Hello everyone. I’m @olivertomolife and I love investing and shareholder benefits!

While common stocks pay out dividends once a year or some companies pay no dividends, REITs pay out dividends twice a year and also pay high dividends, making them attractive.

Have you ever wished you could receive 10,000 yen in dividends every month?

Actually, such a thing may be easier than you think.

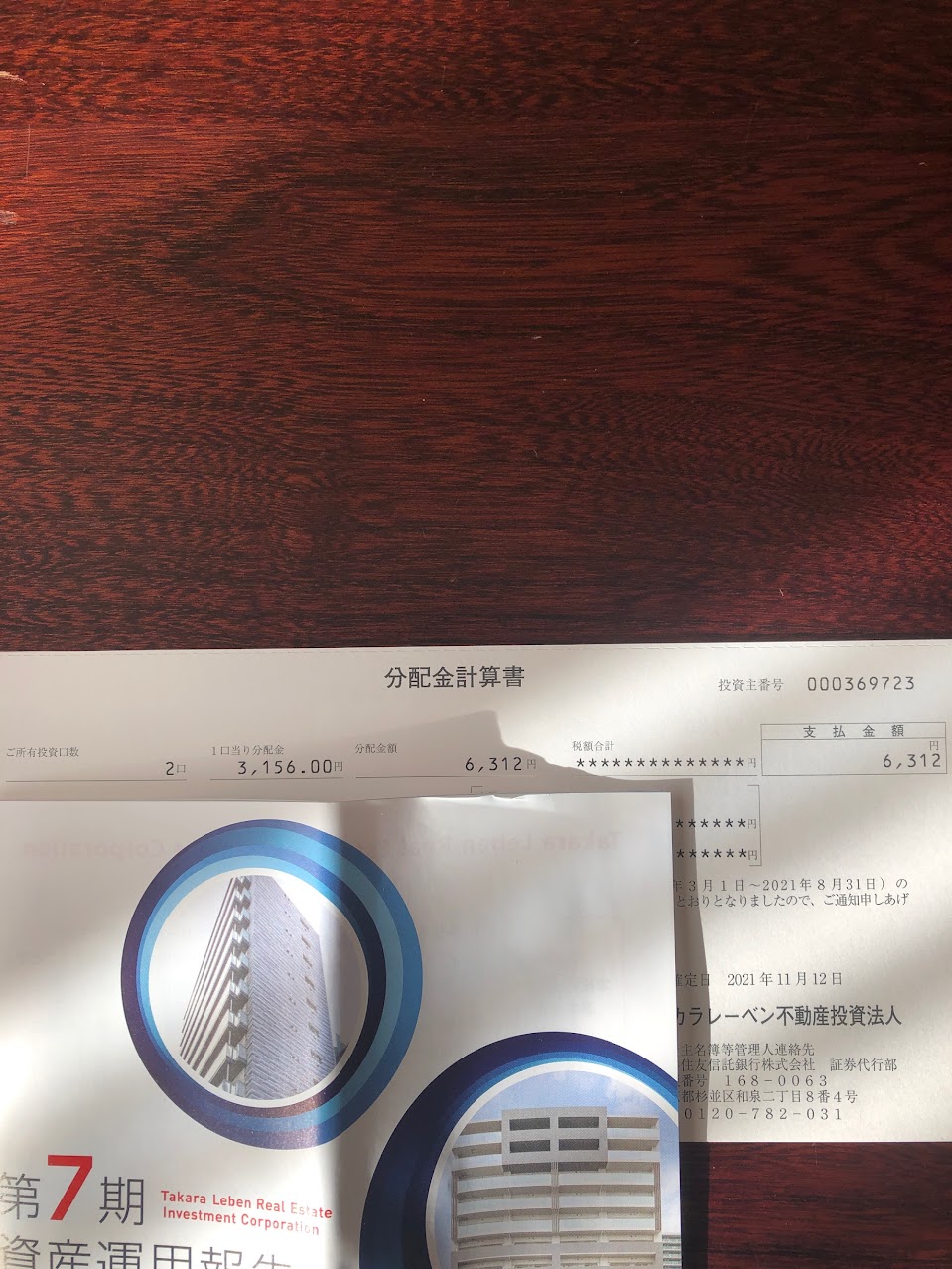

Because at 3492 Takara Leben Real Estate Investment Corporation, we receive an average of 6,000 yen per year!

I believe that REITs, which return most of their profits to their unitholders, are also a very attractive way to invest.

In this article, I would like to introduce the best time to buy REITs and their latest financial results.

- Want to invest in high-dividend REITs

- Looking for REITs with high yield in February/August

- Want to know more about Takara Leben Real Estate Investment Corporation

- When is the best time to buy stock?

- Highlights of the 7th Fiscal Period

- Changes in Distributions

- Increase in New Property Acquisitions

- What is Takara Leben Real Estate Investment Corporation?

- Features of Takara Leben Real Estate Investment Corporation

- Shareholder special benefit program

The author has three years of investment experience and has experience in the securities industry.

Let’s take a look at Takara Leben Real Estate Investment Corporation.

- When is the best time to buy the stock?

- Seventh Fiscal Period Financial Highlights

- Trends in cash distributions

- More newly acquired properties

- What is Takara Leben Real Estate Investment Corporation?

- Features of Takara Leben Real Estate Investment Corporation

- They also offer special benefits to shareholders (abolition)

- Summary

When is the best time to buy the stock?

In conclusion, I think it is a good time to buy when the price reaches around 106,000 yen.

This is because the stock price has leveled off due to the global decline in REITs since August 2021.

The stock price has moved in a range of 90,000 yen, 60,000 yen, and even 130,000 yen since its listing, and I believe it will continue to move higher once the future infections are contained.

I personally think now is the time to stock up, as the yield and portfolio are good.

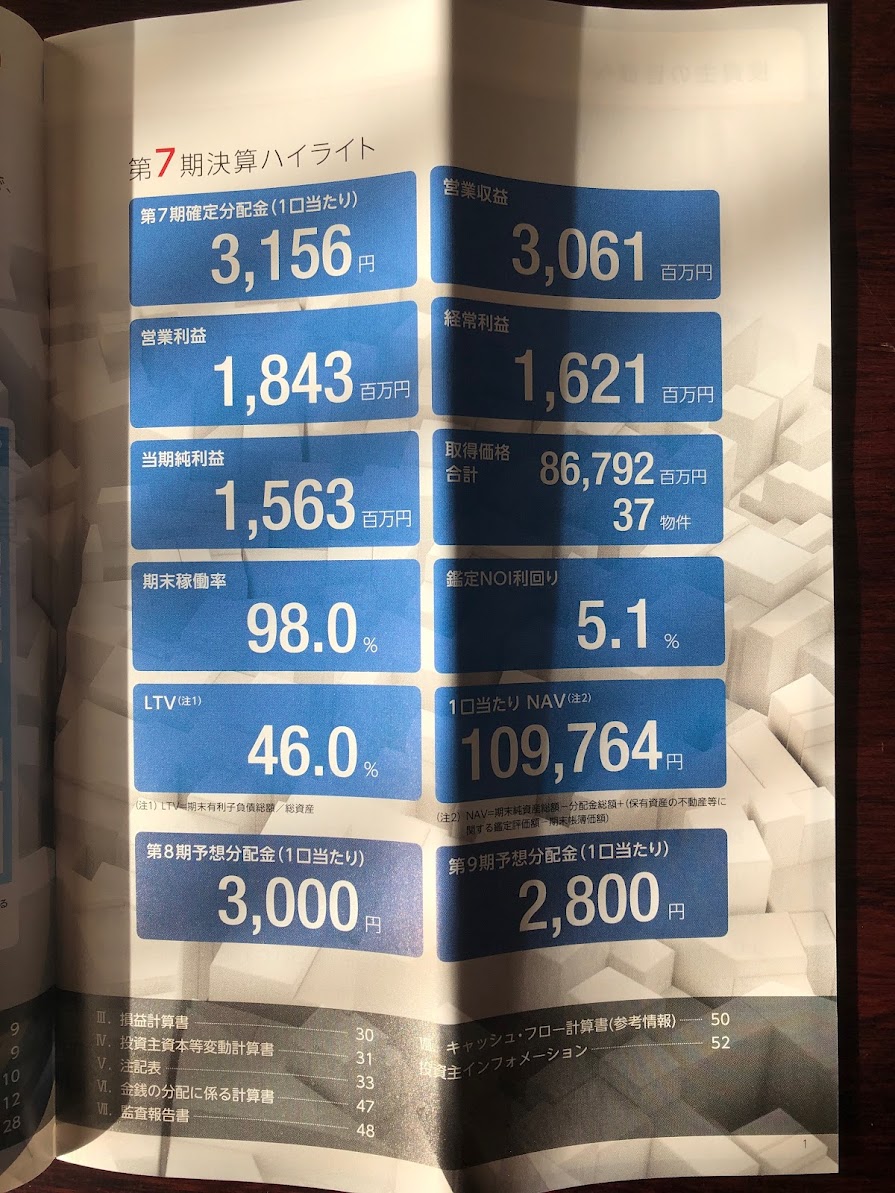

Seventh Fiscal Period Financial Highlights

The latest financial results show a slight increase in operating revenue, net income, and net assets.

Although there is no significant profitability, it can be seen as a steady movement of financial results.

As an unitholder, I would like to pay attention to the results for the next fiscal year.

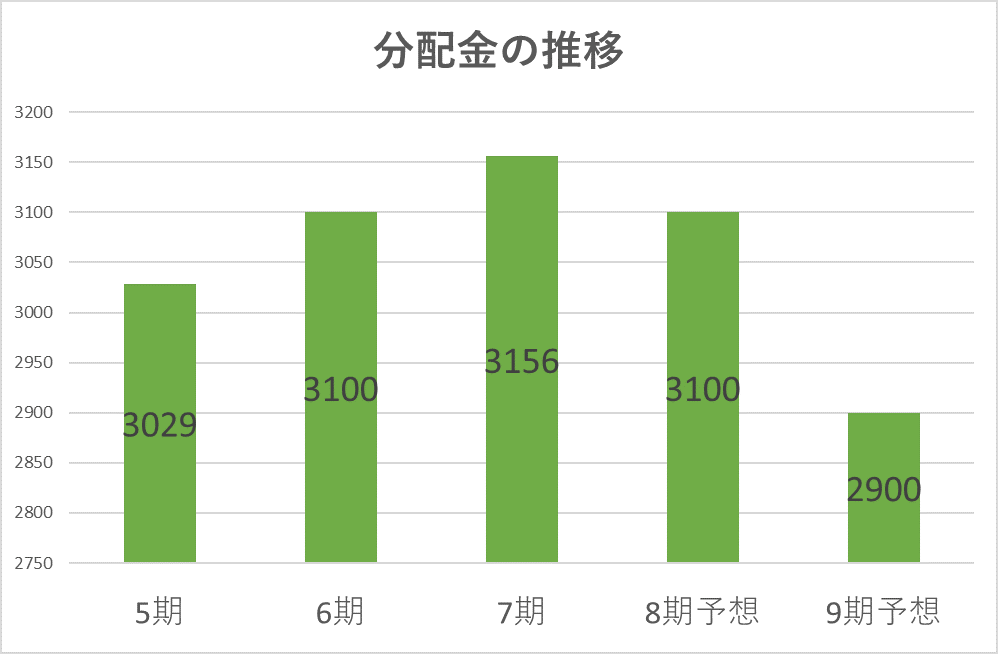

Trends in cash distributions

Distributions have been relatively stable.

However, there is a forecast for a decrease in distributions from the next fiscal year onward, perhaps due to the infection.

Since REITs often revise their distributions, we will wait for brighter news.

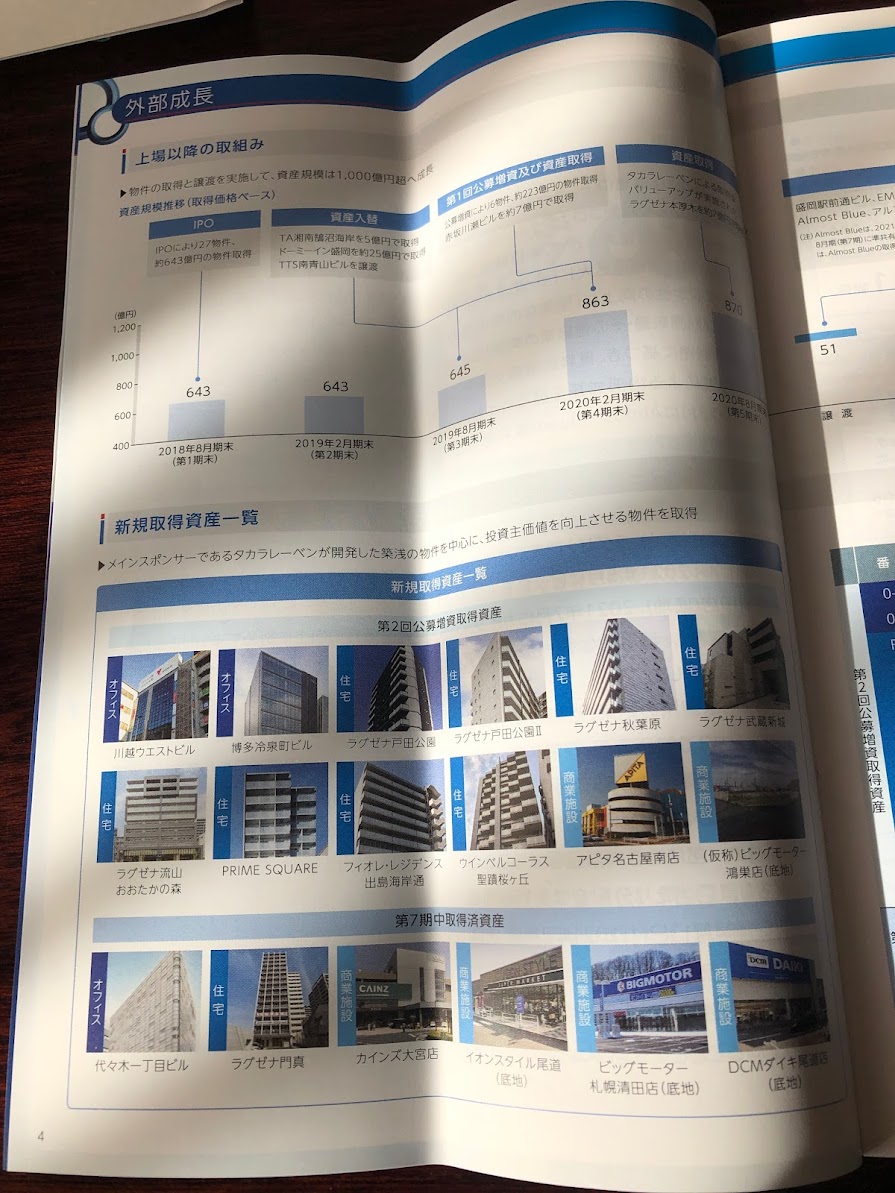

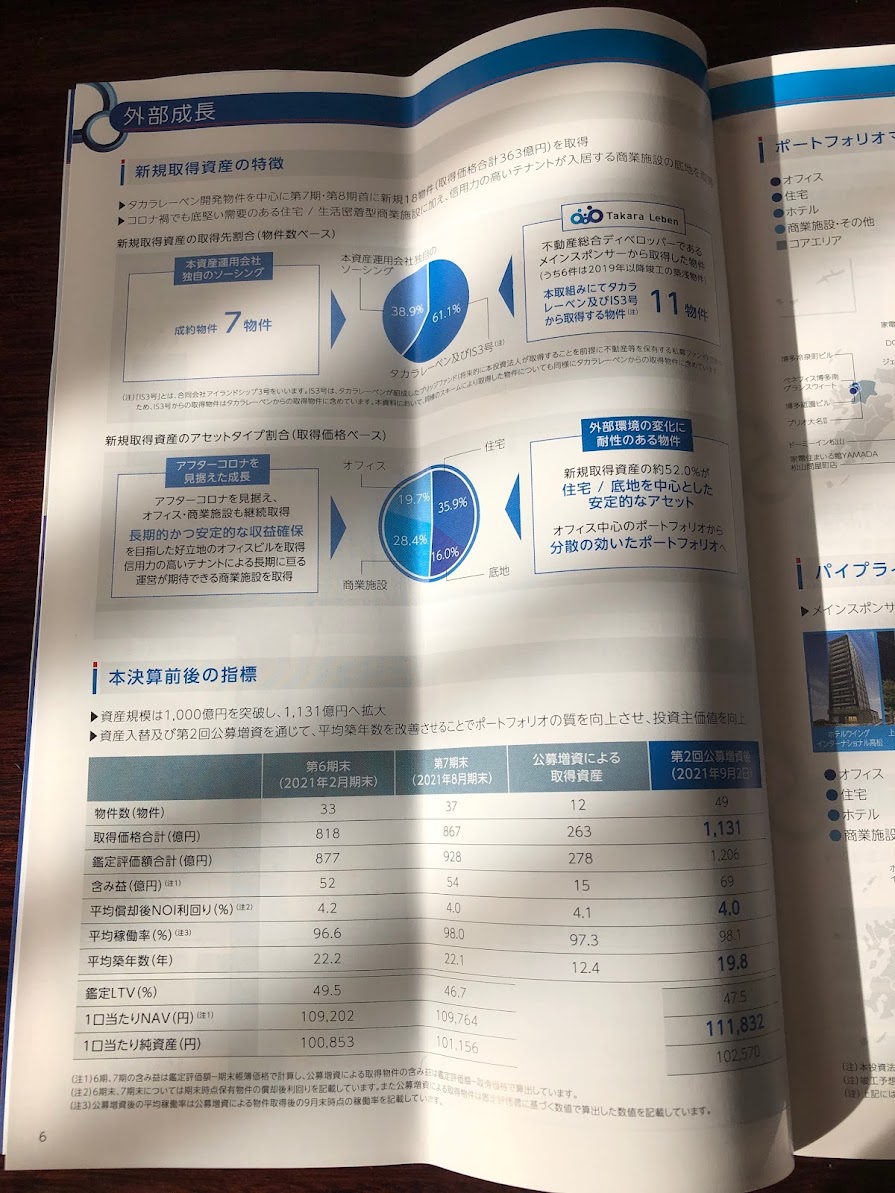

More newly acquired properties

In the seventh fiscal period, we have acquired new properties, mainly residential properties in the Tokyo metropolitan area.

These properties are expected to be profitable as they have been incorporated in anticipation of what will happen after the infection.

The properties will generate further profits by utilizing Takara Leben’s real estate.

What is Takara Leben Real Estate Investment Corporation?

It is a J-REIT listed in 2018 and a new real estate investment corporation established in 2017.

It is sponsored by Takara Leben, Hong Kong-based real estate fund PAG, Kyoritsu Maintenance, and Yamada Holdings.

It invests more than 70% in office buildings and residential properties, and less than 30% in hotels and commercial facilities.

Features of Takara Leben Real Estate Investment Corporation

1 Office-oriented portfolio

Approximately 46% of Takara REIT’s portfolio is comprised of office buildings in the Tokyo metropolitan area.

By having properties in cities where populations are concentrated, stable profitability is secured.

We have also built a portfolio that is not easily affected by the economy, as we have many commercial facilities and residential properties.

2 High occupancy rate

In the 5th/6th fiscal period, the occupancy rate of hotels dropped to 80%, but in other situations, the occupancy rate has been maintained at 90%.

I believe that Takara REIT’s strategy of acquiring properties based on its own estimates is paying off.

We believe that a high occupancy rate is an important indicator for investing in REITs.

3 Four Sponsor Companies

Takara REIT combines the power of four sponsors to manage the REIT.

Thay aim to achieve stable management through a strategy that leverages our strengths in each field.

They also offer special benefits to shareholders (abolition)

They are one of the few REITs to offer a special benefit program.

By owning 10 or more units, you can receive a 2,500 yen shopping coupon from Yamada Holdings, Inc. for February and August vesting.

Although the program is limited to residents of Japan, the yield is good and the annual benefit of 5,000 yen is great.

I want to save so that I can get the benefit in the future!

Summary

- Time to buy at 106,000 yen

- Financial results for the seventh period increased slightly.

- Possibility of decrease in distribution for next fiscal year

In this article, I introduced Takara Leben Real Estate Investment Corporation’s buying opportunity and the REIT!

Takara Leben Real Estate Investment Corporation is a REIT that owns a large number of office properties in the Tokyo metropolitan area, mainly in Tokyo.

Since the acquisition of commercial and residential properties is also increasing year by year, I believe that the future profitability of the company will also expand.

You can earn higher distributions than regular stocks, so why not consider investing?

Investing is your own responsibility. Make your own final decision after referring to various opinions.

In this blog, we are constantly updating articles on Japanese stocks and other topics.

I would be encouraged if you could share them on social networking sites.

Thank you for reading to the end!

コメント