Hello everyone. I’m @olivertomolife, and I love investing and shareholder special offers!

There are many brands of clothing in the world, but which brand do you think of?

Fast Retailing, which I will introduce here, is one of the top companies in the world in terms of size, and its recognition is increasing every year.

Now I’m going to analyze the stock’s price prediction and the company’s business!

- Want to invest in a world-famous Japanese company

- Want to know more about UNIQLO stock

- Want to know about Fast Retailing’s stock price

- Forecasting Fast Retailing’s stock price

- What is Fast Retailing?

- Company Business

- Company Indicators

- Dividend History

- Three investment trusts for inclusion!

The author has three years of investment experience and has worked in the securities industry.

By reading this article, you’ll learn all you need to know about Fast Retailing!

Forecasting Fast Retailing’s Stock Price

In conclusion, we believe that a long-term adjustment in the stock price will occur in the future.

This is because although UNIQLO has become a global company, it is becoming increasingly dependent on China.

Japan is susceptible to external geopolitical risks, so stock prices react quickly to any negative news.

As a result, after hitting an all-time high of 1,000 yen recorded in February 2021, the price has fallen significantly.

However, there is an impression that the lower price is being supported.

I believe that the stock will turn into a full-fledged uptrend once it crosses 89,000 yen.

What is FAST RETAILING?

9983 Fast Retailing Co., Ltd. is a holding company established in 1963.

Under its umbrella are clothing companies such as UNIQLO Inc. and g.u. Inc.

Fast Retailing is a large company whose stock is included in the Nikkei Stock Average and TOPIX large 70.

Since opening its first UNIQLO store in Hiroshima Prefecture in 1984, the company has opened more than 2,300 stores in Japan and overseas.

It is the third largest apparel brand in the world in terms of sales, and has the second largest market capitalization in the world.

Company’s business

The company has four businesses, but the two businesses with the highest sales will be introduced here.

Please also make use of the company website above.

1 Domestic UNIQLO Business

This business accounts for 40% of total sales and has a sales scale of 800 billion yen.

We are involved in everything from the development of clothing tailored to our living environment to sales.

It is also characterized by a higher percentage of products for women than for men.

However, the ratio is not much different.

Some of the issues that they will be working on in the future are reducing shortages and excess inventory by forecasting demand, and improving the efficiency of distribution.

2 Overseas UNIQLO Business

We have opened UNIQLO stores in 24 countries around the world, accounting for 40% of total sales.

The number of stores is steadily increasing and is expected to increase in the future.

We aim to sell clothing suited to each country and introduce products that meet their needs.

The company will accelerate the opening of new stores, especially in Asia.

Company Indicators

The following is a summary of FAST RETAILING’s main indicators.

| PER | PBR | Dividend yield | Dividend payout ratio | Equity ratio |

| 43.76x | 6.64x | 0.65% | 28.9 % | 44.5% |

Overall, the company seems to be overpriced.

However, the capital adequacy ratio is higher than average, which gives me a sense of security.

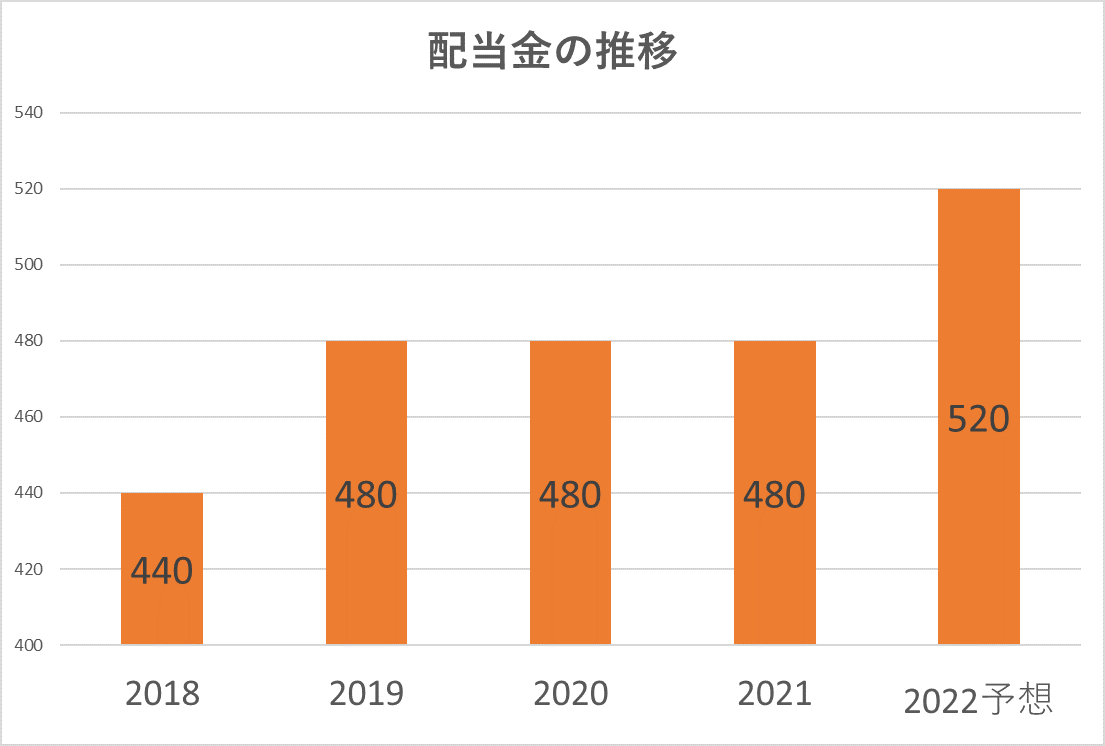

Dividends

Dividends are stable, but they are small relative to the stock price.

It seems to be better to target profits for the purpose of stock price growth rate.

I recommend three investment trusts for inclusion!

Fast Retailing’s stock price is high and many people cannot afford it.

This is where investment trusts come in.

They are managed by professionals and invest in a variety of stocks, so they can diversify your risk.

We have selected three investment trusts that close once a year and include Fast Retailing for your reference.

- Nissay Asset Management Nissay Japan Equity Fund

- Nikko Asset Management Nikko Japan Open (Zipangu)

- JPMorgan Asset Management JPM Japan Meister

Summary

- There is a possibility of stock price adjustment in the future.

- The company has a global influence in apparel.

- Expectations for earnings growth in the future

This is my analysis of Fast Retailing!

Investing is a personal responsibility. Investing is a personal responsibility, so make your own final decision after considering a variety of opinions.

Please stay tuned as we continue to provide useful information for your investment.

Thank you for reading to the end!

コメント