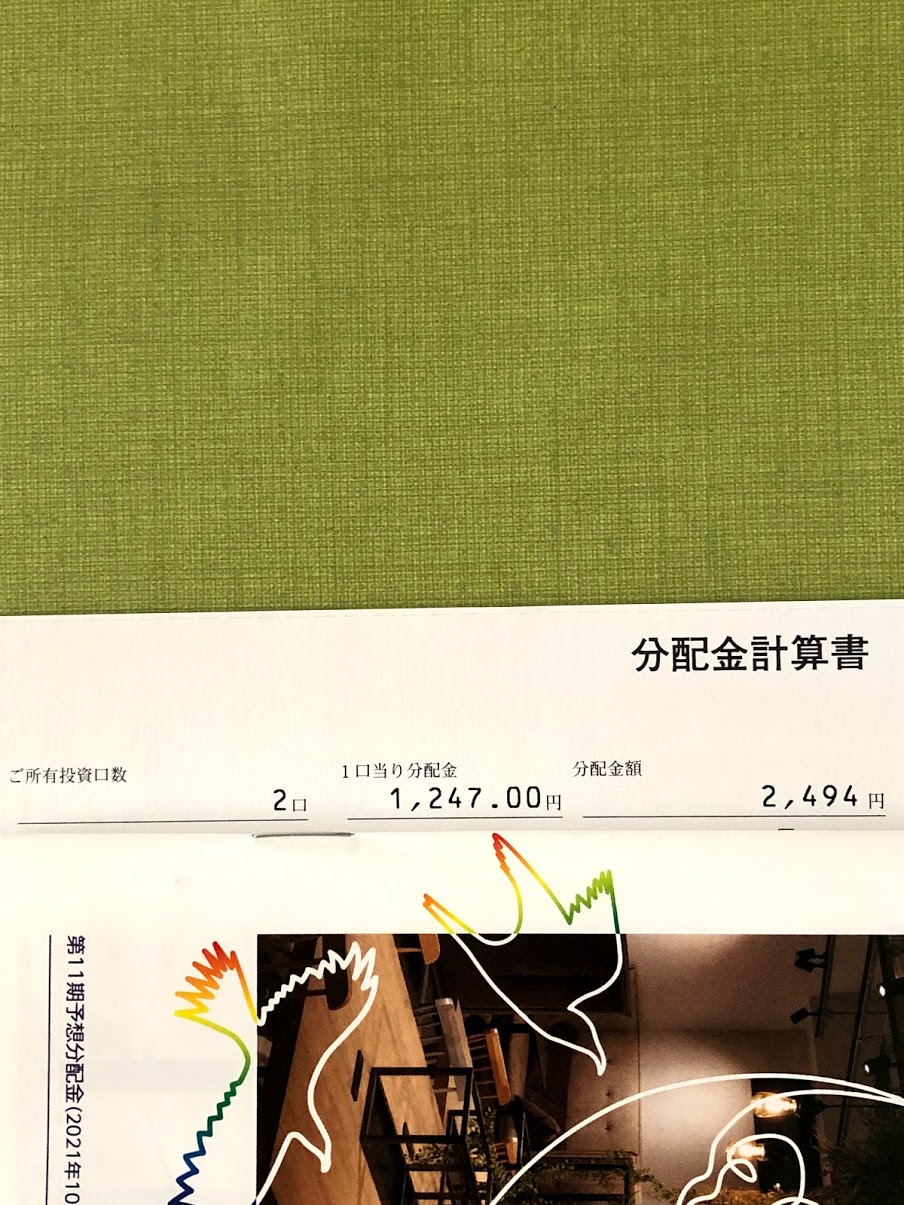

How much dividend will I receive?

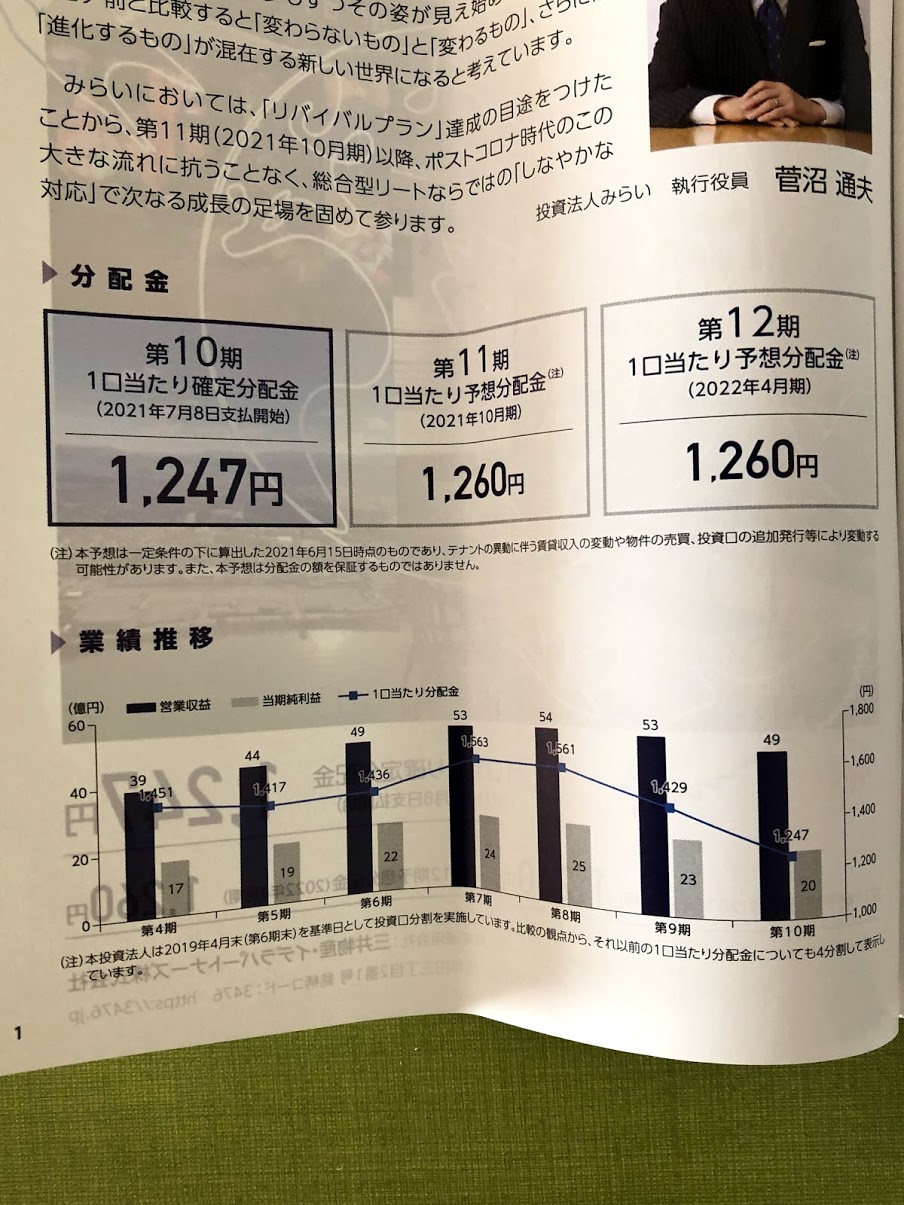

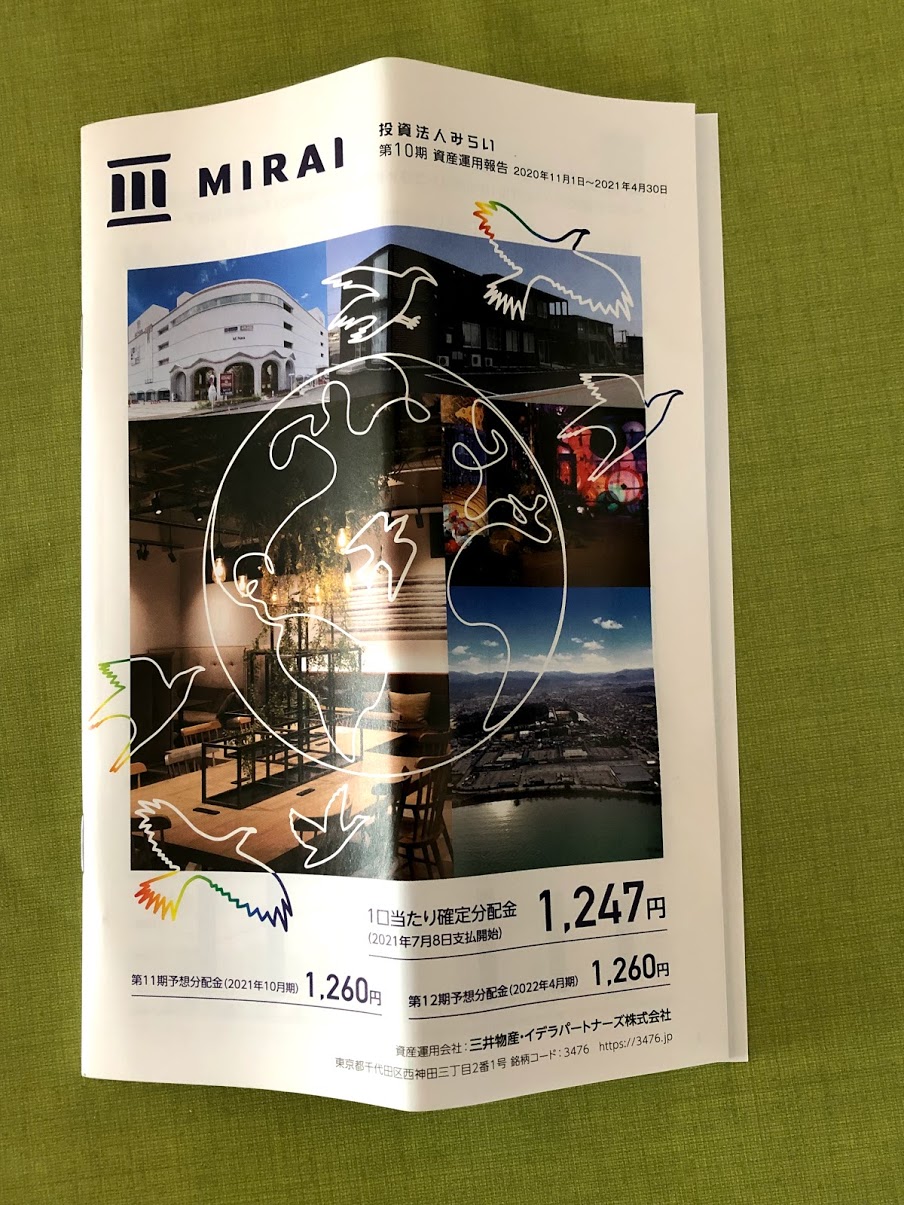

The dividend for this fiscal year was 1247 yen per unit.

The dividend for next fiscal year is expected to be 1,260 yen per unit.

The dividend for next April is expected to be 1260 yen per unit.

There is a possibility of an upward revision, so I’m hopeful!

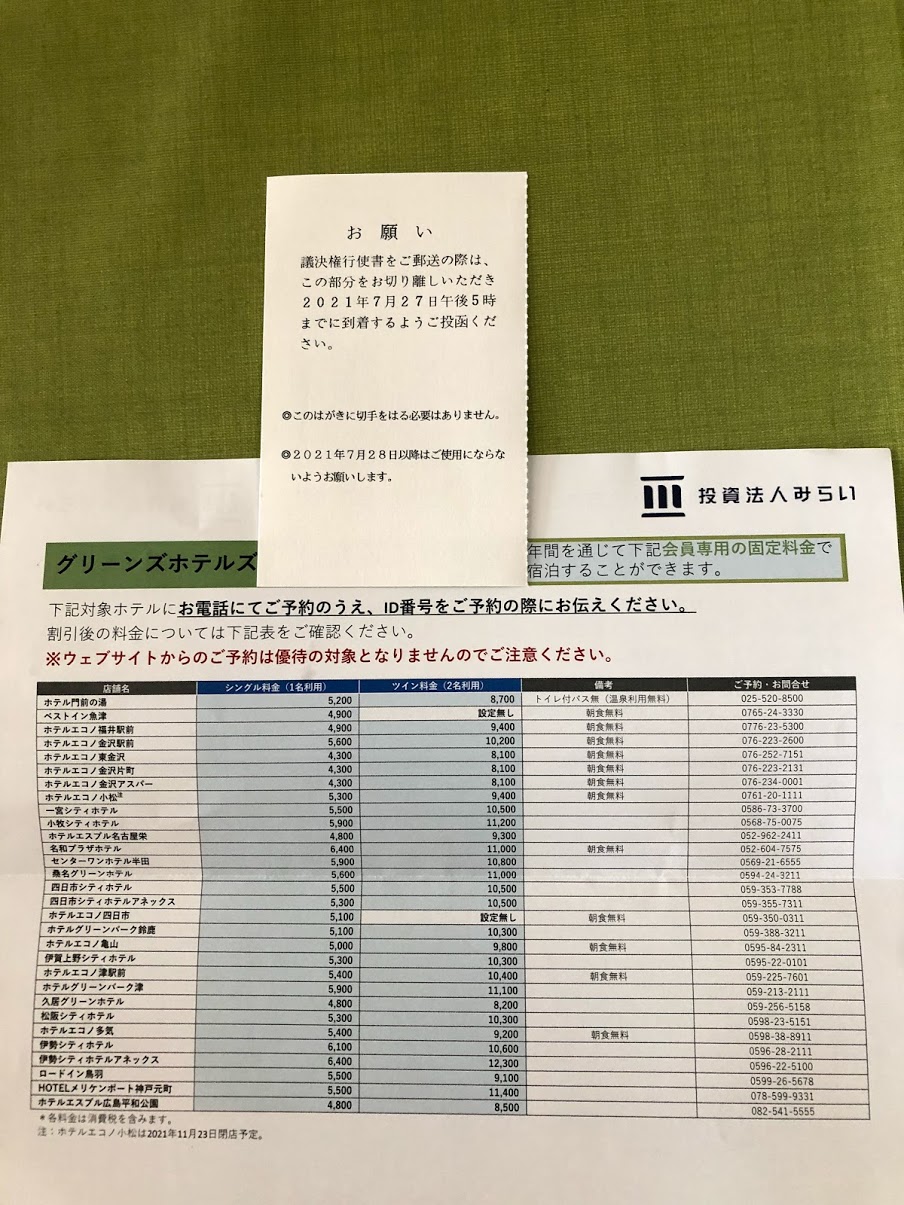

What are the details of the shareholder special benefit plan?

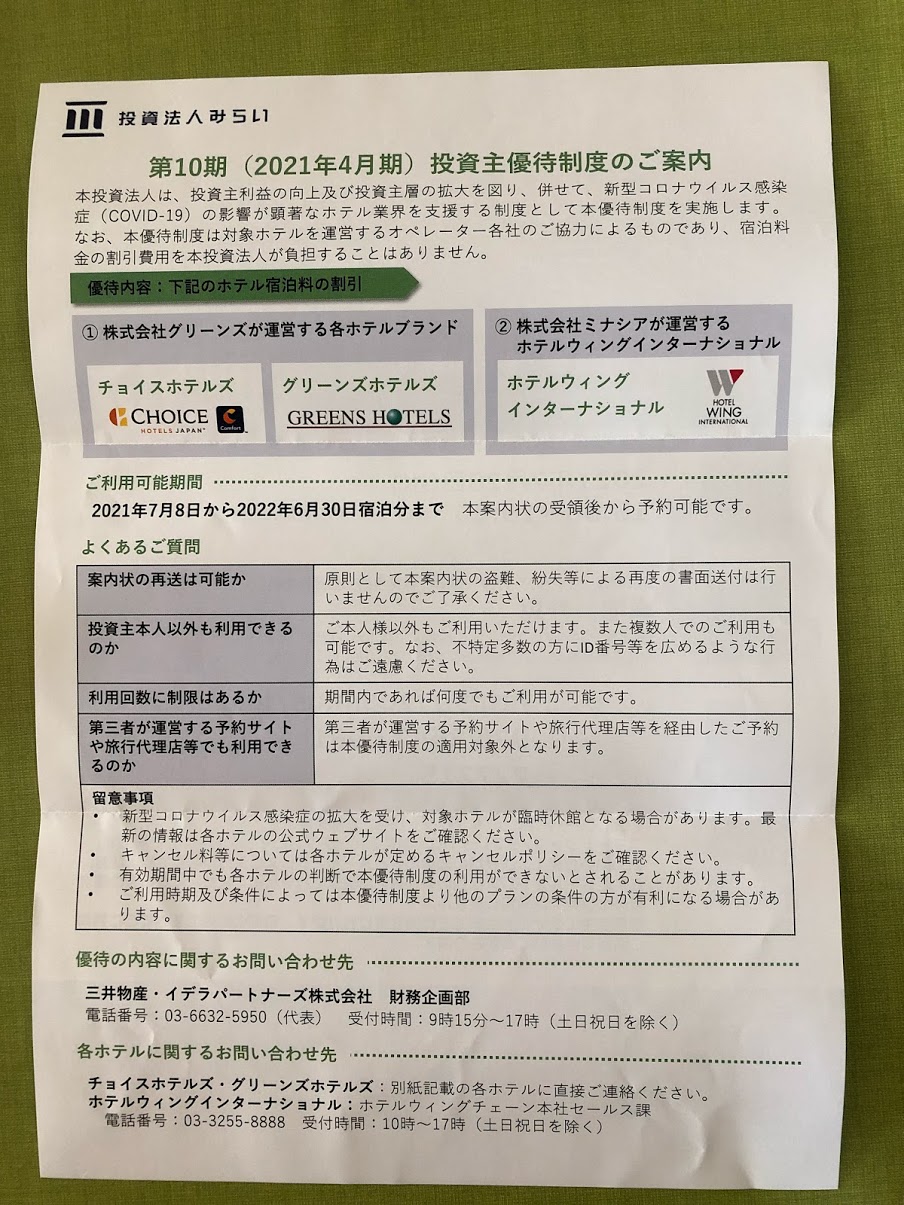

Mirai Investment Corporation offers special benefits to shareholders regardless of the number of units.

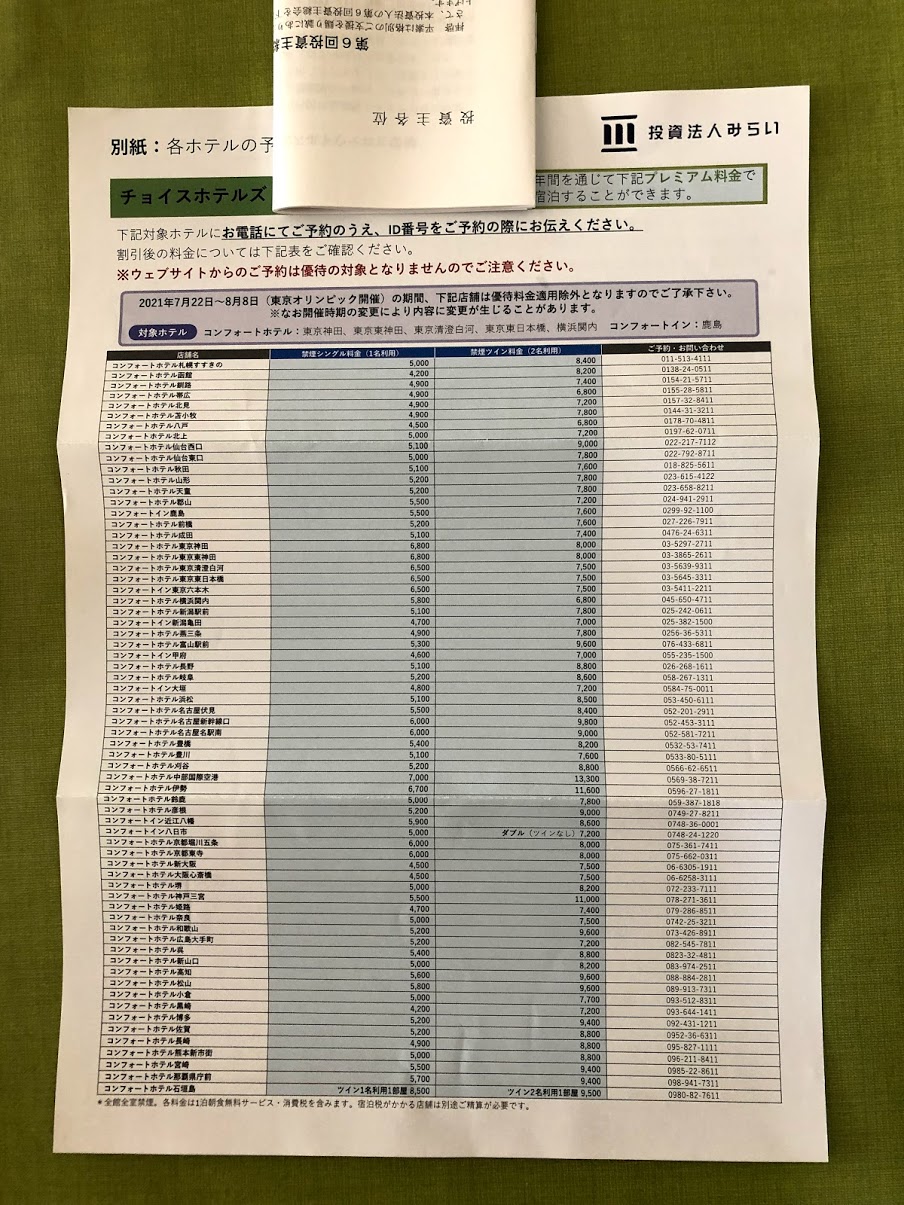

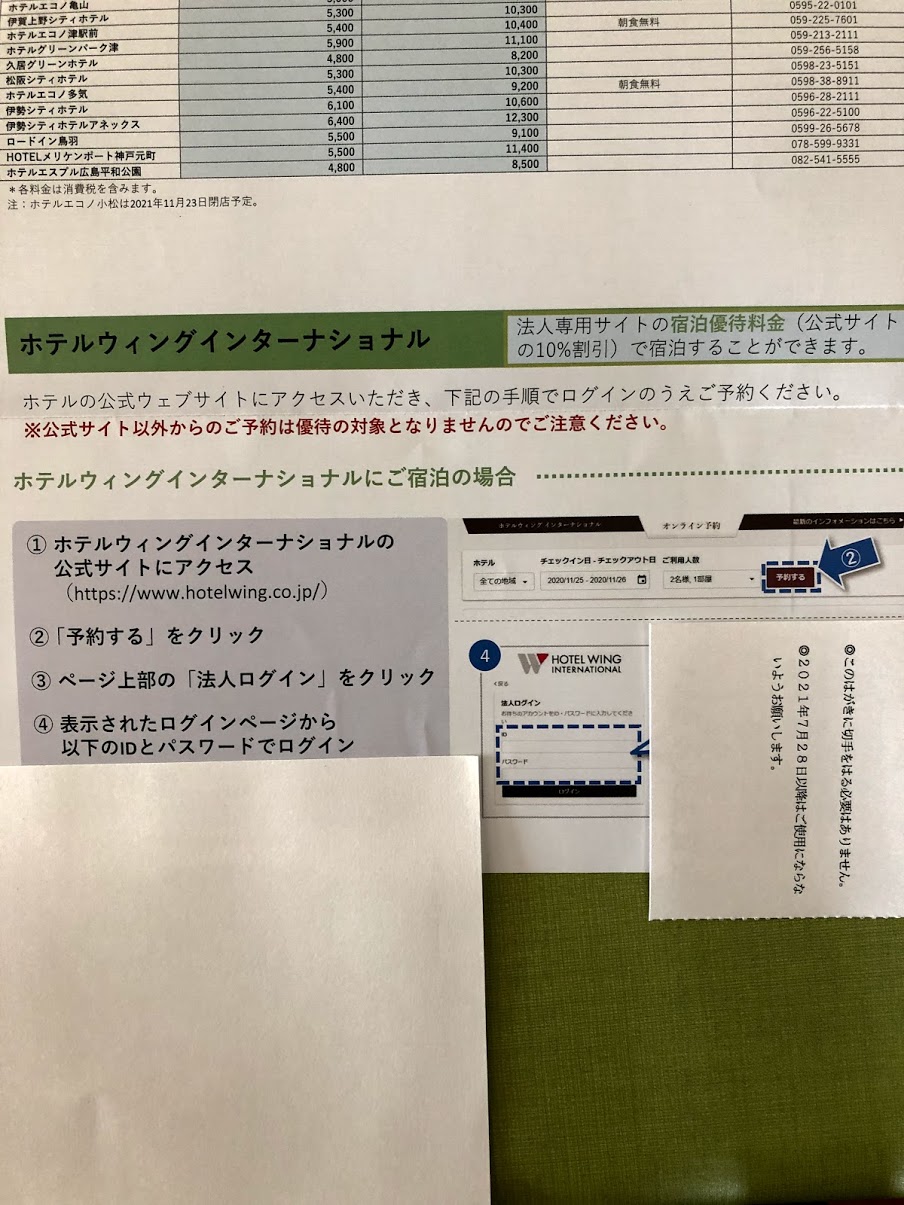

This includes special privileges at Choice Hotels and Greens Hotels and a 10% discount at Hotel Wing.

Each of these hotels are located all over Japan, so I figure this is a convenient benefit for business and travel!

For Choice Hotels and Greens Hotels, you can save even more if you use two people.

Choice Hotels and Greens Hotels offer even better rates for double occupancy, but please note that special offers are only available for phone reservations.

Also, Hotel Wing must be booked through the dedicated page.

How is the performance of the REIT?

Compared to the previous fiscal year, the dividend has decreased significantly.

I believe this is due to the impact of the infection, so it will take a few years to return.

Operating revenue and net income decreased slightly compared to the previous fiscal year.

I hope they will increase in the next fiscal year.

Conclusion

- The easiest to buy among REITs.

- A rare REIT that offers preferential treatment

- Recommended REIT for beginners

I’ve just introduced you to the dividends of Investment Corporation Mirai!

I will continue to introduce Japanese companies in the future, so please stay tuned.

Thank you for reading to the end!

コメント