Hello everyone. I’m @olivertomolife and I love investing and shareholder benefits!

In recent years, there has been a worldwide focus on global environmental issues.

And companies have begun to take new initiatives, such as the commercialization of electric vehicles and the operation of solar power generation.

Iwatani Corporation, which I will introduce here, is a company that deals with hydrogen, a highly anticipated next-generation fuel.

The company’s sales of gas and oil are high, but the number of hydrogen sales is increasing every year.

I will now analyze the company and when to buy the stock.

- Want to buy stocks related to living resources

- Want to invest in companies that procure next-generation fuels

- Want to buy stocks of energy trading companies

- When is the best time to buy Iwatani Corporation?

- What is Iwatani Corporation?

- The Company’s Business

- Company Indicators and Performance

- Dividend Trends

- Three investment trusts for inclusion that I recommend!

The author has three years of investment experience and has experience in the securities industry.

By reading this article, you’ll learn about Iwatani Corporation!

When is the best time to buy Iwatani Corporation?

In conclusion, I think it is a good idea to buy at close to 6000 yen.

Because as we enter 2021, the two declines are both up at 6000 yen.

Since the stock is strong in hydrogen for environmental energy, I believe the stock price has a blue ceiling.

It was an ordinary stock until the next generation of fuels started to make a lot of noise, but the global interest in environmental issues has brought it to our attention.

In the decade to 2021, the stock price is at a high point.

Considering the future transition of resources, we can expect the stock price to rise further.

What is Iwatani Corporation?

The company has a long history, beginning with the sale of enzymes and welding rods in 1930.

Later, in 1945, Iwatani Corporation was established and started selling propane gas and cassette stoves for home use.

In 2010, Iwatani became the first Japanese company to acquire a concession to import helium from Qatar.

In 2014, we opened Japan’s first commercial hydrogen plant, and are working with companies and universities to address environmental issues.

We have offices in 17 countries around the world and aim to provide a stable supply of energy.

Company’s Business

There are four main businesses of the company, but I will introduce the two with the highest sales scale.

Please also make use of the website above.

1 Integrated energy business

We sell LP gas for household use to about 3.2 million households in Japan.

We are the largest seller of LP gas in Japan, and have the advantage of being able to handle the entire process from import to sales in-house.

We also operate an electric power business in partnership with an electric power company.

We aim to achieve efficient sales by utilizing our LP gas sales network.

2 Industrial gas and machinery business

We sell a variety of industrial gases and propose the optimization of gas and machinery.

We support domestic industry by utilizing our 50 manufacturing and supply bases in Japan.

We have been selling hydrogen since 1941, and have a 100% share of the domestic market for liquefied hydrogen.

We are also Japan’s leading supplier of helium, a natural resource.

We procure helium from Qatar and the U.S., and are strong in sales in Asia, including Japan.

Company Indicators and Performance

The following is a summary of Iwatani Corporation’s main indices.

| PER | PBR | Dividend yield | Dividend payout ratio | Equity ratio |

| 16x | 1.58x | 1.11% | 17.4% | 47.6% |

Although the dividend is low, the capital adequacy ratio is high, and the index has room for future dividend increases.

The P/E and P/B ratios are also average and desirable.

Sales have declined since 2019, but operating, ordinary, and net income have increased year over year.

Earnings per share have also risen by 40 yen since 2019.

I believe that the tailwind of next-generation fuels will continue, and our performance will improve further.

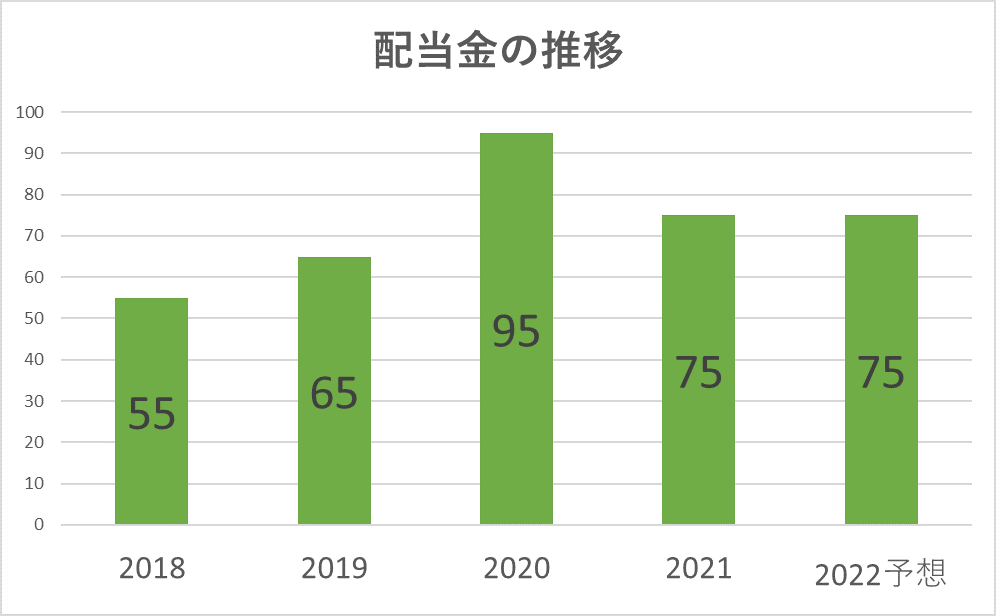

Dividends

Dividends have been stable.

The dividend has been reduced since 2020, but I believe it will be increased within 5 years.

The dividend payout ratio is also low, so I have high expectations for the future.

Three recommended investment trusts for inclusion!

Iwatani Corporation’s stock price is over 6,000 yen, which makes it difficult for some people to buy.

In such cases, I recommend investment trusts.

Since they are managed by professional investment institutions, you can diversify your risk.

I have selected investment trusts that include Iwatani Corporation and close once a year for your reference.

- Fidelity Investment Trust Fidelity Japan Growth Equity Fund

- Nikko Asset Management GW7 Egg

- Daiwa Asset Management Large-Cap Equity Fund

Summary

- The best time to buy is 6,000 yen

- Supply capacity utilizing bases around the world

- Speaking of hydrogen, Iwatani Corporation

I introduced you to Iwatani Corporation!

Investing is your own responsibility. Make your own final decision after referring to a variety of opinions.

I will continue to provide useful information for investment, so please stay tuned.

Thank you for reading to the end!

コメント