Hello everyone. I’m @olivertomolife, and I love investing and shareholder special offers!

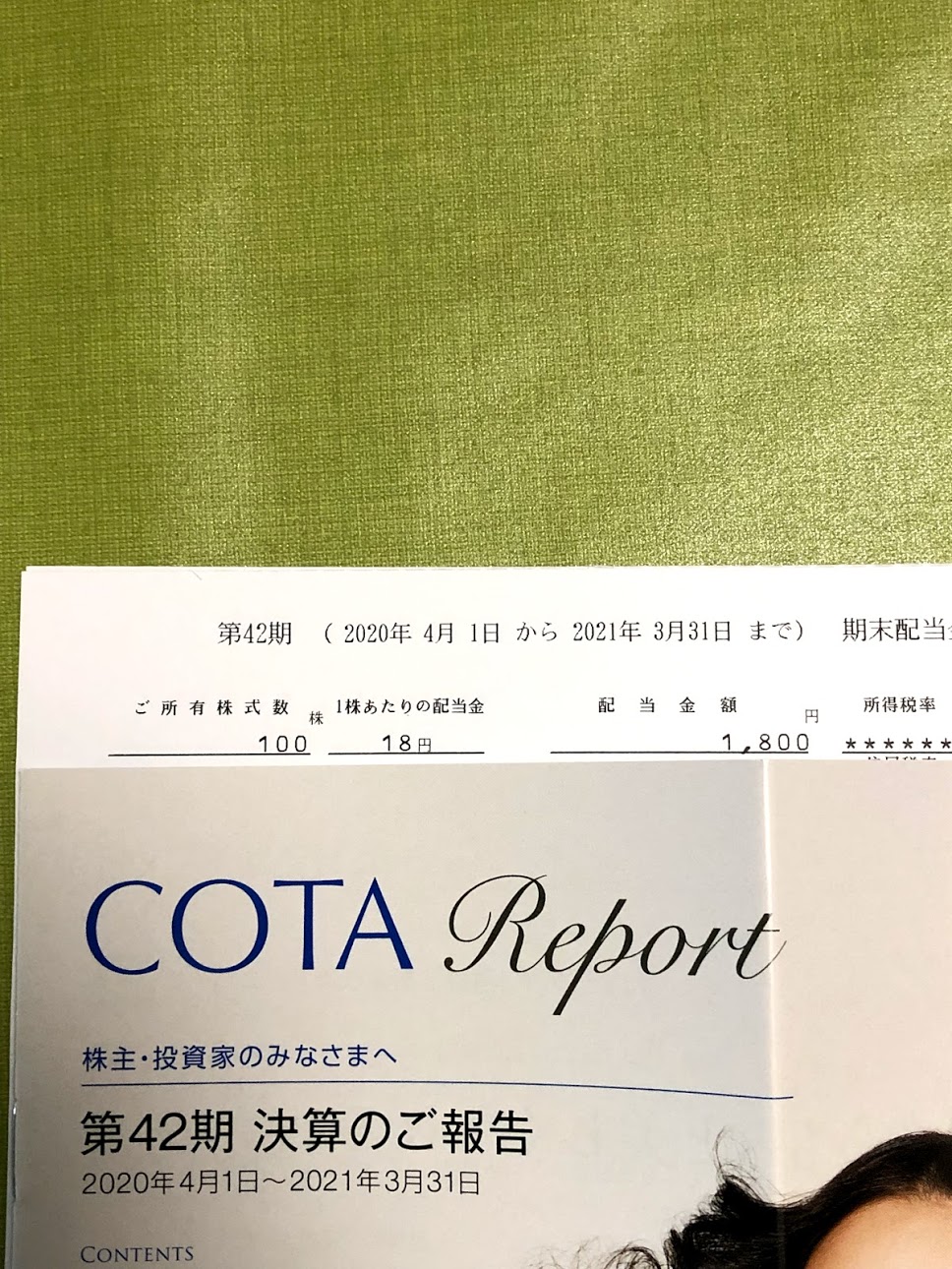

The 42nd fiscal year has ended and I received a dividend from Kota Corporation.

This is a company in an industry that was severely hit by the coronavirus, yet they increased their dividend compared to last time!

It was a great result that shows the company is growing its business regardless of infectious diseases, so I will take a look at the contents.

- People who want to know about Kota Corporation’s dividends

- Interested in Japanese stocks

- Have plans to start investing in the future

- About Cota’s dividend

- Overview of the fiscal year ending March 31, 2021

- Earnings Forecast for Next Fiscal Year

- Details of Sales

- Information on New Products

- Financial Statements

The author has 3 years of investment experience and has a background in the securities industry.

By reading this article, you’ll learn all you need to know about Cota’s dividends and financial results!

About Cota’s dividend

The dividend for the 42nd fiscal year was 18 yen per share.

Incidentally, the dividend for the previous fiscal year was 16.4 yen.

Here’s hoping for some dividend increases in the future!

Summary of Financial Results for March 2021

Net sales for the current fiscal year increased for the 23rd consecutive year, reaching a record high of 7,764 million yen.

Operating income and ordinary income increased to record highs.

Net income also increased for the second consecutive year.

We have good results in each of these indicators, so we have high expectations for the next fiscal year as well.

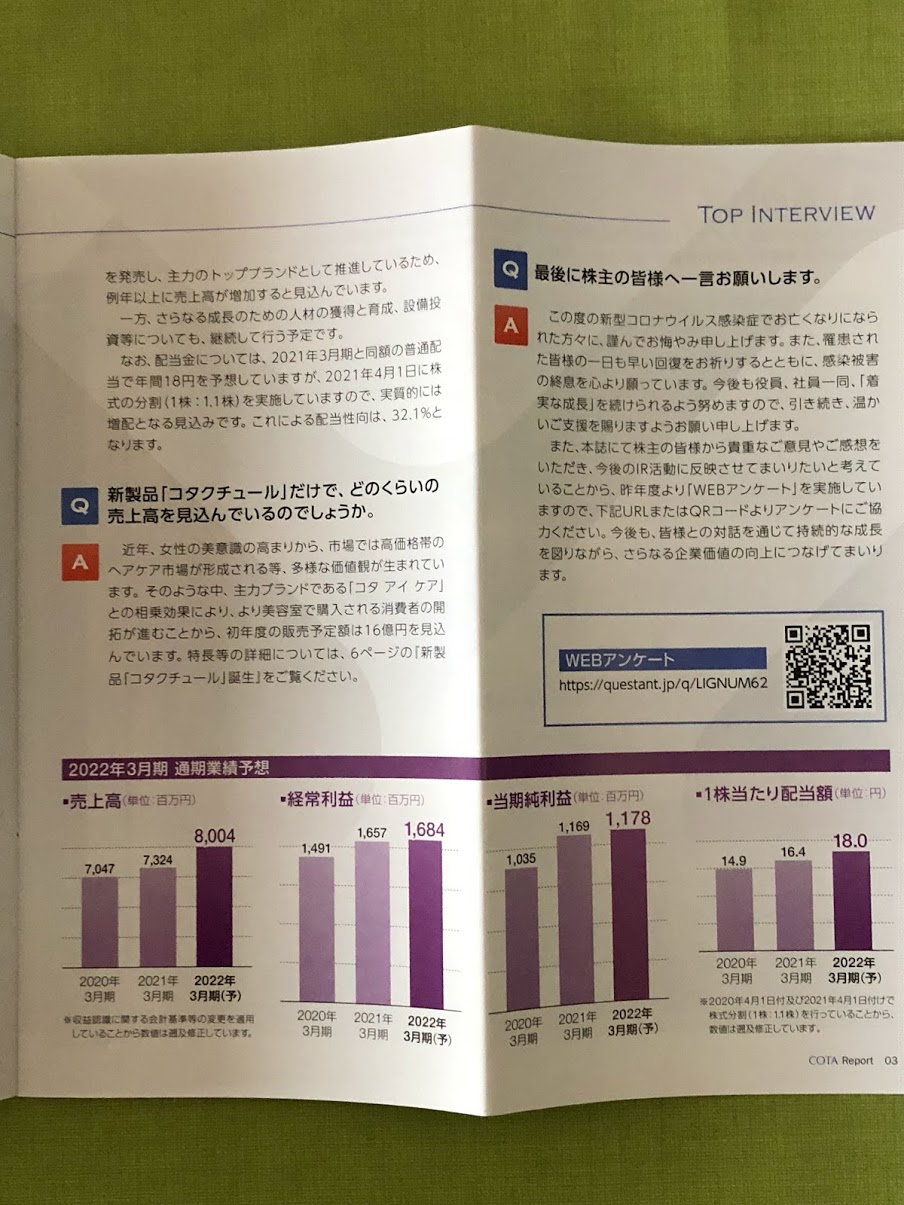

Earnings forecast for the next fiscal year

Each indicator is expected to show an increase in profit in the next fiscal year.

If the situation of infectious diseases changes, we may be in for some surprises!

We can’t take our eyes off the financial results for the next fiscal year either.

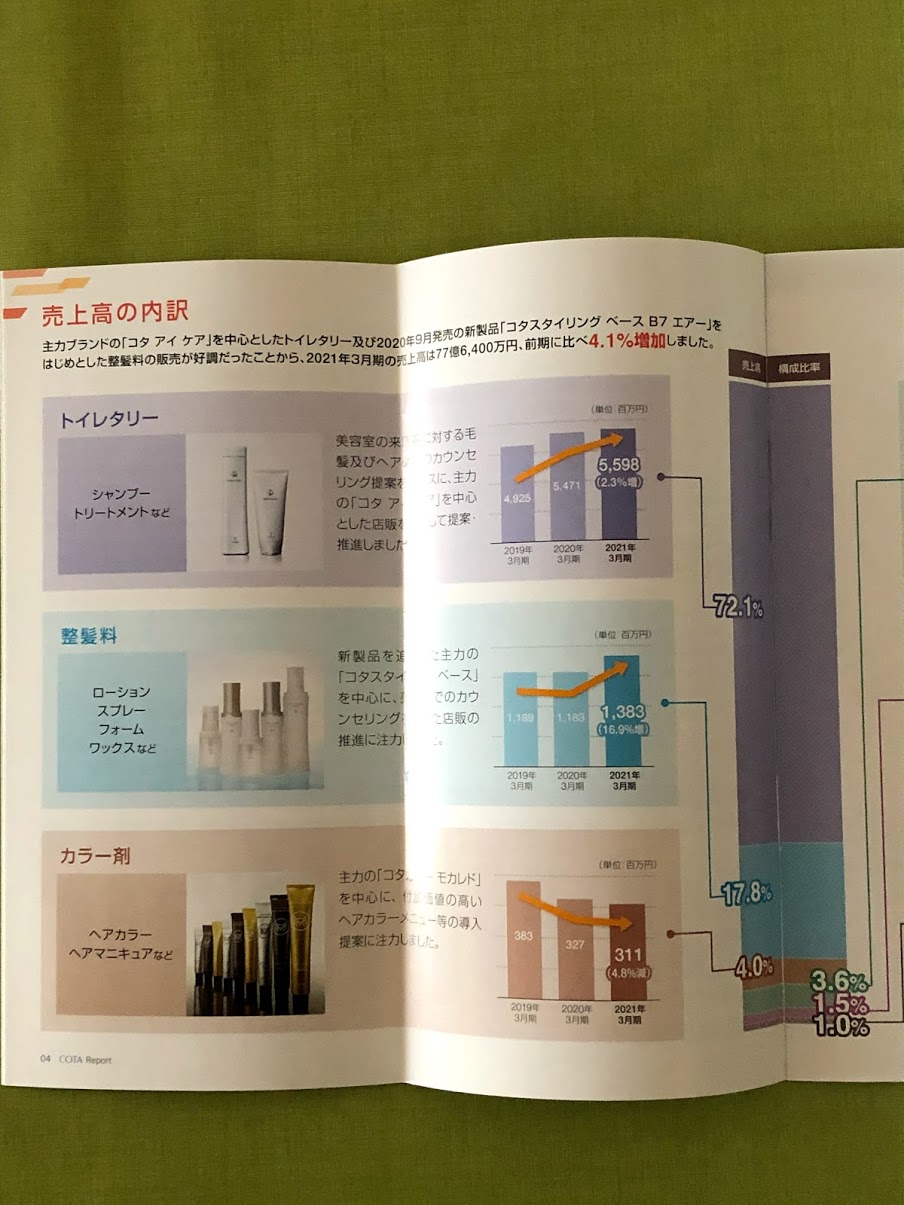

Details of Sales

Let’s take a look at the breakdown of products in order of sales.

1 Toiletries

Our main division, which accounts for 70% of sales, develops shampoos and treatments for beauty salons.

We also provide high quality products to customers through our route through stores.

Profit increased by 2% compared to the previous fiscal year.

2 Hairdressing products

In the styling category, such as sprays and waxes, we increased profits by 16% this fiscal year.

Maybe the coronavirus has made people more careful about their appearance.

3 Colorants

In the hair color and hair nail polish category, profits decreased by 4% compared to the previous fiscal year.

I hope to see increased profits in the future.

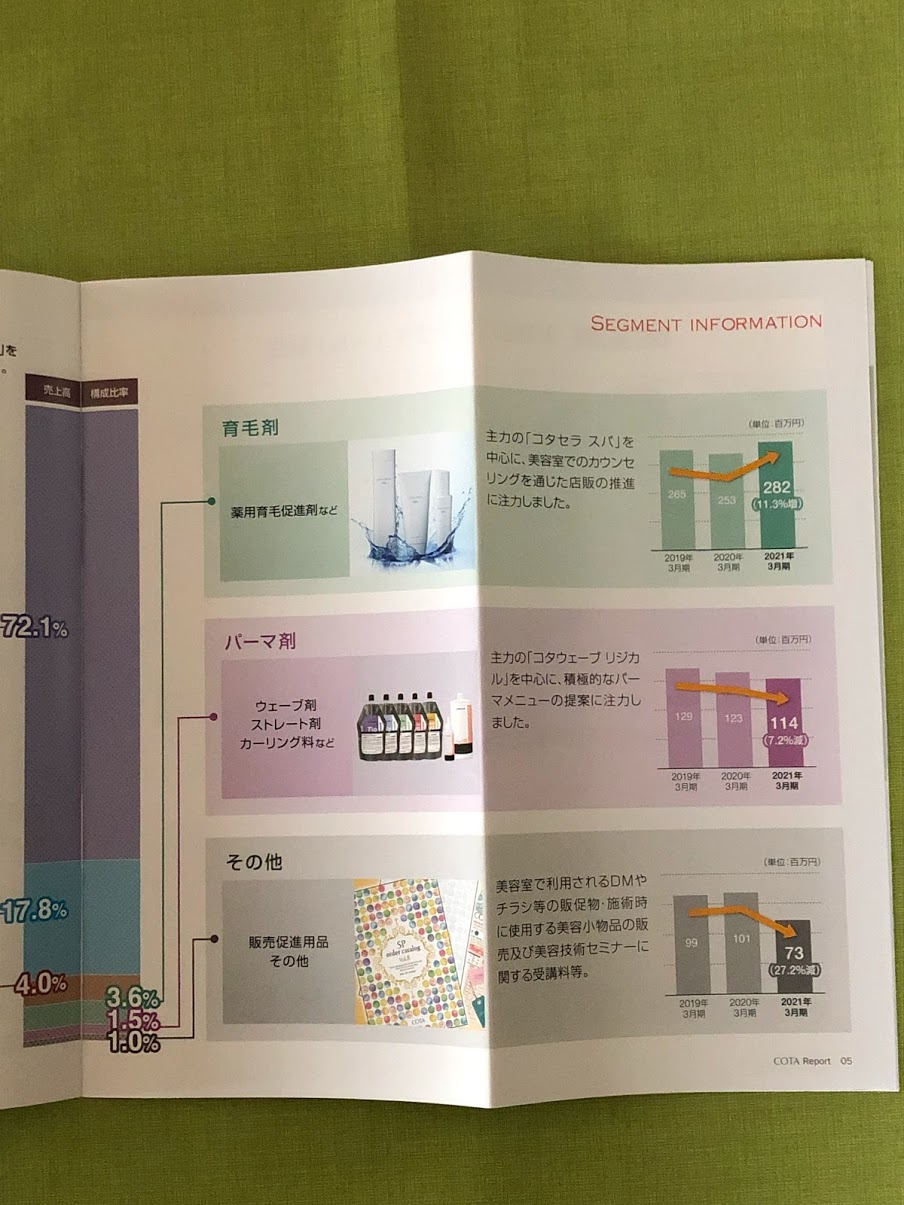

4 Hair Growth Agents

In the category of medicated hair growth agents, profits increased by 11% compared to the previous fiscal year.

It seems that counseling at beauty salons was strong.

5 Permanent wave agents

In the category of perm agents, profits decreased by 7% compared to the previous fiscal year.

I think this was due to a decrease in opportunities to go out due to the coronavirus.

6 Others

This is the department related to sales promotion goods, and the profit decreased by 27% from the previous year.

I think this was due to the decrease in opportunities for direct mail and beauty seminars due to the coronavirus.

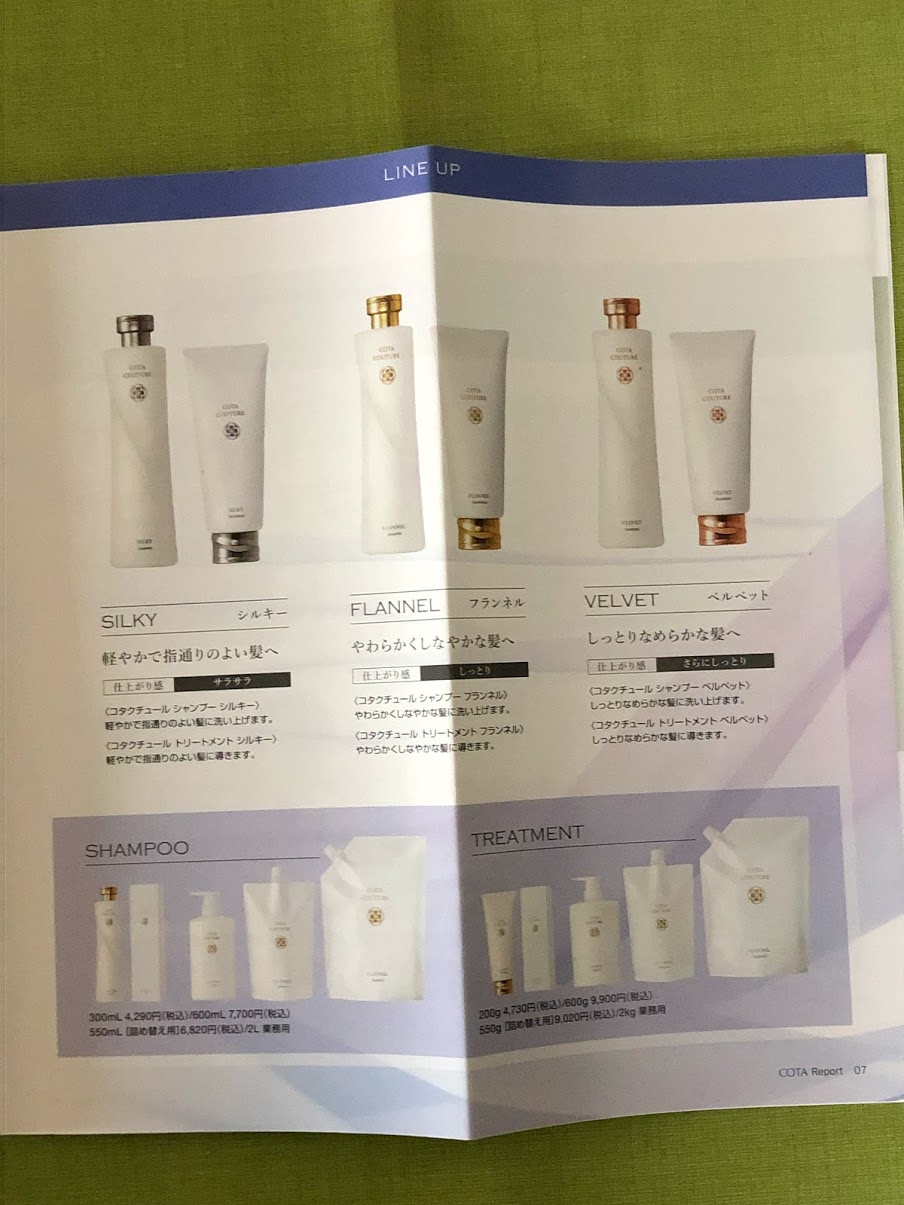

New Product Information

There was an explanation about the new product, Cotactur.

There are three types of products, so you can choose one according to your hair quality.

Since they are high quality products, the prices are higher than the standard ones.

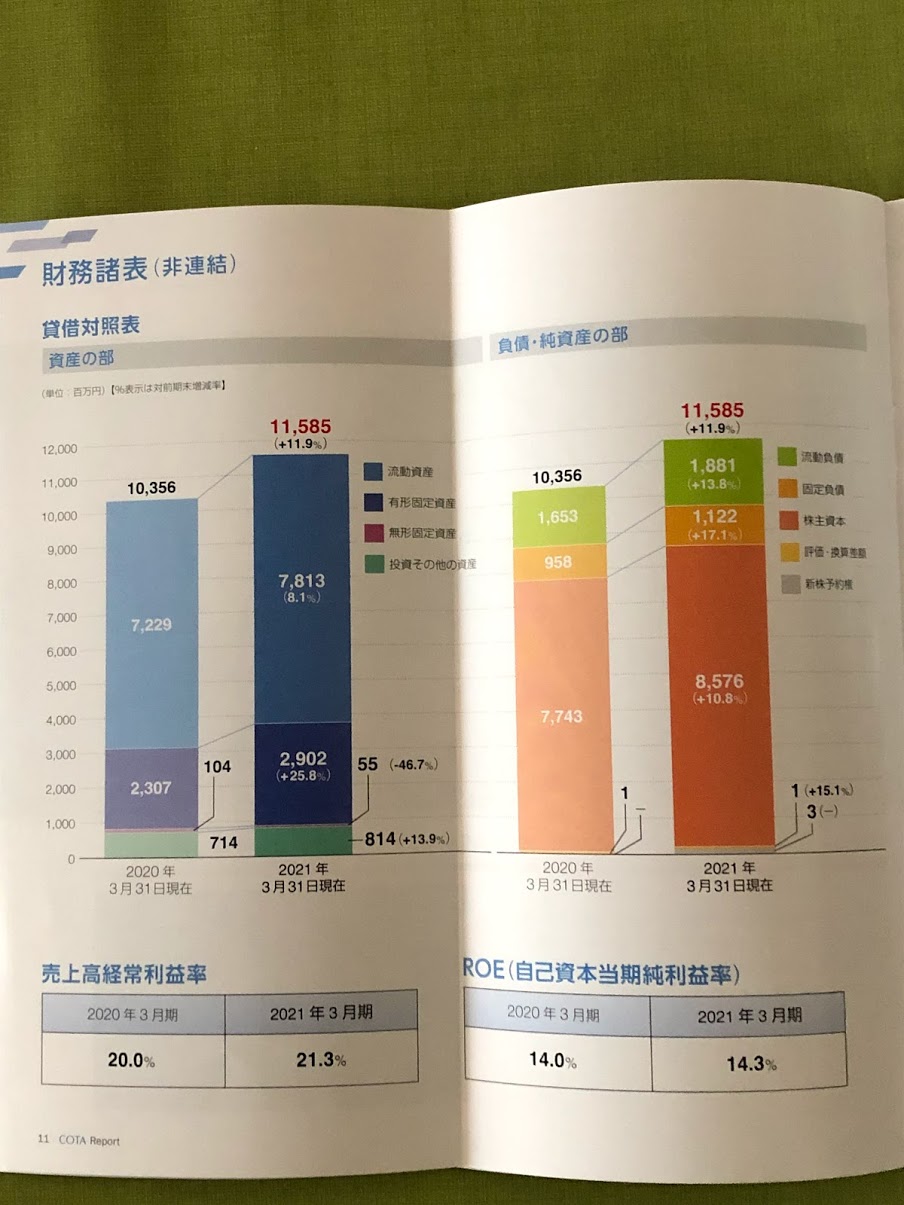

Financial statements

I would also like to take a look at the financial details.

In the assets section, we have increased by 11% over the previous quarter.

The largest increase was in property, plant and equipment, which increased by 25%.

Next, liabilities and net assets increased by 11% over the previous fiscal year.

Of these, the increase in long-term liabilities was the largest, up 17%.

Conclusion

- Cota’s dividend is 18 yen per share.

- The dividend will be paid in late June.

- Expectations for next fiscal year’s results

This is a summary of Cota’s dividend.

We will continue to update the dividend information as needed, so please stay tuned.

Thank you for reading to the end!

コメント